0001708035--12-312021FYfalseP3Y00017080352021-01-012021-12-3100017080352021-06-30iso4217:USD00017080352022-02-25xbrli:shares00017080352020-01-012020-12-3100017080352019-01-012019-12-31iso4217:USDxbrli:shares00017080352021-12-3100017080352020-12-310001708035us-gaap:CommonStockMember2018-12-310001708035us-gaap:AdditionalPaidInCapitalMember2018-12-310001708035us-gaap:RetainedEarningsMember2018-12-310001708035us-gaap:TreasuryStockMember2018-12-310001708035us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-12-310001708035us-gaap:NoncontrollingInterestMember2018-12-3100017080352018-12-310001708035srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:RetainedEarningsMember2018-12-310001708035us-gaap:AccumulatedOtherComprehensiveIncomeMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2018-12-310001708035srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2018-12-310001708035us-gaap:CommonStockMembersrt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMember2018-12-310001708035srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:AdditionalPaidInCapitalMember2018-12-310001708035us-gaap:RetainedEarningsMembersrt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMember2018-12-310001708035srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:TreasuryStockMember2018-12-310001708035us-gaap:AccumulatedOtherComprehensiveIncomeMembersrt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMember2018-12-310001708035srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:NoncontrollingInterestMember2018-12-310001708035srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMember2018-12-310001708035us-gaap:RetainedEarningsMember2019-01-012019-12-310001708035us-gaap:NoncontrollingInterestMember2019-01-012019-12-310001708035us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310001708035us-gaap:TreasuryStockMember2019-01-012019-12-310001708035us-gaap:AdditionalPaidInCapitalMember2019-01-012019-12-310001708035us-gaap:CommonStockMember2019-01-012019-12-310001708035us-gaap:CommonStockMember2019-12-310001708035us-gaap:AdditionalPaidInCapitalMember2019-12-310001708035us-gaap:RetainedEarningsMember2019-12-310001708035us-gaap:TreasuryStockMember2019-12-310001708035us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001708035us-gaap:NoncontrollingInterestMember2019-12-3100017080352019-12-310001708035us-gaap:RetainedEarningsMember2020-01-012020-12-310001708035us-gaap:NoncontrollingInterestMember2020-01-012020-12-310001708035us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001708035us-gaap:TreasuryStockMember2020-01-012020-12-310001708035us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310001708035us-gaap:CommonStockMember2020-01-012020-12-310001708035us-gaap:CommonStockMember2020-12-310001708035us-gaap:AdditionalPaidInCapitalMember2020-12-310001708035us-gaap:RetainedEarningsMember2020-12-310001708035us-gaap:TreasuryStockMember2020-12-310001708035us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001708035us-gaap:NoncontrollingInterestMember2020-12-310001708035us-gaap:RetainedEarningsMember2021-01-012021-12-310001708035us-gaap:NoncontrollingInterestMember2021-01-012021-12-310001708035us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001708035us-gaap:TreasuryStockMember2021-01-012021-12-310001708035us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001708035us-gaap:CommonStockMember2021-01-012021-12-310001708035us-gaap:CommonStockMember2021-12-310001708035us-gaap:AdditionalPaidInCapitalMember2021-12-310001708035us-gaap:RetainedEarningsMember2021-12-310001708035us-gaap:TreasuryStockMember2021-12-310001708035us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001708035us-gaap:NoncontrollingInterestMember2021-12-310001708035ecvt:PerformanceMaterialsMember2020-12-142020-12-140001708035ecvt:PerformanceChemicalsMember2021-08-012021-08-01xbrli:pure0001708035us-gaap:BuildingAndBuildingImprovementsMembersrt:MinimumMember2021-01-012021-12-310001708035us-gaap:BuildingAndBuildingImprovementsMembersrt:MaximumMember2021-01-012021-12-310001708035srt:MinimumMemberus-gaap:MachineryAndEquipmentMember2021-01-012021-12-310001708035us-gaap:MachineryAndEquipmentMembersrt:MaximumMember2021-01-012021-12-310001708035srt:MaximumMember2021-01-012021-12-310001708035ecvt:PerformanceMaterialsMember2020-12-310001708035ecvt:PerformanceMaterialsMember2020-01-012020-12-310001708035ecvt:PerformanceMaterialsMember2021-01-012021-12-310001708035ecvt:PerformanceMaterialsMember2019-01-012019-12-310001708035ecvt:A2020TermLoanFacilityMemberecvt:PerformanceMaterialsMember2020-01-012020-12-310001708035ecvt:PerformanceMaterialsMember2019-12-31ecvt:reporting_unit0001708035ecvt:PerformanceChemicalsMember2021-01-012021-12-310001708035ecvt:PerformanceChemicalsMember2021-01-012021-12-310001708035ecvt:PerformanceChemicalsMember2020-01-012020-12-310001708035ecvt:PerformanceChemicalsMember2020-01-012020-12-310001708035ecvt:PerformanceChemicalsMember2021-12-310001708035ecvt:PerformanceChemicalsMember2020-12-31iso4217:GBP0001708035ecvt:Chem32Member2021-01-012021-12-310001708035ecvt:Chem32Member2021-03-012021-03-010001708035ecvt:Chem32Member2021-03-010001708035ecvt:Chem32Member2021-12-310001708035us-gaap:CustomerRelationshipsMember2021-01-012021-12-310001708035us-gaap:IntellectualPropertyMember2021-01-012021-12-310001708035us-gaap:NoncompeteAgreementsMember2021-01-012021-12-310001708035us-gaap:TradeNamesMember2021-01-012021-12-310001708035us-gaap:OperatingSegmentsMemberecvt:EcoservicesMemberecvt:IndustrialandChemicalProcessMember2021-01-012021-12-310001708035ecvt:CatalystTechnologiesMemberus-gaap:OperatingSegmentsMemberecvt:IndustrialandChemicalProcessMember2021-01-012021-12-310001708035us-gaap:OperatingSegmentsMemberecvt:IndustrialandChemicalProcessMember2021-01-012021-12-310001708035ecvt:FuelsandEmissionControlsMemberus-gaap:OperatingSegmentsMemberecvt:EcoservicesMember2021-01-012021-12-310001708035ecvt:CatalystTechnologiesMemberecvt:FuelsandEmissionControlsMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001708035ecvt:FuelsandEmissionControlsMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001708035us-gaap:OperatingSegmentsMemberecvt:PackagingandEngineeringPlasticsMemberecvt:EcoservicesMember2021-01-012021-12-310001708035ecvt:CatalystTechnologiesMemberus-gaap:OperatingSegmentsMemberecvt:PackagingandEngineeringPlasticsMember2021-01-012021-12-310001708035us-gaap:OperatingSegmentsMemberecvt:PackagingandEngineeringPlasticsMember2021-01-012021-12-310001708035us-gaap:OperatingSegmentsMemberecvt:NaturalResourcesMemberecvt:EcoservicesMember2021-01-012021-12-310001708035ecvt:CatalystTechnologiesMemberus-gaap:OperatingSegmentsMemberecvt:NaturalResourcesMember2021-01-012021-12-310001708035us-gaap:OperatingSegmentsMemberecvt:NaturalResourcesMember2021-01-012021-12-310001708035ecvt:EcoservicesMember2021-01-012021-12-310001708035ecvt:CatalystTechnologiesMember2021-01-012021-12-310001708035us-gaap:OperatingSegmentsMemberecvt:EcoservicesMemberecvt:IndustrialandChemicalProcessMember2020-01-012020-12-310001708035ecvt:CatalystTechnologiesMemberus-gaap:OperatingSegmentsMemberecvt:IndustrialandChemicalProcessMember2020-01-012020-12-310001708035us-gaap:OperatingSegmentsMemberecvt:IndustrialandChemicalProcessMember2020-01-012020-12-310001708035ecvt:FuelsandEmissionControlsMemberus-gaap:OperatingSegmentsMemberecvt:EcoservicesMember2020-01-012020-12-310001708035ecvt:CatalystTechnologiesMemberecvt:FuelsandEmissionControlsMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001708035ecvt:FuelsandEmissionControlsMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001708035us-gaap:OperatingSegmentsMemberecvt:PackagingandEngineeringPlasticsMemberecvt:EcoservicesMember2020-01-012020-12-310001708035ecvt:CatalystTechnologiesMemberus-gaap:OperatingSegmentsMemberecvt:PackagingandEngineeringPlasticsMember2020-01-012020-12-310001708035us-gaap:OperatingSegmentsMemberecvt:PackagingandEngineeringPlasticsMember2020-01-012020-12-310001708035us-gaap:OperatingSegmentsMemberecvt:NaturalResourcesMemberecvt:EcoservicesMember2020-01-012020-12-310001708035ecvt:CatalystTechnologiesMemberus-gaap:OperatingSegmentsMemberecvt:NaturalResourcesMember2020-01-012020-12-310001708035us-gaap:OperatingSegmentsMemberecvt:NaturalResourcesMember2020-01-012020-12-310001708035ecvt:EcoservicesMember2020-01-012020-12-310001708035ecvt:CatalystTechnologiesMember2020-01-012020-12-310001708035us-gaap:OperatingSegmentsMemberecvt:EcoservicesMemberecvt:IndustrialandChemicalProcessMember2019-01-012019-12-310001708035ecvt:CatalystTechnologiesMemberus-gaap:OperatingSegmentsMemberecvt:IndustrialandChemicalProcessMember2019-01-012019-12-310001708035us-gaap:OperatingSegmentsMemberecvt:IndustrialandChemicalProcessMember2019-01-012019-12-310001708035ecvt:FuelsandEmissionControlsMemberus-gaap:OperatingSegmentsMemberecvt:EcoservicesMember2019-01-012019-12-310001708035ecvt:CatalystTechnologiesMemberecvt:FuelsandEmissionControlsMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001708035ecvt:FuelsandEmissionControlsMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001708035us-gaap:OperatingSegmentsMemberecvt:PackagingandEngineeringPlasticsMemberecvt:EcoservicesMember2019-01-012019-12-310001708035ecvt:CatalystTechnologiesMemberus-gaap:OperatingSegmentsMemberecvt:PackagingandEngineeringPlasticsMember2019-01-012019-12-310001708035us-gaap:OperatingSegmentsMemberecvt:PackagingandEngineeringPlasticsMember2019-01-012019-12-310001708035us-gaap:OperatingSegmentsMemberecvt:NaturalResourcesMemberecvt:EcoservicesMember2019-01-012019-12-310001708035ecvt:CatalystTechnologiesMemberus-gaap:OperatingSegmentsMemberecvt:NaturalResourcesMember2019-01-012019-12-310001708035us-gaap:OperatingSegmentsMemberecvt:NaturalResourcesMember2019-01-012019-12-310001708035ecvt:EcoservicesMember2019-01-012019-12-310001708035ecvt:CatalystTechnologiesMember2019-01-012019-12-310001708035us-gaap:FairValueMeasurementsRecurringMember2021-12-310001708035us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2021-12-310001708035us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2021-12-310001708035us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001708035us-gaap:FairValueMeasurementsRecurringMember2020-12-310001708035us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2020-12-310001708035us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2020-12-310001708035us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001708035us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-12-310001708035us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-12-310001708035us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2021-12-310001708035us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2020-12-310001708035us-gaap:AccumulatedTranslationAdjustmentMember2021-12-310001708035us-gaap:AccumulatedTranslationAdjustmentMember2020-12-310001708035us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetGainLossIncludingPortionAttributableToNoncontrollingInterestMember2021-01-012021-12-310001708035us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetGainLossIncludingPortionAttributableToNoncontrollingInterestMember2020-01-012020-12-310001708035us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetGainLossIncludingPortionAttributableToNoncontrollingInterestMember2019-01-012019-12-310001708035us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceIncludingPortionAttributableToNoncontrollingInterestMember2021-01-012021-12-310001708035us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceIncludingPortionAttributableToNoncontrollingInterestMember2020-01-012020-12-310001708035us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceIncludingPortionAttributableToNoncontrollingInterestMember2019-01-012019-12-310001708035ecvt:AccumulatedDefinedBenefitPlansAdjustmentSettlementGain2021-01-012021-12-310001708035ecvt:AccumulatedDefinedBenefitPlansAdjustmentSettlementGain2020-01-012020-12-310001708035ecvt:AccumulatedDefinedBenefitPlansAdjustmentSettlementGain2019-01-012019-12-310001708035us-gaap:AccumulatedDefinedBenefitPlansAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2021-01-012021-12-310001708035us-gaap:AccumulatedDefinedBenefitPlansAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2020-01-012020-12-310001708035us-gaap:AccumulatedDefinedBenefitPlansAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2019-01-012019-12-310001708035us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2021-01-012021-12-310001708035us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2020-01-012020-12-310001708035us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2019-01-012019-12-310001708035us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2021-01-012021-12-310001708035us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2020-01-012020-12-310001708035us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2019-01-012019-12-310001708035us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-12-310001708035us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2019-12-310001708035us-gaap:AccumulatedTranslationAdjustmentMember2019-12-310001708035us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-01-012020-12-310001708035us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-01-012020-12-310001708035us-gaap:AccumulatedTranslationAdjustmentMember2020-01-012020-12-310001708035us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberecvt:AccumulatedDefinedBenefitPlansAdjustmentMemberMember2020-01-012020-12-310001708035us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberecvt:AccumulatedGainLossNetCashFlowHedgeMember2020-01-012020-12-310001708035us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberecvt:AccumulatedTranslationAdjustmentMemberMember2020-01-012020-12-310001708035us-gaap:DiscontinuedOperationsDisposedOfBySaleMember2020-01-012020-12-310001708035us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-12-310001708035us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-01-012021-12-310001708035us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-01-012021-12-310001708035us-gaap:AccumulatedTranslationAdjustmentMember2021-01-012021-12-310001708035us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberecvt:AccumulatedDefinedBenefitPlansAdjustmentMemberMember2021-01-012021-12-310001708035us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberecvt:AccumulatedGainLossNetCashFlowHedgeMember2021-01-012021-12-310001708035us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberecvt:AccumulatedTranslationAdjustmentMemberMember2021-01-012021-12-310001708035us-gaap:DiscontinuedOperationsDisposedOfBySaleMember2021-01-012021-12-310001708035us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-12-310001708035us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMember2021-01-012021-12-310001708035us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMember2020-01-012020-12-310001708035us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2021-01-012021-12-310001708035us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2020-01-012020-12-310001708035us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-01-012021-12-310001708035us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-01-012020-12-310001708035us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:InterestRateCapMemberus-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2021-01-012021-12-310001708035us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:InterestRateCapMemberus-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2020-01-012020-12-310001708035us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2021-01-012021-12-310001708035us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2020-01-012020-12-310001708035us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001708035us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-3100017080352020-03-1200017080352020-12-142020-12-1400017080352021-08-042021-08-040001708035ecvt:BusinessCombinationsMember2021-12-310001708035ecvt:BusinessCombinationsMember2020-12-310001708035ecvt:ZeolystInternationalMember2021-12-310001708035ecvt:ZeolystC.V.Member2021-12-310001708035us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2021-12-310001708035us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2020-12-310001708035us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2021-01-012021-12-310001708035us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2020-01-012020-12-310001708035us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2019-01-012019-12-310001708035ecvt:PQHoldingsEcoServicesMember2021-12-310001708035ecvt:PQHoldingsEcoServicesMember2020-12-310001708035ecvt:PQHoldingsEcoServicesMember2021-01-012021-12-310001708035ecvt:PQHoldingsEcoServicesMember2020-01-012020-12-310001708035ecvt:PQHoldingsEcoServicesMember2019-01-012019-12-310001708035us-gaap:EquityMethodInvesteeMember2021-12-310001708035us-gaap:EquityMethodInvesteeMember2020-12-310001708035us-gaap:EquityMethodInvesteeMember2021-01-012021-12-310001708035us-gaap:EquityMethodInvesteeMember2020-01-012020-12-310001708035us-gaap:EquityMethodInvesteeMember2019-01-012019-12-310001708035us-gaap:LandMember2021-12-310001708035us-gaap:LandMember2020-12-310001708035us-gaap:BuildingAndBuildingImprovementsMember2021-12-310001708035us-gaap:BuildingAndBuildingImprovementsMember2020-12-310001708035us-gaap:MachineryAndEquipmentMember2021-12-310001708035us-gaap:MachineryAndEquipmentMember2020-12-310001708035us-gaap:ConstructionInProgressMember2021-12-310001708035us-gaap:ConstructionInProgressMember2020-12-310001708035us-gaap:OperatingSegmentsMemberecvt:EcoservicesMember2021-01-012021-12-310001708035us-gaap:OperatingSegmentsMemberecvt:EcoservicesMember2020-01-012020-12-310001708035us-gaap:OperatingSegmentsMemberecvt:EcoservicesMember2019-01-012019-12-310001708035ecvt:CatalystTechnologiesMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001708035ecvt:CatalystTechnologiesMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001708035ecvt:CatalystTechnologiesMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001708035us-gaap:CorporateMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001708035us-gaap:CorporateMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001708035us-gaap:CorporateMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001708035us-gaap:OperatingSegmentsMember2021-01-012021-12-310001708035us-gaap:OperatingSegmentsMember2020-01-012020-12-310001708035us-gaap:OperatingSegmentsMember2019-01-012019-12-310001708035ecvt:CatalystTechnologiesMemberecvt:ZeolystJointVentureMember2021-01-012021-12-310001708035ecvt:CatalystTechnologiesMemberecvt:ZeolystJointVentureMember2020-01-012020-12-310001708035ecvt:CatalystTechnologiesMemberecvt:ZeolystJointVentureMember2019-01-012019-12-310001708035us-gaap:MaterialReconcilingItemsMember2021-01-012021-12-310001708035us-gaap:MaterialReconcilingItemsMember2020-01-012020-12-310001708035us-gaap:MaterialReconcilingItemsMember2019-01-012019-12-310001708035country:US2021-01-012021-12-310001708035country:US2020-01-012020-12-310001708035country:US2019-01-012019-12-310001708035ecvt:OtherForeignCountriesMember2021-01-012021-12-310001708035ecvt:OtherForeignCountriesMember2020-01-012020-12-310001708035ecvt:OtherForeignCountriesMember2019-01-012019-12-310001708035ecvt:ProductsMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2021-01-012021-12-310001708035ecvt:ProductsMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2020-01-012020-12-310001708035ecvt:ProductsMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2019-01-012019-12-310001708035country:US2021-12-310001708035country:US2020-12-310001708035ecvt:OtherForeignCountriesMember2021-12-310001708035ecvt:OtherForeignCountriesMember2020-12-310001708035ecvt:EcoservicesMember2019-12-310001708035ecvt:CatalystTechnologiesMember2019-12-310001708035ecvt:EcoservicesMember2020-12-310001708035ecvt:CatalystTechnologiesMember2020-12-310001708035ecvt:EcoservicesMember2021-12-310001708035ecvt:CatalystTechnologiesMember2021-12-310001708035us-gaap:IntellectualPropertyMember2021-12-310001708035us-gaap:IntellectualPropertyMember2020-12-310001708035us-gaap:CustomerRelationshipsMember2021-12-310001708035us-gaap:CustomerRelationshipsMember2020-12-310001708035us-gaap:NoncompeteAgreementsMember2021-12-310001708035us-gaap:NoncompeteAgreementsMember2020-12-310001708035us-gaap:TrademarksMember2021-12-310001708035us-gaap:TrademarksMember2020-12-310001708035us-gaap:TradeNamesMember2021-12-310001708035us-gaap:TradeNamesMember2020-12-310001708035ecvt:PermitsMember2021-12-310001708035ecvt:PermitsMember2020-12-310001708035us-gaap:FiniteLivedIntangibleAssetsMember2021-12-310001708035us-gaap:FiniteLivedIntangibleAssetsMember2020-12-310001708035us-gaap:TradeNamesMember2021-12-310001708035us-gaap:TradeNamesMember2020-12-310001708035us-gaap:InProcessResearchAndDevelopmentMember2021-12-310001708035us-gaap:InProcessResearchAndDevelopmentMember2020-12-310001708035us-gaap:IntellectualPropertyMembersrt:MinimumMember2021-01-012021-12-310001708035us-gaap:IntellectualPropertyMembersrt:MaximumMember2021-01-012021-12-310001708035srt:MinimumMemberus-gaap:CustomerRelationshipsMember2021-01-012021-12-310001708035us-gaap:CustomerRelationshipsMembersrt:MaximumMember2021-01-012021-12-310001708035us-gaap:TrademarksMembersrt:MinimumMember2021-01-012021-12-310001708035us-gaap:TrademarksMembersrt:MaximumMember2021-01-012021-12-310001708035ecvt:PermitsMember2021-01-012021-12-310001708035us-gaap:CostOfSalesMember2021-01-012021-12-310001708035us-gaap:CostOfSalesMember2020-01-012020-12-310001708035us-gaap:CostOfSalesMember2019-01-012019-12-310001708035us-gaap:OtherOperatingIncomeExpenseMember2021-01-012021-12-310001708035us-gaap:OtherOperatingIncomeExpenseMember2020-01-012020-12-310001708035us-gaap:OtherOperatingIncomeExpenseMember2019-01-012019-12-310001708035ecvt:A2016TermLoanFacilityMemberus-gaap:MediumTermNotesMember2021-12-310001708035ecvt:A2016TermLoanFacilityMemberus-gaap:MediumTermNotesMember2020-12-310001708035ecvt:A2020TermLoanFacilityMemberus-gaap:MediumTermNotesMember2021-12-310001708035ecvt:A2020TermLoanFacilityMemberus-gaap:MediumTermNotesMember2020-12-310001708035ecvt:A2021TermLoanFacilityMemberus-gaap:MediumTermNotesMember2021-12-310001708035ecvt:A2021TermLoanFacilityMemberus-gaap:MediumTermNotesMember2020-12-310001708035us-gaap:SeniorNotesMemberecvt:FivePointSevenFivePercentSeniorUnsecuredNotesdue2025Member2021-12-310001708035us-gaap:SeniorNotesMemberecvt:FivePointSevenFivePercentSeniorUnsecuredNotesdue2025Member2020-12-310001708035us-gaap:LineOfCreditMember2021-12-310001708035us-gaap:LineOfCreditMember2020-12-310001708035ecvt:A2016TermLoanFacilityMemberus-gaap:MediumTermNotesMember2016-05-040001708035ecvt:A2016TermLoanFacilityMemberus-gaap:MediumTermNotesMembercurrency:USD2016-05-040001708035ecvt:A2016TermLoanFacilityMemberus-gaap:MediumTermNotesMembercurrency:EUR2016-05-04iso4217:EUR0001708035us-gaap:LineOfCreditMember2016-05-040001708035us-gaap:LineOfCreditMembercurrency:USD2016-05-040001708035us-gaap:LineOfCreditMembercountry:CA2016-05-040001708035us-gaap:LineOfCreditMembersrt:EuropeMember2016-05-040001708035us-gaap:LineOfCreditMembersrt:MinimumMemberus-gaap:LondonInterbankOfferedRateLIBORMember2016-05-042016-05-040001708035us-gaap:LineOfCreditMemberus-gaap:LondonInterbankOfferedRateLIBORMembersrt:MaximumMember2016-05-042016-05-040001708035us-gaap:LineOfCreditMembersrt:MinimumMemberus-gaap:BaseRateMember2016-05-042016-05-040001708035us-gaap:LineOfCreditMemberus-gaap:BaseRateMembersrt:MaximumMember2016-05-042016-05-040001708035us-gaap:LineOfCreditMember2016-05-042016-05-040001708035ecvt:A2016TermLoanFacilityMemberus-gaap:MediumTermNotesMember2018-02-080001708035ecvt:A2016TermLoanFacilityMemberus-gaap:MediumTermNotesMemberus-gaap:LondonInterbankOfferedRateLIBORMember2020-02-072020-02-070001708035ecvt:A2016TermLoanFacilityMemberus-gaap:MediumTermNotesMemberus-gaap:BaseRateMember2020-02-072020-02-0700017080352020-03-202020-03-2000017080352020-03-200001708035currency:USD2020-03-200001708035currency:CAD2020-03-200001708035currency:EUR2020-03-200001708035us-gaap:LineOfCreditMembersrt:MinimumMemberus-gaap:LondonInterbankOfferedRateLIBORMember2020-03-202020-03-200001708035us-gaap:LineOfCreditMemberus-gaap:LondonInterbankOfferedRateLIBORMembersrt:MaximumMember2020-03-202020-03-200001708035us-gaap:LineOfCreditMembersrt:MinimumMemberus-gaap:BaseRateMember2020-03-202020-03-200001708035us-gaap:LineOfCreditMemberus-gaap:BaseRateMembersrt:MaximumMember2020-03-202020-03-200001708035ecvt:A2020TermLoanFacilityMemberus-gaap:MediumTermNotesMemberus-gaap:LondonInterbankOfferedRateLIBORMember2020-07-2200017080352020-07-222020-07-220001708035ecvt:A2020TermLoanFacilityMemberus-gaap:MediumTermNotesMemberus-gaap:LondonInterbankOfferedRateLIBORMember2020-07-222020-07-220001708035us-gaap:SeniorNotesMemberecvt:SixPointSevenFivePercentSeniorSecuredNotesdue2022Member2016-05-040001708035ecvt:A2020TermLoanFacilityMemberus-gaap:MediumTermNotesMember2020-07-220001708035ecvt:A2021TermLoanFacilityMemberus-gaap:MediumTermNotesMember2021-06-090001708035ecvt:A2021TermLoanFacilityMember2021-06-092021-06-090001708035ecvt:A2021TermLoanFacilityMember2021-06-0900017080352021-06-092021-06-0900017080352021-06-090001708035currency:USD2021-06-090001708035currency:EUR2021-06-090001708035ecvt:A2016TermLoanFacilityMember2021-08-012021-08-010001708035ecvt:A2016TermLoanFacilityMemberus-gaap:MediumTermNotesMember2021-08-012021-08-010001708035ecvt:A2021TermLoanFacilityMemberus-gaap:MediumTermNotesMemberus-gaap:LondonInterbankOfferedRateLIBORMember2021-01-012021-12-310001708035us-gaap:RevolvingCreditFacilityMember2021-12-310001708035ecvt:A2016TermLoanFacilityMemberus-gaap:MediumTermNotesMember2020-01-012020-12-310001708035ecvt:A2021TermLoanFacilityMemberus-gaap:MediumTermNotesMember2021-01-012021-12-310001708035us-gaap:LineOfCreditMember2021-01-012021-12-310001708035ecvt:A2020TermLoanFacilityMemberus-gaap:MediumTermNotesMember2020-01-012020-12-310001708035ecvt:FivePointSevenFivePercentSeniorUnsecuredNotesdue2025Memberus-gaap:UnsecuredDebtMember2020-01-012020-12-310001708035ecvt:FivePointSevenFivePercentSeniorUnsecuredNotesdue2025Memberus-gaap:UnsecuredDebtMember2017-12-110001708035us-gaap:SeniorNotesMemberecvt:FivePointSevenFivePercentSeniorUnsecuredNotesdue2025Member2021-08-012021-08-010001708035ecvt:A2021TermLoanFacilityMember2021-12-310001708035ecvt:A2021TermLoanFacilityMember2020-12-310001708035ecvt:July2016InterestRateCapMemberus-gaap:CashFlowHedgingMember2016-07-012016-07-310001708035ecvt:July2016InterestRateCapMemberus-gaap:CashFlowHedgingMembersrt:MinimumMember2016-07-310001708035ecvt:July2016InterestRateCapMemberus-gaap:CashFlowHedgingMembersrt:MaximumMember2016-07-310001708035ecvt:July2016InterestRateCapMemberus-gaap:CashFlowHedgingMember2016-07-310001708035ecvt:November2018InterestRateCapMemberus-gaap:CashFlowHedgingMember2018-11-130001708035ecvt:November2018InterestRateCapMemberus-gaap:CashFlowHedgingMember2018-11-302018-11-300001708035ecvt:November2018InterestRateCapMemberus-gaap:CashFlowHedgingMember2020-02-280001708035ecvt:November2018InterestRateCapMemberus-gaap:CashFlowHedgingMember2021-01-012021-12-310001708035ecvt:November2018InterestRateCapMemberus-gaap:CashFlowHedgingMember2021-03-310001708035ecvt:November2018InterestRateCapMemberus-gaap:CashFlowHedgingMember2020-03-012020-03-310001708035ecvt:November2018InterestRateCapMemberus-gaap:CashFlowHedgingMember2018-11-300001708035ecvt:November2018InterestRateCapMemberus-gaap:CashFlowHedgingMember2018-11-012020-12-310001708035us-gaap:CashFlowHedgingMemberecvt:July2020InterestRateCapMember2020-07-310001708035ecvt:January2022InterestRateCapsMemberus-gaap:SubsequentEventMemberus-gaap:CashFlowHedgingMember2022-01-31ecvt:contracts0001708035us-gaap:SubsequentEventMemberus-gaap:CashFlowHedgingMemberecvt:January2022InterestRateCapExpiringOctober2024Member2022-01-310001708035us-gaap:SubsequentEventMemberus-gaap:CashFlowHedgingMemberecvt:January2022InterestRateCapExpiringOctober2025Member2022-01-310001708035ecvt:January2022InterestRateCapsMemberus-gaap:SubsequentEventMemberus-gaap:CashFlowHedgingMember2022-01-142022-01-140001708035us-gaap:CrossCurrencyInterestRateContractMemberus-gaap:NetInvestmentHedgingMember2019-10-010001708035us-gaap:CrossCurrencyInterestRateContractMember2019-10-312019-10-310001708035us-gaap:CrossCurrencyInterestRateContractMemberus-gaap:NetInvestmentHedgingMember2021-12-310001708035us-gaap:CrossCurrencyInterestRateContractMemberus-gaap:NetInvestmentHedgingMember2021-01-012021-12-310001708035us-gaap:InterestRateCapMemberus-gaap:CashFlowHedgingMemberus-gaap:OtherNoncurrentAssetsMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-12-310001708035us-gaap:InterestRateCapMemberus-gaap:CashFlowHedgingMemberus-gaap:OtherNoncurrentAssetsMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-12-310001708035us-gaap:DesignatedAsHedgingInstrumentMember2021-12-310001708035us-gaap:DesignatedAsHedgingInstrumentMember2020-12-310001708035us-gaap:InterestRateCapMemberus-gaap:CashFlowHedgingMemberus-gaap:AccruedLiabilitiesMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-12-310001708035us-gaap:InterestRateCapMemberus-gaap:CashFlowHedgingMemberus-gaap:AccruedLiabilitiesMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-12-310001708035us-gaap:InterestRateCapMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherNoncurrentLiabilitiesMember2021-12-310001708035us-gaap:InterestRateCapMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherNoncurrentLiabilitiesMember2020-12-310001708035us-gaap:InterestRateCapMember2021-01-012021-12-310001708035us-gaap:InterestRateCapMemberus-gaap:InterestExpenseMember2021-01-012021-12-310001708035us-gaap:InterestRateCapMember2020-01-012020-12-310001708035us-gaap:InterestRateCapMemberus-gaap:InterestExpenseMember2020-01-012020-12-310001708035us-gaap:InterestRateCapMember2019-01-012019-12-310001708035us-gaap:InterestRateCapMemberus-gaap:InterestExpenseMember2019-01-012019-12-310001708035us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2021-01-012021-12-310001708035us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2020-01-012020-12-310001708035us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2019-01-012019-12-310001708035us-gaap:CurrencySwapMember2021-01-012021-12-310001708035us-gaap:CurrencySwapMember2020-01-012020-12-310001708035us-gaap:CurrencySwapMember2019-01-012019-12-310001708035us-gaap:SaleOfSubsidiaryGainLossMember2021-01-012021-12-310001708035us-gaap:SaleOfSubsidiaryGainLossMember2020-01-012020-12-310001708035us-gaap:SaleOfSubsidiaryGainLossMember2019-01-012019-12-310001708035ecvt:InterestIncomeExpenseMember2021-01-012021-12-310001708035ecvt:InterestIncomeExpenseMember2020-01-012020-12-310001708035ecvt:InterestIncomeExpenseMember2019-01-012019-12-310001708035us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-01-012021-12-310001708035us-gaap:DomesticCountryMember2021-01-012021-12-310001708035us-gaap:DomesticCountryMember2020-01-012020-12-310001708035us-gaap:DomesticCountryMember2019-01-012019-12-310001708035us-gaap:ForeignCountryMember2021-01-012021-12-310001708035us-gaap:ForeignCountryMember2020-01-012020-12-310001708035us-gaap:ForeignCountryMember2019-01-012019-12-310001708035us-gaap:SegmentContinuingOperationsMember2021-01-012021-12-310001708035us-gaap:SegmentContinuingOperationsMember2020-01-012020-12-310001708035us-gaap:SegmentContinuingOperationsMember2019-01-012019-12-310001708035us-gaap:PensionPlansDefinedBenefitMember2021-01-012021-12-310001708035us-gaap:PensionPlansDefinedBenefitMembercountry:US2020-12-310001708035us-gaap:PensionPlansDefinedBenefitMembercountry:US2019-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2020-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2019-12-310001708035us-gaap:PensionPlansDefinedBenefitMembercountry:US2021-01-012021-12-310001708035us-gaap:PensionPlansDefinedBenefitMembercountry:US2020-01-012020-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2021-01-012021-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2020-01-012020-12-310001708035us-gaap:PensionPlansDefinedBenefitMembercountry:US2021-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2021-12-310001708035us-gaap:PensionPlansDefinedBenefitMembercountry:US2019-01-012019-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2019-01-012019-12-310001708035us-gaap:UnfundedPlanMember2021-12-310001708035us-gaap:UnfundedPlanMember2020-12-31ecvt:plan0001708035us-gaap:EquitySecuritiesMemberecvt:EcoServicesPensionEquityPlanMemberus-gaap:PensionPlansDefinedBenefitMember2021-12-310001708035ecvt:EcoServicesPensionEquityPlanMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DebtSecuritiesMember2021-12-310001708035us-gaap:EquitySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMemberecvt:EcoServicesHourlyPensionPlanMember2021-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberecvt:EcoServicesHourlyPensionPlanMemberus-gaap:DebtSecuritiesMember2021-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:CashAndCashEquivalentsMember2021-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberus-gaap:CashAndCashEquivalentsMember2021-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CashAndCashEquivalentsMember2021-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CashAndCashEquivalentsMember2021-12-310001708035us-gaap:PrivateEquityFundsDomesticMemberus-gaap:PensionPlansDefinedBenefitMember2021-12-310001708035us-gaap:PrivateEquityFundsDomesticMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2021-12-310001708035us-gaap:PrivateEquityFundsDomesticMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2021-12-310001708035us-gaap:PrivateEquityFundsDomesticMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2021-12-310001708035us-gaap:PrivateEquityFundsForeignMemberus-gaap:PensionPlansDefinedBenefitMember2021-12-310001708035us-gaap:PrivateEquityFundsForeignMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2021-12-310001708035us-gaap:PrivateEquityFundsForeignMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2021-12-310001708035us-gaap:PrivateEquityFundsForeignMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2021-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasuryAndGovernmentMember2021-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel1Member2021-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel2Member2021-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel3Member2021-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMember2021-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2021-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2021-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMember2021-12-310001708035us-gaap:PensionPlansDefinedBenefitMember2021-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2021-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2021-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2021-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:CashAndCashEquivalentsMember2020-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberus-gaap:CashAndCashEquivalentsMember2020-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CashAndCashEquivalentsMember2020-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CashAndCashEquivalentsMember2020-12-310001708035us-gaap:PrivateEquityFundsDomesticMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001708035us-gaap:PrivateEquityFundsDomesticMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2020-12-310001708035us-gaap:PrivateEquityFundsDomesticMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2020-12-310001708035us-gaap:PrivateEquityFundsDomesticMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2020-12-310001708035us-gaap:PrivateEquityFundsForeignMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001708035us-gaap:PrivateEquityFundsForeignMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2020-12-310001708035us-gaap:PrivateEquityFundsForeignMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2020-12-310001708035us-gaap:PrivateEquityFundsForeignMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2020-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasuryAndGovernmentMember2020-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel1Member2020-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel2Member2020-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel3Member2020-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMember2020-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2020-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2020-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMember2020-12-310001708035ecvt:OtherInsurancePoliciesMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001708035ecvt:OtherInsurancePoliciesMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2020-12-310001708035ecvt:OtherInsurancePoliciesMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2020-12-310001708035ecvt:OtherInsurancePoliciesMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2020-12-310001708035us-gaap:PensionPlansDefinedBenefitMember2020-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2020-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2020-12-310001708035us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2020-12-310001708035us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2021-01-012021-12-310001708035us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2020-12-310001708035us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2019-12-310001708035us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2020-01-012020-12-310001708035us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2021-12-310001708035us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2019-01-012019-12-310001708035ecvt:TwoThousandSeventeenOmnibusPlanMemberMember2021-12-310001708035us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001708035us-gaap:EmployeeStockOptionMember2018-12-310001708035us-gaap:EmployeeStockOptionMember2019-01-012019-12-310001708035us-gaap:EmployeeStockOptionMember2019-12-310001708035us-gaap:EmployeeStockOptionMember2020-01-012020-12-310001708035us-gaap:EmployeeStockOptionMember2020-12-310001708035us-gaap:EmployeeStockOptionMember2021-12-310001708035us-gaap:RestrictedStockUnitsRSUMembersrt:DirectorMember2021-01-012021-12-310001708035ecvt:EmployeeMemberus-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001708035ecvt:PerformanceStockUnitsMember2021-01-012021-12-310001708035srt:MinimumMemberecvt:PerformanceStockUnitsMember2021-01-012021-12-310001708035ecvt:PerformanceStockUnitsMembersrt:MaximumMember2021-01-012021-12-310001708035ecvt:A2020MonteCarloSimulationMember2021-01-012021-12-310001708035ecvt:A2021MonteCarloSimulationMember2021-01-012021-12-310001708035us-gaap:RestrictedStockMember2018-12-310001708035us-gaap:RestrictedStockUnitsRSUMember2018-12-310001708035ecvt:PerformanceStockUnitsMember2018-12-310001708035us-gaap:RestrictedStockMember2019-01-012019-12-310001708035us-gaap:RestrictedStockUnitsRSUMember2019-01-012019-12-310001708035ecvt:PerformanceStockUnitsMember2019-01-012019-12-310001708035us-gaap:RestrictedStockMember2019-12-310001708035us-gaap:RestrictedStockUnitsRSUMember2019-12-310001708035ecvt:PerformanceStockUnitsMember2019-12-310001708035us-gaap:RestrictedStockMember2020-01-012020-12-310001708035us-gaap:RestrictedStockUnitsRSUMember2020-01-012020-12-310001708035ecvt:PerformanceStockUnitsMember2020-01-012020-12-310001708035us-gaap:RestrictedStockMember2020-12-310001708035us-gaap:RestrictedStockUnitsRSUMember2020-12-310001708035ecvt:PerformanceStockUnitsMember2020-12-310001708035us-gaap:RestrictedStockMember2021-01-012021-12-310001708035us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001708035us-gaap:RestrictedStockMember2021-12-310001708035us-gaap:RestrictedStockUnitsRSUMember2021-12-310001708035ecvt:PerformanceStockUnitsMember2021-12-310001708035us-gaap:PerformanceSharesMember2021-01-012021-12-310001708035ecvt:SharebasedCompensationAwardTrancheFourMemberus-gaap:PerformanceSharesMember2021-01-012021-12-310001708035us-gaap:RestrictedStockMember2021-01-012021-12-310001708035us-gaap:RestrictedStockMember2020-01-012020-12-310001708035us-gaap:RestrictedStockMember2019-01-012019-12-310001708035us-gaap:PerformanceSharesMember2021-01-012021-12-310001708035us-gaap:PerformanceSharesMember2020-01-012020-12-310001708035us-gaap:PerformanceSharesMember2019-01-012019-12-310001708035ecvt:RestrictedStockRestrictedStockUnitsRSUsandPerformanceStockUnitsPSUsMember2021-01-012021-12-310001708035ecvt:RestrictedStockRestrictedStockUnitsRSUsandPerformanceStockUnitsPSUsMember2020-01-012020-12-310001708035ecvt:RestrictedStockRestrictedStockUnitsRSUsandPerformanceStockUnitsPSUsMember2019-01-012019-12-310001708035us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001708035us-gaap:EmployeeStockOptionMember2020-01-012020-12-310001708035us-gaap:EmployeeStockOptionMember2019-01-012019-12-310001708035ecvt:SubsurfaceRemediationAndWetlandsManagementMember2021-12-310001708035ecvt:SubsurfaceRemediationAndWetlandsManagementMember2020-12-310001708035ecvt:SubsurfaceRemediationAndSoilVaporExtractionMember2021-12-310001708035ecvt:SubsurfaceRemediationAndSoilVaporExtractionMember2020-12-310001708035ecvt:OperatingLeaseRentalPaymentsMemberus-gaap:CorporateJointVentureMember2021-01-012021-12-310001708035ecvt:OperatingLeaseRentalPaymentsMemberus-gaap:CorporateJointVentureMember2020-01-012020-12-310001708035ecvt:OperatingLeaseRentalPaymentsMemberus-gaap:CorporateJointVentureMember2019-01-012019-12-310001708035ecvt:ManufacturingCostsMemberus-gaap:CorporateJointVentureMember2021-01-012021-12-310001708035ecvt:ManufacturingCostsMemberus-gaap:CorporateJointVentureMember2020-01-012020-12-310001708035ecvt:ManufacturingCostsMemberus-gaap:CorporateJointVentureMember2019-01-012019-12-310001708035ecvt:ServicesMemberus-gaap:CorporateJointVentureMember2021-01-012021-12-310001708035ecvt:ServicesMemberus-gaap:CorporateJointVentureMember2020-01-012020-12-310001708035ecvt:ServicesMemberus-gaap:CorporateJointVentureMember2019-01-012019-12-310001708035ecvt:ProductDemonstrationCostsMemberus-gaap:CorporateJointVentureMember2021-01-012021-12-310001708035ecvt:ProductDemonstrationCostsMemberus-gaap:CorporateJointVentureMember2020-01-012020-12-310001708035ecvt:ProductDemonstrationCostsMemberus-gaap:CorporateJointVentureMember2019-01-012019-12-310001708035ecvt:INEOSCapitalPartnersMember2021-01-012021-12-310001708035ecvt:INEOSCapitalPartnersMember2020-01-012020-12-310001708035ecvt:INEOSCapitalPartnersMember2019-01-012019-12-3100017080352021-01-012021-03-3100017080352021-04-012021-06-3000017080352021-07-012021-09-3000017080352021-10-012021-12-3100017080352020-01-012020-03-3100017080352020-04-012020-06-3000017080352020-07-012020-09-3000017080352020-10-012020-12-310001708035srt:ParentCompanyMember2021-01-012021-12-310001708035srt:ParentCompanyMember2020-01-012020-12-310001708035srt:ParentCompanyMember2019-01-012019-12-310001708035srt:ParentCompanyMember2021-12-310001708035srt:ParentCompanyMember2020-12-310001708035srt:ParentCompanyMember2019-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| | | | | |

(Mark One) |

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2021

OR | | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-38221

ECOVYST INC.

| | | | | | | | | | | |

| Delaware | | 81-3406833 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| |

| 300 Lindenwood Drive | | |

Malvern, Pennsylvania | | 19355 |

| (Address of principal executive offices) | | (Zip Code) |

| | | | | |

(610) | 651-4400 |

| (Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol | Name of each exchange on which registered |

| Common stock, par value $0.01 per share | ECVT | New York Stock Exchange |

| | |

| | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ý Yes ¨ No |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes ý No |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ý Yes ¨ No |

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ý Yes ¨ No |

| | | | | | | | | | | | | | | | | | | | |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. |

| Large accelerated filer | | ☒ | | Accelerated filer | | ☐ |

| | | | |

| Non-accelerated filer | | ☐ | | Smaller reporting company | | ☐ |

| | | | | | |

| | | | Emerging growth company | | ☐ |

| | | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ |

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ☐ Yes ý No |

The aggregate market value of Ecovyst Inc. voting and non-voting common equity held by non-affiliates as of June 30, 2021 (the last business day of the registrant’s most recently completed second fiscal quarter) based on the closing sale price of $15.36 per share as reported on the New York Stock Exchange was $855,331,738. |

The number of shares of common stock outstanding as of February 25, 2022 was 138,205,783. |

| | | | | | | | | | | | | | |

| | | | |

| | | | |

DOCUMENTS INCORPORATED BY REFERENCE |

Portions of the Ecovyst Inc. Proxy Statement for the 2022 Annual Meeting of Stockholders are incorporated by reference into Part III of this report. |

ECOVYST INC.

INDEX—FORM 10-K

December 31, 2021 | | | | | | | | |

| | Page |

| | |

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | |

| | |

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| Item 9C. | | |

| | |

| | |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| | |

| | |

| Item 15. | | |

| Item 16. | | |

| | |

| | |

| | |

PART I

Forward-looking Statements and Risk Factor Summary

This Annual Report on Form 10-K (“Form 10-K”) includes “forward-looking statements” that express our opinions, expectations, beliefs, plans, objectives, assumptions or projections regarding future events or future results. The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should” and similar expressions are intended to identify these forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy, short- and long-term business operations and objections, and financial needs. Examples of forward-looking statements include, but are not limited to, statements we make regarding the impact of the novel coronavirus (“COVID-19”) pandemic on our operations and financial results and our liquidity, and our belief that our current level of operations, cash and cash equivalents, cash flow from operations and borrowings under our credit facilities and other lines of credit will provide us adequate cash to fund the working capital, capital expenditure, debt service and other requirements for our business for at least the next twelve months.

These forward-looking statements are subject to a number of risks, uncertainties and assumptions. Moreover, we operate in a very competitive and rapidly changing environment and new risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed herein may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

Some of the key factors that could cause actual results to differ from our expectations include the following risks related to our business:

•as a global business, we are exposed to local business risks in different countries;

•we are affected by general economic conditions and economic downturns;

•exchange rate fluctuations could adversely affect our financial condition, results of operations and cash flows;

•our international operations require us to comply with anti-corruption laws, trade and export controls and regulations of the U.S. government and various international jurisdictions in which we do business;

•alternative technology or other changes in our customers’ products may reduce or eliminate the need for certain of our products;

•our new product development and research and development efforts may not succeed and our competitors may develop more effective or successful products;

•our substantial level of indebtedness could adversely affect our financial condition;

•if we are unable to pass on increases in raw material prices, including natural gas, to our customers or to retain or replace our key suppliers, our results of operations and cash flows may be negatively affected;

•we face substantial competition in the industries in which we operate;

•we are subject to the risk of loss resulting from non-payment or non-performance by our customers;

•we rely on a limited number of customers for a meaningful portion of our business;

•multi-year customer contracts in our Ecoservices segment are subject to potential early termination and such contracts may not be renewed at the end of their respective terms;

•our quarterly results of operations are subject to fluctuations because the demand for some of our products is seasonal;

•our growth projects may result in significant expenditures before generating revenues, if any, which may materially and adversely affect our ability to implement our business strategy;

•we may be liable to damages based on product liability claims brought against us or our customers for costs associated with recalls of our or our customers’ products;

•we are subject to extensive environmental, health and safety regulations and face various risks associated with potential non-compliance or releases of hazardous materials;

•existing and proposed regulations to address climate change by limiting greenhouse gas emissions may cause us to incur significant additional operating and capital expenses and may impact our business and results of operations;

•production and distribution of our products could be disrupted for a variety of reasons, and such disruptions could expose us to significant losses or liabilities;

•the insurance that we maintain may not fully cover all potential exposures;

•we could be subject to damages based on claims brought against us by our customers or lose customers as a result of the failure of our products to meet certain quality specifications;

•our failure to protect our intellectual property and infringement on the intellectual property rights of third parties;

•losses and damages in connection with information technology risks could adversely affect our operations;

•the impact of the ongoing COVID-19 pandemic on the global economy and financial markets, as well as on our business and our suppliers, and the response of governments and of our company to the outbreak including variants of the virus and associated containment, remediation and vaccination efforts; and

•the other risks and uncertainties discussed in “Item 1A—Risk Factors.”

The forward-looking statements included herein are made only as of the date hereof. You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected in the forward-looking statements will be achieved or occur. Moreover, neither we nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. We undertake no obligation to update publicly any forward-looking statements for any reason after the date of this Form 10-K to conform these statements to actual results or to changes in our expectations.

ITEM 1. BUSINESS.

Ecovyst Inc. (“Ecovyst” or the “Company”), formerly PQ Group Holdings Inc. (“PQ Group Holdings”) was incorporated in Delaware on August 7, 2015. We trace our roots to 1831, and our business has a nearly 200-year history of innovation, enabling environmental improvements in areas such as fuel efficiency and emissions, while improving the sustainability of our planet. On May 4, 2016, we consummated a series of transactions (the “Business Combination”) to reorganize and combine the then-existing businesses with Eco Services Operations LLC under a new holdings company, then called PQ Group Holdings. On October 3, 2017, we completed our initial public offering (“IPO”). On August 1, 2021, we changed our name from “PQ Group Holdings Inc.” to “Ecovyst Inc.”, changed the ticker symbol of our common stock listed on the New York Stock Exchange from “PQG” to “ECVT” and rebranded our former segments from “Refining Services” to “Ecoservices” and “Catalysts” to “Catalyst Technologies.” Our common stock is listed on the New York Stock Exchange under the stock ticker “ECVT”. Unless the context otherwise indicates, the terms “Ecovyst Inc.,” “we,” “us,” “our,” or the “Company” mean Ecovyst Inc. and our subsidiaries.

On December 14, 2020, we completed the sale of our Performance Materials business to Potters Buyer, LLC (the “Purchaser”), an affiliate of The Jordan Company, L.P., for a purchase price of $650 million, which was subject to certain adjustments for indebtedness, working capital, and cash at the closing of the transaction. The results of operations, financial condition, and cash flows for the Performance Materials businesses are presented herein as discontinued operations. Except where noted, any tables, percentages or metrics included within this filing exclude the results of our former Performance Materials business. Refer to Note 4 to our Consolidated Financial Statements for additional information.

Effective on August 1, 2021, we completed the sale of our Performance Chemicals business for $1.1 billion, subject to certain adjustments set forth in the agreement. We used a portion of the net cash proceeds to repay the entire Senior Secured Term Loan Facility due February 2027 of $231.4 million and the 5.750% Senior Notes due 2025 (the “Senior Notes”) of $295.0 million. The Senior Notes were redeemed at a redemption price equal to the sum of 102.875% of the principal amount of the Senior Notes plus accrued and unpaid interest to, but excluding, August 2, 2021. Additionally, our Board of Directors (the “Board”) declared a special cash dividend of $3.20 per share, payable on August 23, 2021 to shareholders of record as of the close of business on August 12, 2021. The results of operations, financial condition, and cash flows for the Performance Chemicals business are presented herein as discontinued operations. Refer to Note 5 to our Consolidated Financial Statements for additional information.

Our Company

We are a leading, integrated and innovative global provider of specialty catalysts and services. We believe that our products, which are predominantly inorganic, and services contribute to improving the sustainability of the environment. Our value-added products seek to address global demand trends that are often either the subject of significant environmental and safety regulations or are driven by consumer preferences for environmentally friendlier alternative products, which provides us with high-margin growth opportunities. Specifically, our products and solutions help companies produce vehicles with improved fuel efficiency and cleaner emissions. Because our products are predominantly inorganic and carbon-free, we believe we contribute to improving the sustainability of our planet.

We believe we are a leader in each of our business segments, holding what we estimate to be a number one or number two supply share position for products that generated more than 90% of our 2021 sales. We believe that our global footprint and efficient network of strategically located manufacturing facilities provide us with a strong competitive advantage in serving our customers both regionally as well as globally.

We believe, with our long history of established partnerships with our customers and our reputation for providing reliable, quality of products and solutions, our products deliver significant value to our customers, as demonstrated by our profit margins. Our products typically constitute a small portion of our customers’ overall end-product costs yet are critical to product performance.

We have a long track record of innovation that is reflected in our technical and production expertise in silica, zeolites and catalyst technologies.

We are highly diversified by business, geography and end use. In 2021 the majority of our sales were for applications that have historically had relatively predictable, consistent demand patterns driven by consumption or frequent replacement cycles.

As a result of our competitive strengths, we have generally maintained stable margins through changing macro economic cycles.

In 2021, we served global customers across many end uses and, as of December 31, 2021, operated out of 10 strategically located manufacturing facilities.

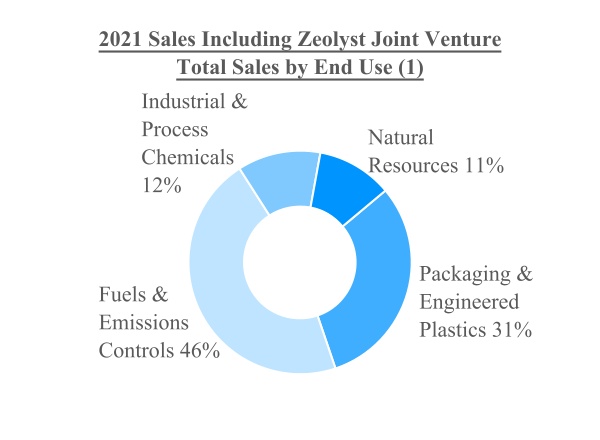

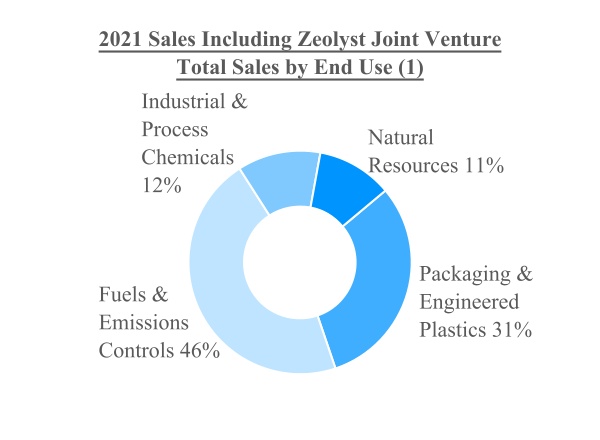

(1)Percentage calculations include $131.3 million of total sales attributable to the Zeolyst Joint Venture (“Zeolyst JV”), which represents 50% of its total sales for the year ended December 31, 2021. The Zeolyst JV sales are included in both the Fuels & Emission Controls and Packaging & Engineered Plastics end uses. Refer to “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Basis of Presentation” for a description of the treatment of the Zeolyst Joint Venture in our consolidated financial information.

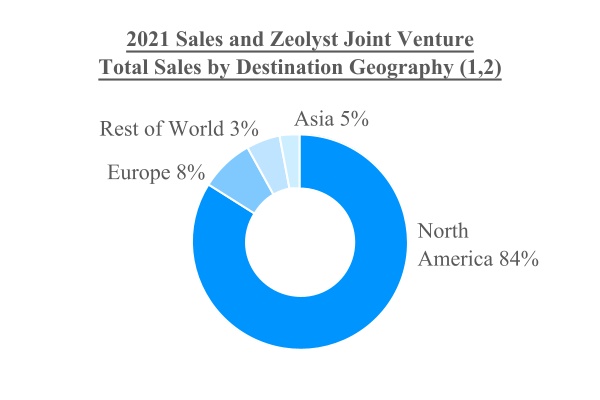

(2)Based on the delivery destination for products sold in 2021.

Our Strategy

We intend to capitalize on our strong business foundation, sustainability driven innovation and customer partnerships to grow sales profitably, maintain high margins, deploy capital efficiently and generate free cash flow in order to create shareholder value. We believe that our long history of operational excellence and proven reliability, technology leadership, strong customer relationships, innovation track record and consistent business execution developed from our industry experience positions us well to execute our business strategy.

Our Industry

Our industry is characterized by constant development of new products and the need to support customers with new product innovation and technical services to meet their needs, coupled with consistent product quality and a reliable source of supply in a safe and environmentally sustainable manner. Products sold to our customers can be high value-add even when they represent a small portion of the overall end product costs, and success can be achieved by helping customers improve their product performance, value, and quality. As a result, operating margins in this sector have historically been high and generally stable through economic cycles. In addition, many products in the specialty chemicals industry benefit from economics that favor incumbent producers because the capital cost to expand existing capacity is typically significantly less than the capital cost necessary to build a new plant. The combination of attractive operating margins and generally predictable maintenance capital expenditure requirements can produce attractive cash flows.

Our Product End Uses

The table below summarizes our key end use applications and products as well as the significant growth drivers in those applications.

| | | | | | | | | | | | | | | | | |

| Sales and Zeolyst JV Total Sales(1) | | |

| Key End Uses | 2021 | 2020 | 2019 | Significant Growth Drivers | Key Ecovyst Products |

| Fuels & Emission Controls | 46% | 51% | 54% | • Global regulatory requirements to: | • Refinery hydrocracking catalysts |

| | | | • Remove nitrogen oxides from emissions | • Emission control catalysts |

| | | | • Remove sulfur from diesel and gasoline | • Catalyst recycling regeneration services |

| | | | • Increase gasoline octane in order to improve fuel efficiency while lowering vapor pressure to regulated levels | • Acid regeneration |

| | | | • Improve lubricant characteristics to improve fuel efficiencies | |

| | | | | |

| | | | | |

| | | | |

| Packaging & Engineered Plastics | 31% | 27% | 26% | • Demand for increased process efficiency and reduction of by-products in production chemicals | • Catalysts for high-density polyethylene and chemicals syntheses |

| | | | • Demand for high-density polyethylene and nylon lightweighting of automotive components | • Antiblocks for film packaging |

| | | | | • Sulfur derivatives for nylon production |

| Industrial & Process Chemicals | 12% | 11% | 11% | • Demand for a wide range of products including construction materials, auto, consumer goods, and chemicals | • Sulfur derivatives for industrial production |

| | | | | • Treatment services |

| Natural Resources | 11% | 11% | 9% | • Recovery in global oil drilling/U.S. copper production | • Sulfuric acid for mining |

| | | | • Demand for metals and minerals for low carbon technologies and infrastructure | |

| | | | | |

| | | | | |

(1) Percentage calculations include $131.3 million, $128.6 million and $170.3 million of total sales attributable to the Zeolyst JV, which represents 50% of its total sales for each of the years ended December 31, 2021, 2020 and 2019, respectively. The Zeolyst JV sales are included in both the Fuels & Emission Controls and Packaging & Engineered Plastics key end uses. Refer to “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Basis of Presentation” for a description of the treatment of the Zeolyst Joint Venture in our consolidated financial information.

Competitive Business Strengths

Favorable Secular Growth Trends Across the Portfolio

We focus on serving end use applications where we believe significant future growth potential exists. Our products address our customers’ needs, which are typically driven either by regulatory requirements or consumer preferences, on a global basis. In 2021, a majority of our sales were to end uses such as fuels and emission controls, consumer products and industrial applications that generally do not exhibit as much cyclicality as other applications. We believe that our products incorporate innovative environmental and safety solutions to address evolving customer demands, examples of which include the following:

Increased use of plastics as a substitute for heavier and less versatile materials, such as glass and metal, is driving increased global demand for polyethylene capacity expansions and production. Further, we are seeing expansions shift towards silica-based technology, which we believe will drive growth for our Silica Catalysts product group within our Catalyst Technologies segment.

Light- and heavy-duty diesel engines are subject to a broad set of regulatory requirements and are subject to increasingly strict standards. We believe these trends present global opportunities for the Zeolyst Joint Venture to support our customers in meeting these standards through our sales of emission control catalysts. While the US Environmental Protection Agency and European Union have led other nations in terms of standards that limit the amount of nitrogen oxides, carbon dioxide and other emissions for diesel engines, other emerging regions are implementing similar standards, specifically China, with the China VI (equivalent to Euro VI) emission standard enacted in 2020.

Given stringent fuel efficiency standards that are driving the design of new engines and the resulting higher-octane gasoline requirements that can be achieved through alkylate blending, we believe that our Ecoservices segment is well positioned to benefit from any related growth in demand for alkylate.

We also believe we have opportunities to displace other less environmentally friendly materials for industrial and consumer good applications through our business segments. Our Ecoservices segment is the largest North American recycler and one of the largest consumers of refinery by-products of sulfur, enabling them to be converted to other applications. In our Catalyst Technologies segment, we are helping our customers meet evolving regulatory requirements for the reduction of sulfur from diesel fuel and reduction of NOx emissions from diesel engines through our custom zeolites. Similarly, our specialty zeolites and silica supported catalysts are enabling our customers to improve fuel economy and utilize renewable resources through development of improved lubricants, lightweight polymers and renewable transportation fuel.

Leading Supply Positions

We believe that we maintain a leading supply position for certain products sold within each of our segments, holding what we estimate to be the number one or two supply share position in 2021 for products that generated more than 90% of our sales. We believe that our global footprint and efficient network of strategically located manufacturing facilities provides us with a strong competitive advantage in serving our customers both globally and regionally, and that it would be costly for our competitors to replicate our network.

In our Catalyst Technologies segment, we primarily compete on a global basis. We are a leading supplier of refinery hydrocracking catalyst used to remove sulfur, and emission control catalysts used in the heavy- and light-duty diesel industries to reduce nitrogen oxides emissions. We are also a global supplier of silica catalysts and supports for polyethylene manufacturers and the exclusive supplier of methyl methacrylate (“MMA”) catalysts used in the patented Alpha process practiced by a global MMA leader.

In our Ecoservices segment, we hold an estimated number one supply share position in the United States in sulfuric acid regeneration services based on 2021 sales volume of greater than 50%.

Innovation Track Record

A key competitive advantage is derived from our depth of expertise in silica, zeolites and catalysts technologies. Further, we have the ability to tailor and scale specialty grades to meet changing demands and technical support for large scale commercialization. Many of our products require close customer collaboration to address constantly evolving customer application challenges. Given the long lead-time required for product development and commercialization, which can be up to ten years, we work closely and build long-term relationships with our customers. In many cases, our

relationships have spanned decades given our ability to meet customized specifications and performance characteristics while also maintaining strict quality standards.

These long-term relationships have allowed us to innovate together with our customers to meet evolving demands. For example, we have developed zeolite-based catalysts that are an effective and efficient method to reduce pollutants from heavy- and light-duty diesel engines and enable our customers to meet increasingly stringent vehicle emission standards worldwide. In addition, our proprietary silica catalyst has enabled development of a high strength high-density polyethylene (“HDPE”) resin that is used for making lightweight plastic gasoline tanks for automobiles.

Long-Term, High-Quality Customer Relationships

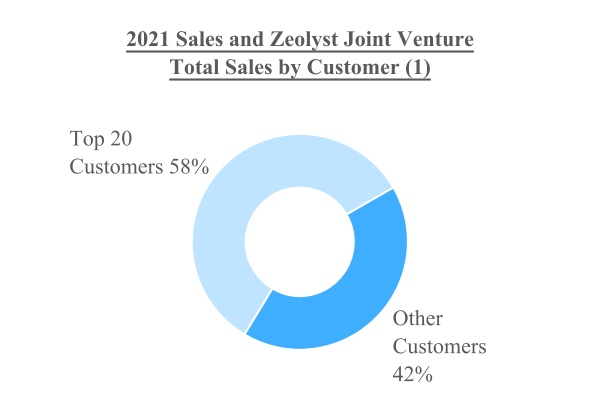

We collaborate with leading multinational companies that often seek global solutions. Our customers include large industrial companies such as Exxon Mobil, BASF, and Unilever, and global catalyst producers such as Albemarle and W.R. Grace. We also supply catalysts to leading chemical and petrochemical producers such as BASF, Dow Chemical, Lucite, LyondellBasell, and Shell. We have long-term relationships with our top ten customers, based on 2021 sales, that average more than 50 years. In addition, our customer base is diversified, with our top ten customers in 2021 representing approximately 41% of our sales for the year ended December 31, 2021 (including our proportionate 50% share of sales attributable to the Zeolyst JV), and one customer representing 11% or $78.5 million of our sales in both our Ecoservices and Catalyst Technologies businesses during this period.

Secured Contractual Pass-through of Raw Material Costs Support Stable Margins

We have been able to mitigate the impact of raw material or energy price volatility using a variety of mechanisms, including hedging and raw material cost pass-through clauses in our sales contracts and other adjustment provisions. Most of our Ecoservices contracts feature minimum volume protection and/or quarterly price adjustments for items such as commodity inputs, labor, the Chemical Engineering Plant Cost Index and natural gas. In 2021, approximately 80% of our Ecoservices segment sales were sold under contracts that included some form of raw material pass-through clause. These price adjustments generally reflect our Ecoservices actual cost structure in producing sulfuric acid, and tend to provide us with some protection against volatility in labor, fixed costs and raw material pricing. Freight expenses are generally passed through directly to customers.

Our products are predominantly inorganic and carbon-free, and are produced from readily available raw materials such as industrial sand and caustic soda, which prices have historically been less volatile than oil. We also use natural gas in our manufacturing process where our North American facilities have benefited from the plentiful supplies of shale gas. In addition, we have long-term relationships with many of our key raw materials suppliers across all our business segments.

Long Term Customer Contracts Enhance Sales Predictability and Stability

We partner with many of our customers under long-term contract agreements, mutually exclusive product supply arrangements and/or specified products for certain license production processes. In our Ecoservices segment, approximately 40% of our production capacity serves customers with staggered five to ten year “take or pay” contracts with potential for value pricing resets and cost pass-through for our regeneration services product line that enhances sales and margin predictability and stability. Excluding contracts with automatic evergreen provisions, approximately 50% of our sulfuric acid volume for the year ended December 31, 2021 was under contracts expiring at the end of 2022 or beyond.

In our Catalyst Technologies segment, we are either the sole or dual supplier to key global customers under various term agreements up to 10 years for each of polyethylene catalysts and silica catalysts supports. Further, we are an exclusive multi-year supplier of MMA catalyst to a leading global producer. In our zeolite catalysts product group, we operate with a mix of evergreen and various term contracts depending on the product customization with value pricing ranging from 1 to 3 years to supply catalysts and zeolite powders for the refining, petrochemical and chemical industries and nitrogen oxides control catalysts for diesel transportation industries. These terms, in line with industry standards, provide us with flexibility in satisfying customers.

Strategic and Differentiated Manufacturing Know-how and Supply Chain Global Network

Ecoservices’ predecessor company, Stauffer Chemical, was a leader in pioneering the current sulfuric acid regeneration technology in the 1940s. Since then, we have leveraged our process technology expertise and ability to deliver our products by barge, rail, truck and pipeline to become the largest sulfuric acid regenerator in North America and a leading North American producer of high quality virgin sulfuric acid. Ecoservices has also applied its expert knowledge in sulfur chemistry to provide treatment services for hazardous/non hazardous wastes, and most recently activate catalysts with our patented Chem32 technology.

Our Catalyst Technologies product development and manufacturing technology is customized based on deep silica based and zeolite based material science know-how. Our R&D centers develop fit for purpose catalysts with customers. We believe we have a differentiated capability to develop such products and manufacture them consistently.

Stable Margins and Cash Flow Generation Across Changing Macroeconomic Cycles