Exhibit 99.1 INVESTOR DAY | APRIL 8, 2021 | 10am ESTExhibit 99.1 INVESTOR DAY | APRIL 8, 2021 | 10am EST

Welcome Nahla Azmy Vice President, Investor Relations and Financial CommunicationsWelcome Nahla Azmy Vice President, Investor Relations and Financial Communications

Agenda for Target PQ Virtual Investor Conference 10:00-10:01 Welcome & Legal Nahla Azmy – VP, Investor Relations and Financial Communications 10:01-10:20 Opening Remarks and Strategy Overview Belgacem Chariag – Chairman, President and Chief Executive Officer Refining Services Overview 10:20-10:30 Kurt Bitting – President, Refining Services Catalysts Overview 10:30-10:45 Tom Schneberger – President, Catalyst Technologies 10:45-10:55 10 min Break Innovation Overview 10:55- 11:05 Dr. Ray Kolberg – VP, Technology and Business Development 11:05-11:12 Financial Performance & Goals Overview Mike Crews – EVP and Chief Financial Officer Mike Feehan – VP, Finance and Treasurer 11:12-11:15 Closing Remarks Belgacem Chariag – Chairman, President and Chief Executive Officer 11:15-11:20 5 min Break 11:20 Q&A Agenda for Target PQ Virtual Investor Conference 10:00-10:01 Welcome & Legal Nahla Azmy – VP, Investor Relations and Financial Communications 10:01-10:20 Opening Remarks and Strategy Overview Belgacem Chariag – Chairman, President and Chief Executive Officer Refining Services Overview 10:20-10:30 Kurt Bitting – President, Refining Services Catalysts Overview 10:30-10:45 Tom Schneberger – President, Catalyst Technologies 10:45-10:55 10 min Break Innovation Overview 10:55- 11:05 Dr. Ray Kolberg – VP, Technology and Business Development 11:05-11:12 Financial Performance & Goals Overview Mike Crews – EVP and Chief Financial Officer Mike Feehan – VP, Finance and Treasurer 11:12-11:15 Closing Remarks Belgacem Chariag – Chairman, President and Chief Executive Officer 11:15-11:20 5 min Break 11:20 Q&A

Legal Disclaimer ContinuingOperations Financial results are on a continuing operations basis, which excludes the Performance Materials business from all quarterly and yearly results presented, unless otherwise indicated. Financial results are also presented to exclude the Performance Chemicalsbusiness,whichissubjecttoapendingsalewhichtheCompanypreviouslyannouncedonMarch1,2021,butfinancialresultsdonotreflectproformafinancialinformationpresentedpursuanttoArticle11ofRegulationS-X. Forward-LookingStatements Some of theinformation containedin thispresentation, the conference call during which thispresentationisreviewed and any discussions that followconstitutes“forward-looking statements”. Forward-looking statements can beidentified by words such as“anticipates,”“intends,”“plans,”“seeks,”“believes,”“estimates,”“expects,”“projects” and similar referencestofuture periods. Forward-looking statements arebased on our currentexpectations and assumptionsregarding ourbusiness, the economyandotherfutureconditions.Becauseforward-lookingstatementsrelatetothefuture,theyaresubjecttoinherentuncertainties,risksandchangesincircumstancesthataredifficulttopredict.Examplesofforwardlookingstatementsinclude, but are not limited to, statements regarding the sale of the Performance Chemicals business segment, including the intended uses of proceeds therefrom, our future results of operations, financial condition, liquidity, prospects, growth, strategies, capitalallocationprograms,productandserviceofferingsandendusedemandtrends,and2025goals.Ouractualresultsmaydiffermateriallyfromthosecontemplatedbytheforward-lookingstatements.Wecautionyou,therefore,againstrelyingon any of these forward-looking statements. They are neither statements of historical fact nor guarantees or assurances of future performance. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to, our ability to close on the sale of the Performance Chemicals business segment on our anticipated timeline, or at all, our ability to successfully integrate Chem32, regional, national or global political, economic, business, competitive, market and regulatory conditions, including the ongoing COVID-19 pandemic, tariffs, and trade disputes, currency exchange rates and other factors, including those described in the sections titled “Risk Factors” and “Management Discussion & Analysis of Financial Condition and Results of Operations” in our filings with the SEC, which are available on the SEC’s website at www.sec.gov. Any forward-looking statement made by us in this presentation, the conference call during which this presentation is reviewed and any discussions that follow speaks only as of the date on which it is made. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possibleforustopredictallofthem.Weundertakenoobligationtoupdateanyforward-lookingstatement,whetherasaresultofnewinformation,futuredevelopmentsorotherwise,exceptasmayberequiredbyapplicablelaw. Non-GAAPFinancialMeasures This presentation includes certain non-GAAP financial measures, including adjusted EBITDA, adjusted EBITDA margin, cash conversion, total ecovyst sales, ecovyst sales, total ecovyst segment adjusted EBITDA, total ecovyst adjusted EBITDA, total ecovyst adjusted EBITDA margin, free cash flowand net debt and target total sales, which are provided to assist in an understanding of our business and its performance. These non-GAAP financial measures should be consideredonly assupplemental to, and not as superior to, financial measures prepared in accordance with GAAP. Non-GAAP financial measures should be read only in conjunction with consolidated financials prepared in accordance with GAAP. Reconciliations of non-GAAP measures to the relevantGAAPmeasuresareprovidedintheappendixofthispresentation. The Company is not able to provide a reconciliation of the Company's forward-looking non-GAAP financial information to the corresponding GAAP measures without unreasonable effort because of the inherent difficulty in forecasting and quantifying certain amounts necessary for sucha reconciliation such ascertain non-cash, nonrecurring or other items that are included in net income and EBITDA as well as the related tax impacts of these items and asset dispositions/ acquisitions and changes in foreign currency exchange rates that are included in cash flow, due to the uncertainty and variability of the nature and amount of these future charges and costs. The Company is also not able to providea reconciliation of total ecovyst segment adjusted EBITDA to ecovyst net income(loss)withoutunreasonableeffortduetocertainGAAPmeasuresthatarenotcurrently calculable. ZeolystJointVenture Zeolyst International and Zeolyst C.V. (our 50% owned joint ventures that we refer to collectively as our “Zeolyst Joint Venture”) are accounted for as an equity method investment in accordance with GAAP. The presentation of our Zeolyst Joint Venture’ssalesinthispresentationrepresents50%ofthesalesofourZeolystJointVenture. WedonotrecordsalesbyourZeolystJointVentureasrevenueandsuchsalesarenotconsolidatedwithinourresultsofoperations.However,ourAdjusted EBITDA reflects our share of the earnings of our Zeolyst Joint Venture that have been recorded as equity in net income from affiliated companies in our consolidated statements of income for such periods and includes Zeolyst Joint Venture adjustmentsonaproportionatebasisbasedonour50%ownershipinterest. Accordingly,ourAdjustedEBITDAmarginsarecalculatedincluding50%ofthesalesofourZeolystJointVenturefortherelevantperiodsinthedenominator.Legal Disclaimer ContinuingOperations Financial results are on a continuing operations basis, which excludes the Performance Materials business from all quarterly and yearly results presented, unless otherwise indicated. Financial results are also presented to exclude the Performance Chemicalsbusiness,whichissubjecttoapendingsalewhichtheCompanypreviouslyannouncedonMarch1,2021,butfinancialresultsdonotreflectproformafinancialinformationpresentedpursuanttoArticle11ofRegulationS-X. Forward-LookingStatements Some of theinformation containedin thispresentation, the conference call during which thispresentationisreviewed and any discussions that followconstitutes“forward-looking statements”. Forward-looking statements can beidentified by words such as“anticipates,”“intends,”“plans,”“seeks,”“believes,”“estimates,”“expects,”“projects” and similar referencestofuture periods. Forward-looking statements arebased on our currentexpectations and assumptionsregarding ourbusiness, the economyandotherfutureconditions.Becauseforward-lookingstatementsrelatetothefuture,theyaresubjecttoinherentuncertainties,risksandchangesincircumstancesthataredifficulttopredict.Examplesofforwardlookingstatementsinclude, but are not limited to, statements regarding the sale of the Performance Chemicals business segment, including the intended uses of proceeds therefrom, our future results of operations, financial condition, liquidity, prospects, growth, strategies, capitalallocationprograms,productandserviceofferingsandendusedemandtrends,and2025goals.Ouractualresultsmaydiffermateriallyfromthosecontemplatedbytheforward-lookingstatements.Wecautionyou,therefore,againstrelyingon any of these forward-looking statements. They are neither statements of historical fact nor guarantees or assurances of future performance. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to, our ability to close on the sale of the Performance Chemicals business segment on our anticipated timeline, or at all, our ability to successfully integrate Chem32, regional, national or global political, economic, business, competitive, market and regulatory conditions, including the ongoing COVID-19 pandemic, tariffs, and trade disputes, currency exchange rates and other factors, including those described in the sections titled “Risk Factors” and “Management Discussion & Analysis of Financial Condition and Results of Operations” in our filings with the SEC, which are available on the SEC’s website at www.sec.gov. Any forward-looking statement made by us in this presentation, the conference call during which this presentation is reviewed and any discussions that follow speaks only as of the date on which it is made. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possibleforustopredictallofthem.Weundertakenoobligationtoupdateanyforward-lookingstatement,whetherasaresultofnewinformation,futuredevelopmentsorotherwise,exceptasmayberequiredbyapplicablelaw. Non-GAAPFinancialMeasures This presentation includes certain non-GAAP financial measures, including adjusted EBITDA, adjusted EBITDA margin, cash conversion, total ecovyst sales, ecovyst sales, total ecovyst segment adjusted EBITDA, total ecovyst adjusted EBITDA, total ecovyst adjusted EBITDA margin, free cash flowand net debt and target total sales, which are provided to assist in an understanding of our business and its performance. These non-GAAP financial measures should be consideredonly assupplemental to, and not as superior to, financial measures prepared in accordance with GAAP. Non-GAAP financial measures should be read only in conjunction with consolidated financials prepared in accordance with GAAP. Reconciliations of non-GAAP measures to the relevantGAAPmeasuresareprovidedintheappendixofthispresentation. The Company is not able to provide a reconciliation of the Company's forward-looking non-GAAP financial information to the corresponding GAAP measures without unreasonable effort because of the inherent difficulty in forecasting and quantifying certain amounts necessary for sucha reconciliation such ascertain non-cash, nonrecurring or other items that are included in net income and EBITDA as well as the related tax impacts of these items and asset dispositions/ acquisitions and changes in foreign currency exchange rates that are included in cash flow, due to the uncertainty and variability of the nature and amount of these future charges and costs. The Company is also not able to providea reconciliation of total ecovyst segment adjusted EBITDA to ecovyst net income(loss)withoutunreasonableeffortduetocertainGAAPmeasuresthatarenotcurrently calculable. ZeolystJointVenture Zeolyst International and Zeolyst C.V. (our 50% owned joint ventures that we refer to collectively as our “Zeolyst Joint Venture”) are accounted for as an equity method investment in accordance with GAAP. The presentation of our Zeolyst Joint Venture’ssalesinthispresentationrepresents50%ofthesalesofourZeolystJointVenture. WedonotrecordsalesbyourZeolystJointVentureasrevenueandsuchsalesarenotconsolidatedwithinourresultsofoperations.However,ourAdjusted EBITDA reflects our share of the earnings of our Zeolyst Joint Venture that have been recorded as equity in net income from affiliated companies in our consolidated statements of income for such periods and includes Zeolyst Joint Venture adjustmentsonaproportionatebasisbasedonour50%ownershipinterest. Accordingly,ourAdjustedEBITDAmarginsarecalculatedincluding50%ofthesalesofourZeolystJointVenturefortherelevantperiodsinthedenominator.

Opening Remarks & Strategy Overview Belgacem Chariag Chairman, President, and Chief Executive OfficerOpening Remarks & Strategy Overview Belgacem Chariag Chairman, President, and Chief Executive Officer

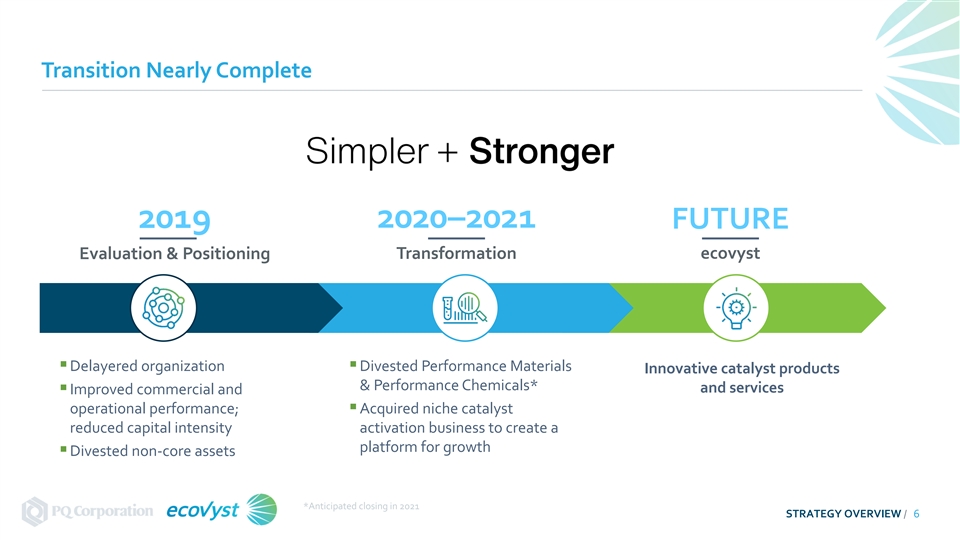

Transition Nearly Complete 2019 2020–2021 FUTURE Evaluation & Positioning Transformation ecovyst § Delayered organization § Divested Performance Materials Innovative catalyst products & Performance Chemicals* and services § Improved commercial and operational performance; § Acquired niche catalyst reduced capital intensity activation business to create a platform for growth § Divested non-core assets *Anticipated closing in 2021 STRATEGY OVERVIEW / 6Transition Nearly Complete 2019 2020–2021 FUTURE Evaluation & Positioning Transformation ecovyst § Delayered organization § Divested Performance Materials Innovative catalyst products & Performance Chemicals* and services § Improved commercial and operational performance; § Acquired niche catalyst reduced capital intensity activation business to create a platform for growth § Divested non-core assets *Anticipated closing in 2021 STRATEGY OVERVIEW / 6

ecovyst Is… Simpler Nimbler Leaner & Stronger Sustainability Growing & Innovative Focused Greening STRATEGY OVERVIEW / 7ecovyst Is… Simpler Nimbler Leaner & Stronger Sustainability Growing & Innovative Focused Greening STRATEGY OVERVIEW / 7

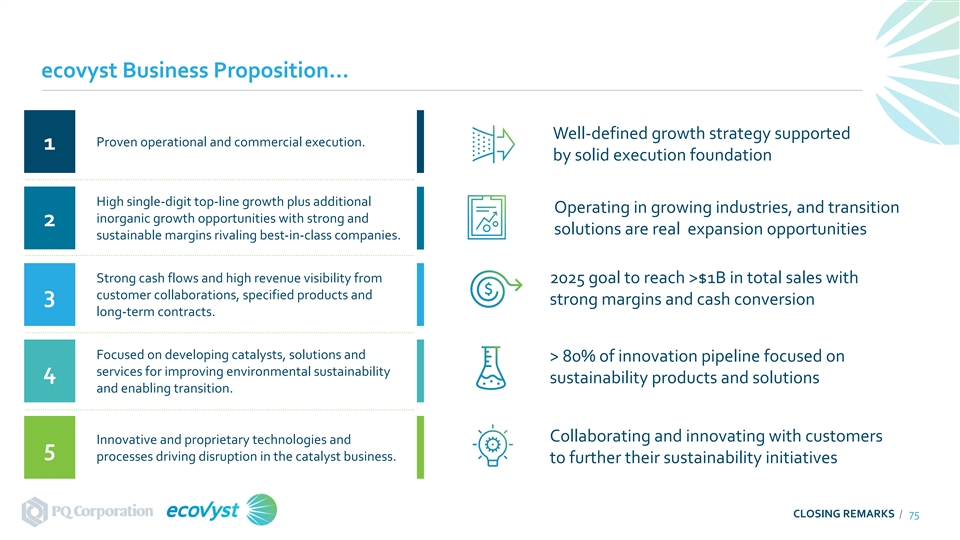

ecovyst Business Proposition… Proven operational and commercial execution 1 High single-digit top-line growth plus additional inorganic growth opportunities with 2 strong and sustainable margins rivaling best-in-class companies Strong cash flows and high revenue visibility from customer collaborations, specified 3 products and long-term contracts Focused on developing catalysts, solutions and services for improving environmental 4 sustainability and enabling transition Innovative and proprietary technologies and processes driving disruption in the catalyst 5 5 business STRATEGY OVERVIEW / 8ecovyst Business Proposition… Proven operational and commercial execution 1 High single-digit top-line growth plus additional inorganic growth opportunities with 2 strong and sustainable margins rivaling best-in-class companies Strong cash flows and high revenue visibility from customer collaborations, specified 3 products and long-term contracts Focused on developing catalysts, solutions and services for improving environmental 4 sustainability and enabling transition Innovative and proprietary technologies and processes driving disruption in the catalyst 5 5 business STRATEGY OVERVIEW / 8

We Are a Focused Pure-Play Our technologies support ecological health. We are well positioned and confident in Vying for, and propelling customers’ expansion and growth. We are a catalyst for positive change Catalyst Ecoservices Technologies Note: PQ Group Holdings Inc. intends to change its name to Ecovyst Inc. in connection with the completion of the pending sale of its Performance Chemicals business, which it previously announced on March 1, 2021. STRATEGY OVERVIEW / 9We Are a Focused Pure-Play Our technologies support ecological health. We are well positioned and confident in Vying for, and propelling customers’ expansion and growth. We are a catalyst for positive change Catalyst Ecoservices Technologies Note: PQ Group Holdings Inc. intends to change its name to Ecovyst Inc. in connection with the completion of the pending sale of its Performance Chemicals business, which it previously announced on March 1, 2021. STRATEGY OVERVIEW / 9

Ecoservices We partner with our customers to help them meet increasingly stringent standards for clean fuels, vehicle fuel economy, and lower emissions North American Leader in Sulfuric Acid Recycling and Related Services Specialty Grade High Purity Offsite Catalyst and Related Regeneration Services Virgin Sulfuric Acid Processing Services 39% 64% 68% Business Businesss Average Adjusted Deep Growing Focused Secure Of total Of total ecovyst 1 Represents Advantages EBITDA margins expertise customer innovation on revenue ecovyst Segment Adjusted 4,5 last 4 years 2,3,5 3,5 demand sustainability streams sales EBITDA 1 Represents the Refining Services segment in historical financial statements 2 Includes 50% portion of the Zeolyst Joint Venture 3 2020 STRATEGY OVERVIEW / 10 4 2017-2020 5 See GAAP reconciliations.Ecoservices We partner with our customers to help them meet increasingly stringent standards for clean fuels, vehicle fuel economy, and lower emissions North American Leader in Sulfuric Acid Recycling and Related Services Specialty Grade High Purity Offsite Catalyst and Related Regeneration Services Virgin Sulfuric Acid Processing Services 39% 64% 68% Business Businesss Average Adjusted Deep Growing Focused Secure Of total Of total ecovyst 1 Represents Advantages EBITDA margins expertise customer innovation on revenue ecovyst Segment Adjusted 4,5 last 4 years 2,3,5 3,5 demand sustainability streams sales EBITDA 1 Represents the Refining Services segment in historical financial statements 2 Includes 50% portion of the Zeolyst Joint Venture 3 2020 STRATEGY OVERVIEW / 10 4 2017-2020 5 See GAAP reconciliations.

Catalyst Technologies We partner with our customers to help improve the performance, durability and environmental profile of their products. Our products are required to meet the evolving standards of cleaner fuels, reduced waste and emission control. Leader in Tailored Solutions for Specialty and Emission Control Catalysts Polyethylene Fuels & Emission Control Niche Custom Catalysts 32% 36% 38% Business Business Of total ecovyst Of total Collaborative Focused Positioned to Expected Average Adjusted 1 Represents Advantages Segment Adjusted ecovyst EBITDA margins last 4 customer innovation on grow faster margin 3,5 2,3,5 4,5 EBITDA sales partnerships sustainability than market expansion years 1 Represents the Catalysts segment in historical financial statements 2 Includes 50% portion of the Zeolyst Joint Venture 3 2020 STRATEGY OVERVIEW / 11 4 2017-2020 5 See GAAP reconciliations.Catalyst Technologies We partner with our customers to help improve the performance, durability and environmental profile of their products. Our products are required to meet the evolving standards of cleaner fuels, reduced waste and emission control. Leader in Tailored Solutions for Specialty and Emission Control Catalysts Polyethylene Fuels & Emission Control Niche Custom Catalysts 32% 36% 38% Business Business Of total ecovyst Of total Collaborative Focused Positioned to Expected Average Adjusted 1 Represents Advantages Segment Adjusted ecovyst EBITDA margins last 4 customer innovation on grow faster margin 3,5 2,3,5 4,5 EBITDA sales partnerships sustainability than market expansion years 1 Represents the Catalysts segment in historical financial statements 2 Includes 50% portion of the Zeolyst Joint Venture 3 2020 STRATEGY OVERVIEW / 11 4 2017-2020 5 See GAAP reconciliations.

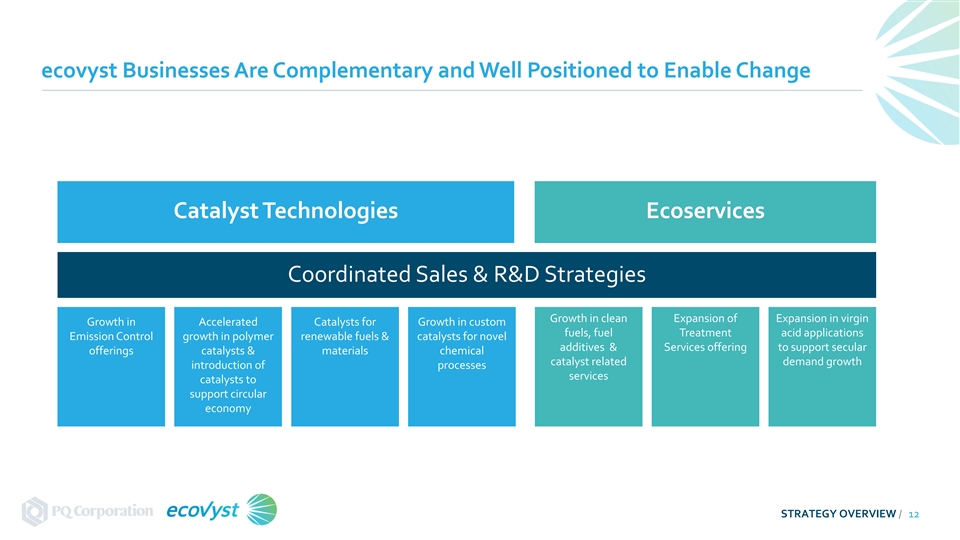

ecovyst Businesses Are Complementary and Well Positioned to Enable Change Catalyst Technologies Ecoservices Coordinated Sales & R&D Strategies Growth in clean Expansion of Expansion in virgin Growth in Accelerated Catalysts for Growth in custom fuels, fuel Treatment acid applications Emission Control growth in polymer renewable fuels & catalysts for novel additives & Services offering to support secular offerings catalysts & materials chemical catalyst related demand growth introduction of processes services catalysts to support circular economy STRATEGY OVERVIEW / 12ecovyst Businesses Are Complementary and Well Positioned to Enable Change Catalyst Technologies Ecoservices Coordinated Sales & R&D Strategies Growth in clean Expansion of Expansion in virgin Growth in Accelerated Catalysts for Growth in custom fuels, fuel Treatment acid applications Emission Control growth in polymer renewable fuels & catalysts for novel additives & Services offering to support secular offerings catalysts & materials chemical catalyst related demand growth introduction of processes services catalysts to support circular economy STRATEGY OVERVIEW / 12

Change Is Accelerating in the Industries We Serve, and Our Customers Must Adapt We partner with our customers in novel, chemistry-based technologies to address the increasing demand for high Increased environmental Transportation and Growing need for performing, sustainable products and sustainability focus energy products are environmentally friendly changing polymers and light- • Manufacturing processes weighting of products are expected to make • Existing fuels must get measurable improvement cleaner and more efficient • Increasing investment in in their environmental to support installed fleet plastics recycling profile STRATEGY OVERVIEW / 13Change Is Accelerating in the Industries We Serve, and Our Customers Must Adapt We partner with our customers in novel, chemistry-based technologies to address the increasing demand for high Increased environmental Transportation and Growing need for performing, sustainable products and sustainability focus energy products are environmentally friendly changing polymers and light- • Manufacturing processes weighting of products are expected to make • Existing fuels must get measurable improvement cleaner and more efficient • Increasing investment in in their environmental to support installed fleet plastics recycling profile STRATEGY OVERVIEW / 13

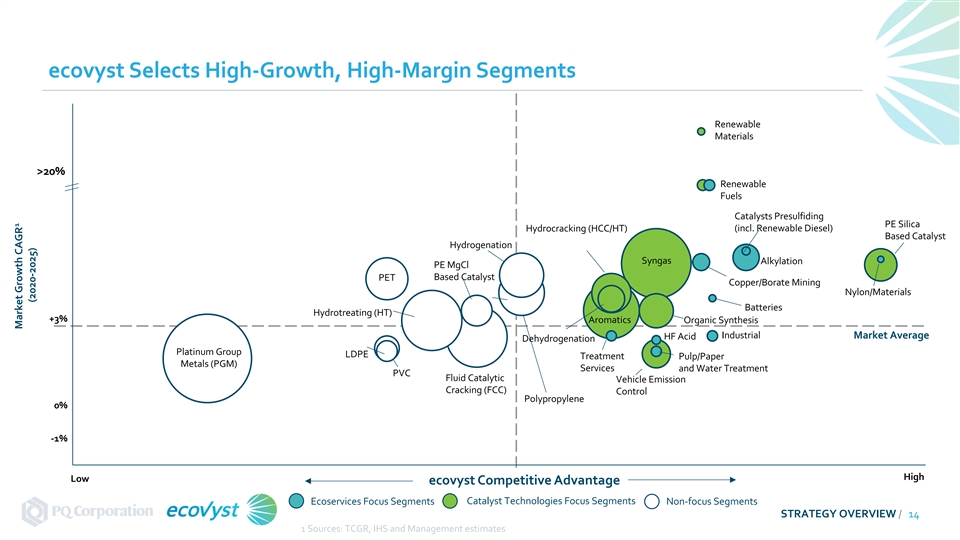

ecovyst Selects High-Growth, High-Margin Segments Renewable Materials >20% Renewable Fuels Catalysts Presulfiding PE Silica (incl. Renewable Diesel) Hydrocracking (HCC/HT) Based Catalyst Hydrogenation Syngas Alkylation PE MgCl Based Catalyst PET Copper/Borate Mining Nylon/Materials Batteries Hydrotreating (HT) +3% Aromatics Organic Synthesis Industrial Market Average HF Acid Dehydrogenation Platinum Group LDPE Treatment Pulp/Paper Metals (PGM) Services and Water Treatment PVC Fluid Catalytic Vehicle Emission Cracking (FCC) Control Polypropylene 0% -1% High Low ecovyst Competitive Advantage Catalyst Technologies Focus Segments Ecoservices Focus Segments Non-focus Segments STRATEGY OVERVIEW / 14 1 Sources: TCGR, IHS and Management estimates 1 Market Growth CAGR (2020-2025)ecovyst Selects High-Growth, High-Margin Segments Renewable Materials >20% Renewable Fuels Catalysts Presulfiding PE Silica (incl. Renewable Diesel) Hydrocracking (HCC/HT) Based Catalyst Hydrogenation Syngas Alkylation PE MgCl Based Catalyst PET Copper/Borate Mining Nylon/Materials Batteries Hydrotreating (HT) +3% Aromatics Organic Synthesis Industrial Market Average HF Acid Dehydrogenation Platinum Group LDPE Treatment Pulp/Paper Metals (PGM) Services and Water Treatment PVC Fluid Catalytic Vehicle Emission Cracking (FCC) Control Polypropylene 0% -1% High Low ecovyst Competitive Advantage Catalyst Technologies Focus Segments Ecoservices Focus Segments Non-focus Segments STRATEGY OVERVIEW / 14 1 Sources: TCGR, IHS and Management estimates 1 Market Growth CAGR (2020-2025)

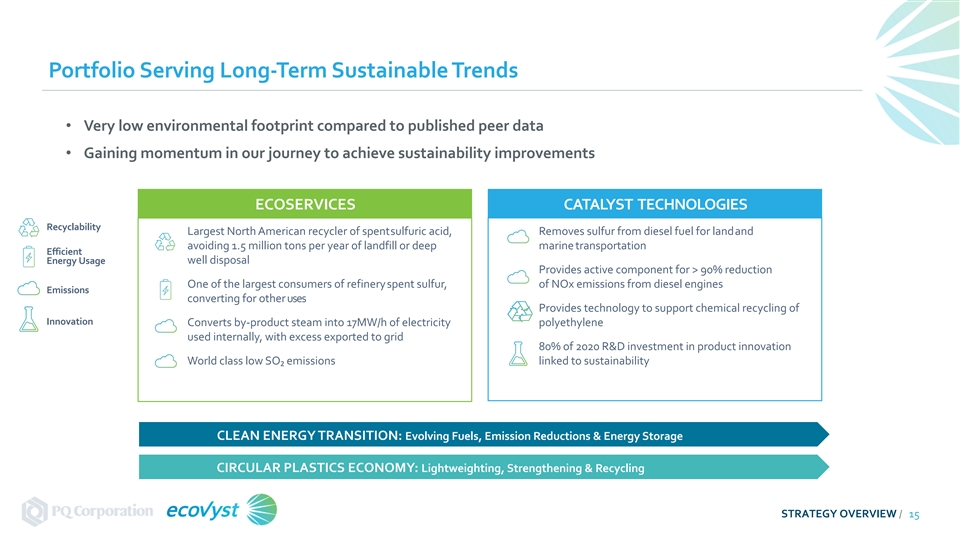

Portfolio Serving Long-Term Sustainable Trends • Very low environmental footprint compared to published peer data • Gaining momentum in our journey to achieve sustainability improvements ECOSERVICES CATALYST TECHNOLOGIES Recyclability Largest North American recycler of spentsulfuric acid, Removes sulfur from diesel fuel for landand avoiding 1.5 million tons per year of landfill or deep marine transportation Efficient Energy Usage well disposal Provides active component for > 90% reduction One of the largest consumers of refinery spent sulfur, of NOx emissions from diesel engines Emissions converting for other uses Provides technology to support chemical recycling of Innovation Converts by-product steam into 17MW/h of electricity polyethylene used internally, with excess exported to grid 80% of 2020 R&D investment in product innovation World class low SO₂ emissions linked to sustainability CLEAN ENERGY TRANSITION: Evolving Fuels, Emission Reductions & Energy Storage CIRCULAR PLASTICS ECONOMY: Lightweighting, Strengthening & Recycling STRATEGY OVERVIEW / 15Portfolio Serving Long-Term Sustainable Trends • Very low environmental footprint compared to published peer data • Gaining momentum in our journey to achieve sustainability improvements ECOSERVICES CATALYST TECHNOLOGIES Recyclability Largest North American recycler of spentsulfuric acid, Removes sulfur from diesel fuel for landand avoiding 1.5 million tons per year of landfill or deep marine transportation Efficient Energy Usage well disposal Provides active component for > 90% reduction One of the largest consumers of refinery spent sulfur, of NOx emissions from diesel engines Emissions converting for other uses Provides technology to support chemical recycling of Innovation Converts by-product steam into 17MW/h of electricity polyethylene used internally, with excess exported to grid 80% of 2020 R&D investment in product innovation World class low SO₂ emissions linked to sustainability CLEAN ENERGY TRANSITION: Evolving Fuels, Emission Reductions & Energy Storage CIRCULAR PLASTICS ECONOMY: Lightweighting, Strengthening & Recycling STRATEGY OVERVIEW / 15

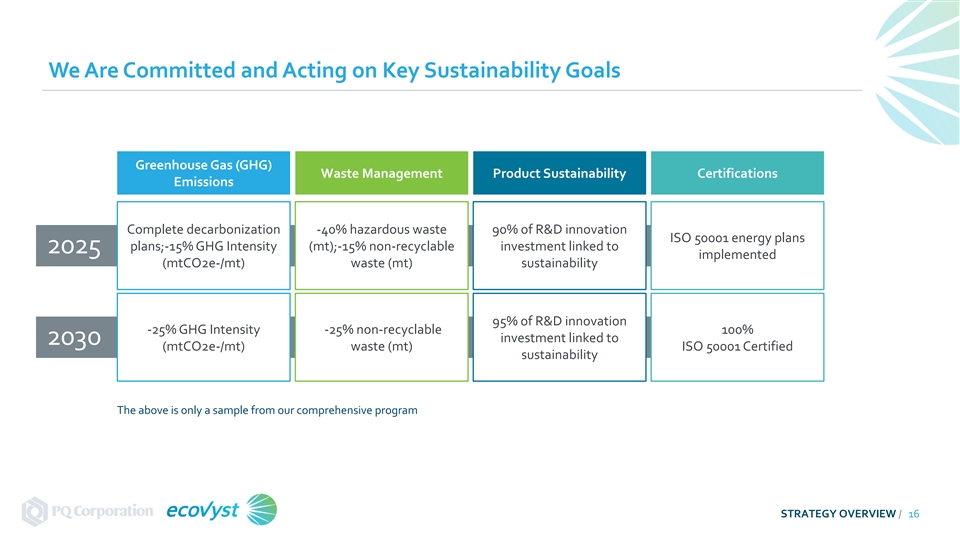

We Are Committed and Acting on Key Sustainability Goals Greenhouse Gas (GHG) Waste Management Product Sustainability Certifications Emissions Complete decarbonization -40% hazardous waste 90% of R&D innovation ISO 50001 energy plans plans;-15% GHG Intensity (mt);-15% non-recyclable investment linked to 2025 implemented (mtCO2e-/mt) waste (mt) sustainability 95% of R&D innovation -25% GHG Intensity -25% non-recyclable 100% investment linked to 2030 (mtCO2e-/mt) waste (mt) ISO 50001 Certified sustainability The above is only a sample from our comprehensive program STRATEGY OVERVIEW / 16We Are Committed and Acting on Key Sustainability Goals Greenhouse Gas (GHG) Waste Management Product Sustainability Certifications Emissions Complete decarbonization -40% hazardous waste 90% of R&D innovation ISO 50001 energy plans plans;-15% GHG Intensity (mt);-15% non-recyclable investment linked to 2025 implemented (mtCO2e-/mt) waste (mt) sustainability 95% of R&D innovation -25% GHG Intensity -25% non-recyclable 100% investment linked to 2030 (mtCO2e-/mt) waste (mt) ISO 50001 Certified sustainability The above is only a sample from our comprehensive program STRATEGY OVERVIEW / 16

Innovation Continues to Be Integral to Future Growth Sustainability Focused ~80% Growth through Chemistry Technical of innovation pipeline is Customer Collaborations Scale Up Know-how balanced innovation focused on customer sustainability solutions STRATEGY OVERVIEW / 17Innovation Continues to Be Integral to Future Growth Sustainability Focused ~80% Growth through Chemistry Technical of innovation pipeline is Customer Collaborations Scale Up Know-how balanced innovation focused on customer sustainability solutions STRATEGY OVERVIEW / 17

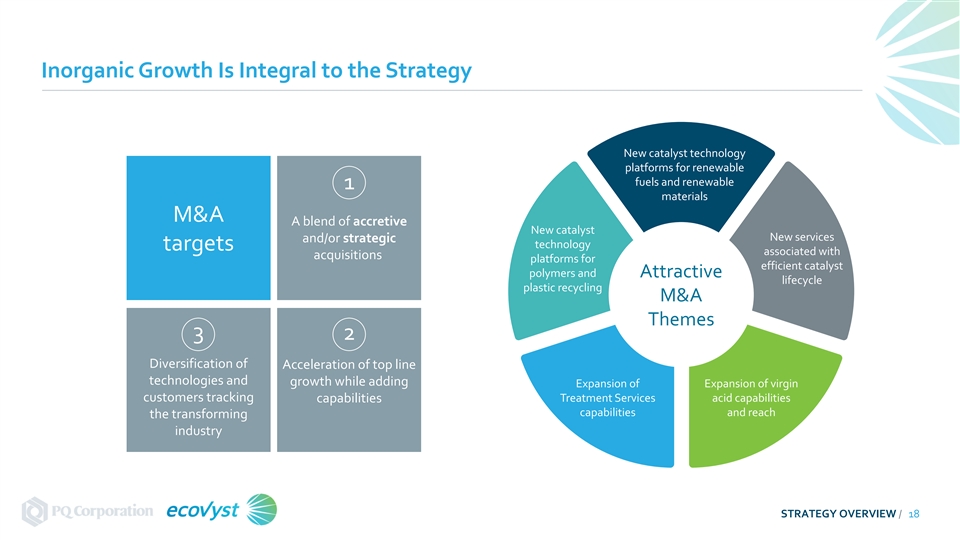

Inorganic Growth Is Integral to the Strategy New catalyst technology platforms for renewable fuels and renewable 1 materials M&A A blend of accretive New catalyst New services and/or strategic technology targets associated with acquisitions platforms for efficient catalyst polymers and Attractive lifecycle plastic recycling M&A Themes 3 2 Diversification of Acceleration of top line technologies and growth while adding Expansion of Expansion of virgin customers tracking Treatment Services acid capabilities capabilities capabilities and reach the transforming industry STRATEGY OVERVIEW / 18Inorganic Growth Is Integral to the Strategy New catalyst technology platforms for renewable fuels and renewable 1 materials M&A A blend of accretive New catalyst New services and/or strategic technology targets associated with acquisitions platforms for efficient catalyst polymers and Attractive lifecycle plastic recycling M&A Themes 3 2 Diversification of Acceleration of top line technologies and growth while adding Expansion of Expansion of virgin customers tracking Treatment Services acid capabilities capabilities capabilities and reach the transforming industry STRATEGY OVERVIEW / 18

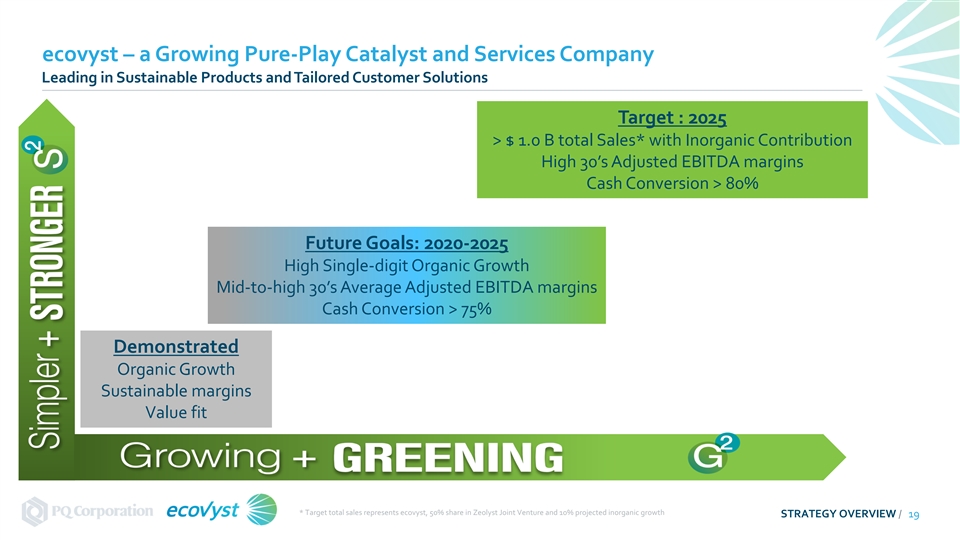

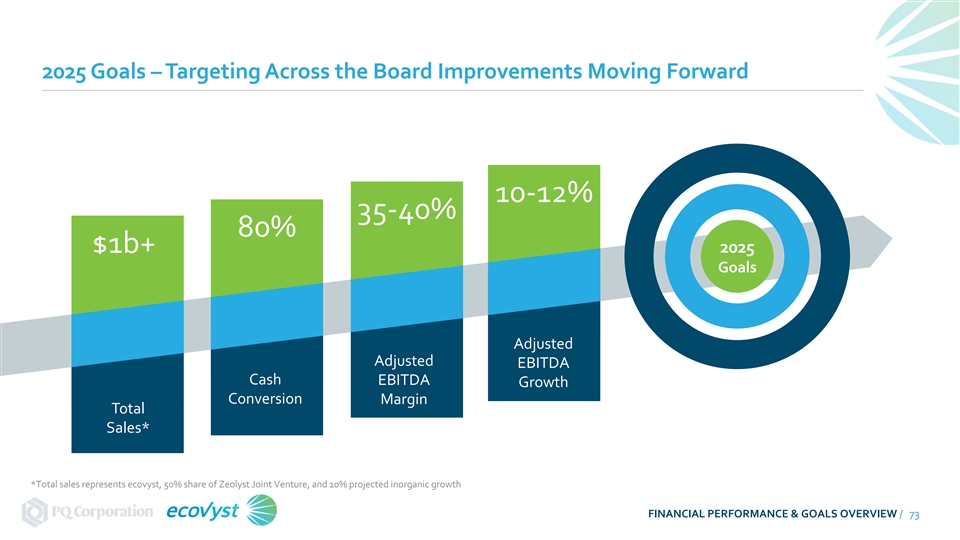

ecovyst – a Growing Pure-Play Catalyst and Services Company Leading in Sustainable Products and Tailored Customer Solutions Target : 2025 > $ 1.0 B total Sales* with Inorganic Contribution High 30’s Adjusted EBITDA margins Cash Conversion > 80% Our Past 2025 Goals • Demonstrated Organic Growth Future Goals: 2020-2025 • Sustainable Margins High Single-digit Organic Growth • Value Fit Mid-to-high 30’s Average Adjusted EBITDA margins Cash Conversion > 75% Demonstrated Organic Growth Sustainable margins Value fit * Target total sales represents ecovyst, 50% share in Zeolyst Joint Venture and 10% projected inorganic growth STRATEGY OVERVIEW / 19ecovyst – a Growing Pure-Play Catalyst and Services Company Leading in Sustainable Products and Tailored Customer Solutions Target : 2025 > $ 1.0 B total Sales* with Inorganic Contribution High 30’s Adjusted EBITDA margins Cash Conversion > 80% Our Past 2025 Goals • Demonstrated Organic Growth Future Goals: 2020-2025 • Sustainable Margins High Single-digit Organic Growth • Value Fit Mid-to-high 30’s Average Adjusted EBITDA margins Cash Conversion > 75% Demonstrated Organic Growth Sustainable margins Value fit * Target total sales represents ecovyst, 50% share in Zeolyst Joint Venture and 10% projected inorganic growth STRATEGY OVERVIEW / 19

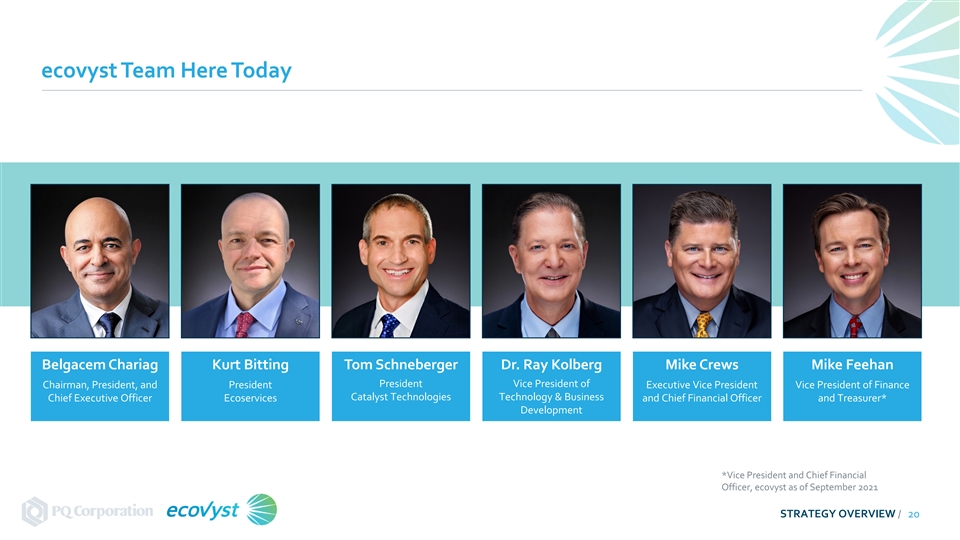

ecovyst Team Here Today Belgacem Chariag Kurt Bitting Tom Schneberger Dr. Ray Kolberg Mike Crews Mike Feehan President Vice President of Chairman, President, and President Executive Vice President Vice President of Finance Catalyst Technologies Technology & Business Chief Executive Officer Ecoservices and Chief Financial Officer and Treasurer* Development *Vice President and Chief Financial Officer, ecovyst as of September 2021 STRATEGY OVERVIEW / 20ecovyst Team Here Today Belgacem Chariag Kurt Bitting Tom Schneberger Dr. Ray Kolberg Mike Crews Mike Feehan President Vice President of Chairman, President, and President Executive Vice President Vice President of Finance Catalyst Technologies Technology & Business Chief Executive Officer Ecoservices and Chief Financial Officer and Treasurer* Development *Vice President and Chief Financial Officer, ecovyst as of September 2021 STRATEGY OVERVIEW / 20

Ecoservices Overview Kurt Bitting President, Ecoservices YOUR CATALYST FOR POSITIVE CHANGE APPENDIX / 22Ecoservices Overview Kurt Bitting President, Ecoservices YOUR CATALYST FOR POSITIVE CHANGE APPENDIX / 22

Key Takeaways We have the ability to deliver profitable growth across diverse end uses We have superior process technology and logistics capabilities We are enabling sustainable solutions EC ECO OS SER ERV VI IC CES ES O OV VER ERV VI IEW EW / / 23 23Key Takeaways We have the ability to deliver profitable growth across diverse end uses We have superior process technology and logistics capabilities We are enabling sustainable solutions EC ECO OS SER ERV VI IC CES ES O OV VER ERV VI IEW EW / / 23 23

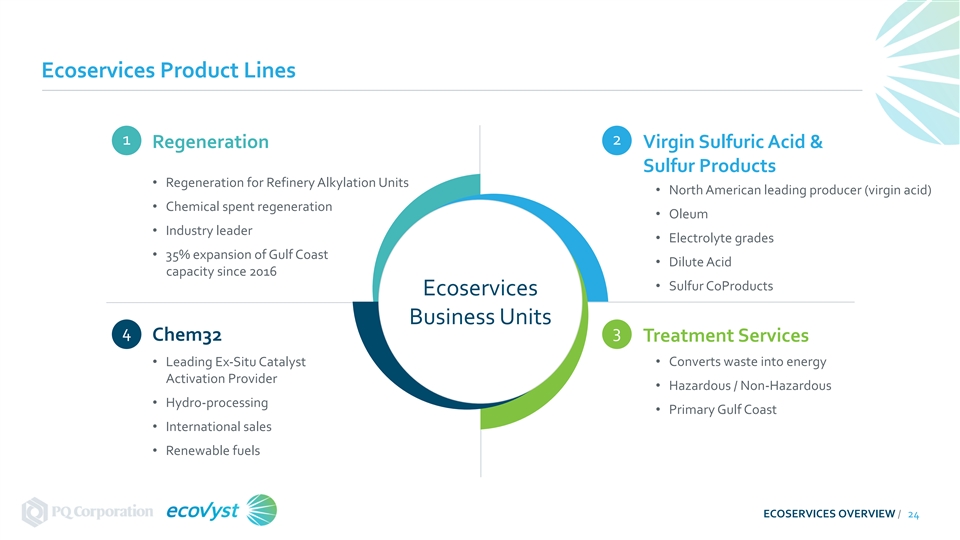

Ecoservices Product Lines 1 2 Regeneration Virgin Sulfuric Acid & Sulfur Products • Regeneration for Refinery Alkylation Units • North American leading producer (virgin acid) • Chemical spent regeneration • Oleum • Industry leader • Electrolyte grades • 35% expansion of Gulf Coast • Dilute Acid capacity since 2016 • Sulfur CoProducts Ecoservices Business Units 4 3 Chem32 Treatment Services • Leading Ex-Situ Catalyst • Converts waste into energy Activation Provider • Hazardous / Non-Hazardous • Hydro-processing • Primary Gulf Coast • International sales • Renewable fuels ECOSERVICES OVERVIEW / 24Ecoservices Product Lines 1 2 Regeneration Virgin Sulfuric Acid & Sulfur Products • Regeneration for Refinery Alkylation Units • North American leading producer (virgin acid) • Chemical spent regeneration • Oleum • Industry leader • Electrolyte grades • 35% expansion of Gulf Coast • Dilute Acid capacity since 2016 • Sulfur CoProducts Ecoservices Business Units 4 3 Chem32 Treatment Services • Leading Ex-Situ Catalyst • Converts waste into energy Activation Provider • Hazardous / Non-Hazardous • Hydro-processing • Primary Gulf Coast • International sales • Renewable fuels ECOSERVICES OVERVIEW / 24

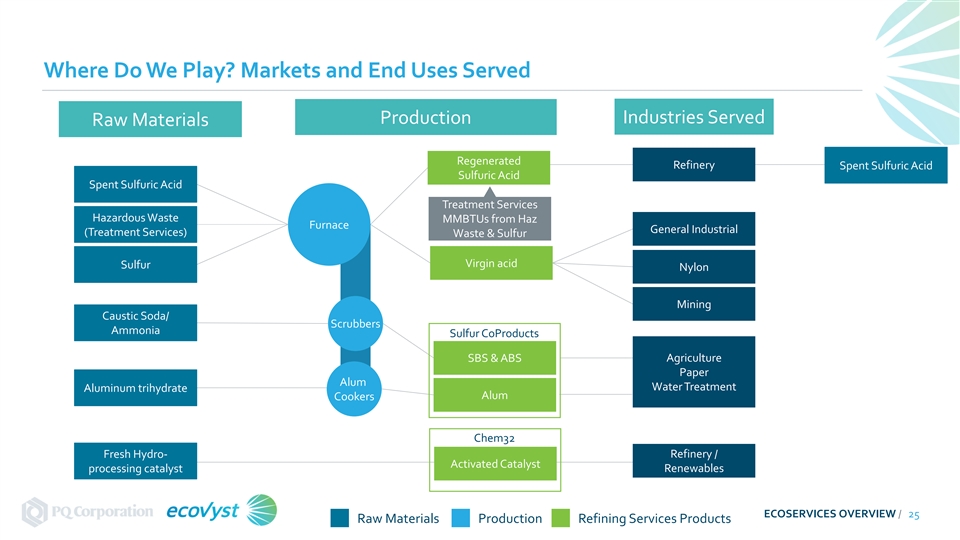

Where Do We Play? Markets and End Uses Served Industries Served Production Raw Materials Regenerated Refinery Spent Sulfuric Acid Sulfuric Acid Spent Sulfuric Acid Treatment Services Hazardous Waste MMBTUs from Haz Furnace General Industrial (Treatment Services) Waste & Sulfur Virgin acid Sulfur Nylon Mining Caustic Soda/ Scrubbers Ammonia Sulfur CoProducts SBS & ABS Agriculture Paper Alum Water Treatment Aluminum trihydrate Alum Cookers Chem32 Fresh Hydro- Refinery / Activated Catalyst processing catalyst Renewables ECOSERVICES OVERVIEW / 25 Raw Materials Production Refining Services ProductsWhere Do We Play? Markets and End Uses Served Industries Served Production Raw Materials Regenerated Refinery Spent Sulfuric Acid Sulfuric Acid Spent Sulfuric Acid Treatment Services Hazardous Waste MMBTUs from Haz Furnace General Industrial (Treatment Services) Waste & Sulfur Virgin acid Sulfur Nylon Mining Caustic Soda/ Scrubbers Ammonia Sulfur CoProducts SBS & ABS Agriculture Paper Alum Water Treatment Aluminum trihydrate Alum Cookers Chem32 Fresh Hydro- Refinery / Activated Catalyst processing catalyst Renewables ECOSERVICES OVERVIEW / 25 Raw Materials Production Refining Services Products

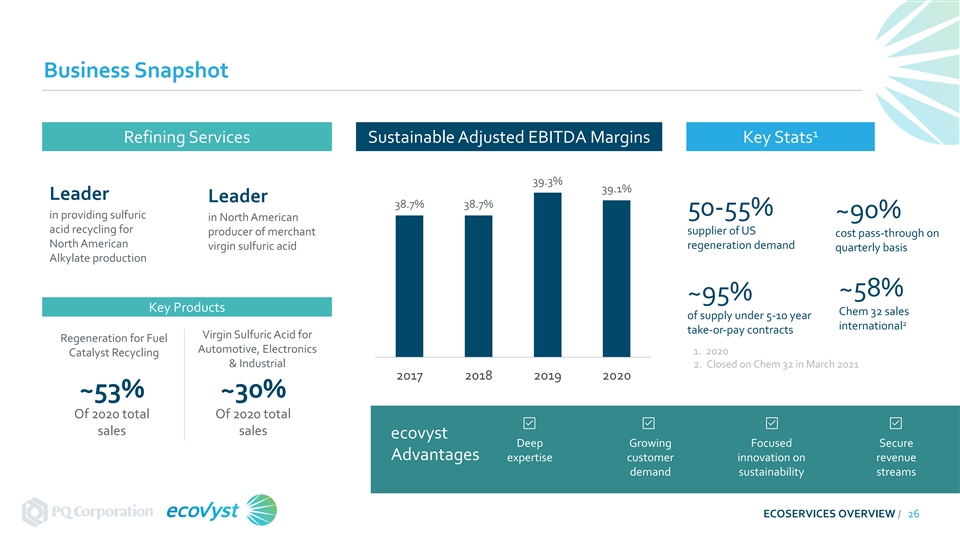

Business Snapshot 1 Refining Services Sustainable Adjusted EBITDA Margins Key Stats 39.3% 39.1% Leader Leader 38.7% 38.7% 50-55% ~90% in providing sulfuric in North American acid recycling for supplier of US producer of merchant cost pass-through on North American regeneration demand virgin sulfuric acid quarterly basis Alkylate production ~58% ~95% Key Products Chem 32 sales of supply under 5-10 year 2 international take-or-pay contracts Virgin Sulfuric Acid for Regeneration for Fuel Automotive, Electronics 1. 2020 Catalyst Recycling & Industrial 2. Closed on Chem 32 in March 2021 2017 2018 2019 2020 ~53% ~30% Of 2020 total Of 2020 total sales sales ecovyst Deep Growing Focused Secure Advantages expertise customer innovation on revenue demand sustainability streams ECOSERVICES OVERVIEW / 26Business Snapshot 1 Refining Services Sustainable Adjusted EBITDA Margins Key Stats 39.3% 39.1% Leader Leader 38.7% 38.7% 50-55% ~90% in providing sulfuric in North American acid recycling for supplier of US producer of merchant cost pass-through on North American regeneration demand virgin sulfuric acid quarterly basis Alkylate production ~58% ~95% Key Products Chem 32 sales of supply under 5-10 year 2 international take-or-pay contracts Virgin Sulfuric Acid for Regeneration for Fuel Automotive, Electronics 1. 2020 Catalyst Recycling & Industrial 2. Closed on Chem 32 in March 2021 2017 2018 2019 2020 ~53% ~30% Of 2020 total Of 2020 total sales sales ecovyst Deep Growing Focused Secure Advantages expertise customer innovation on revenue demand sustainability streams ECOSERVICES OVERVIEW / 26

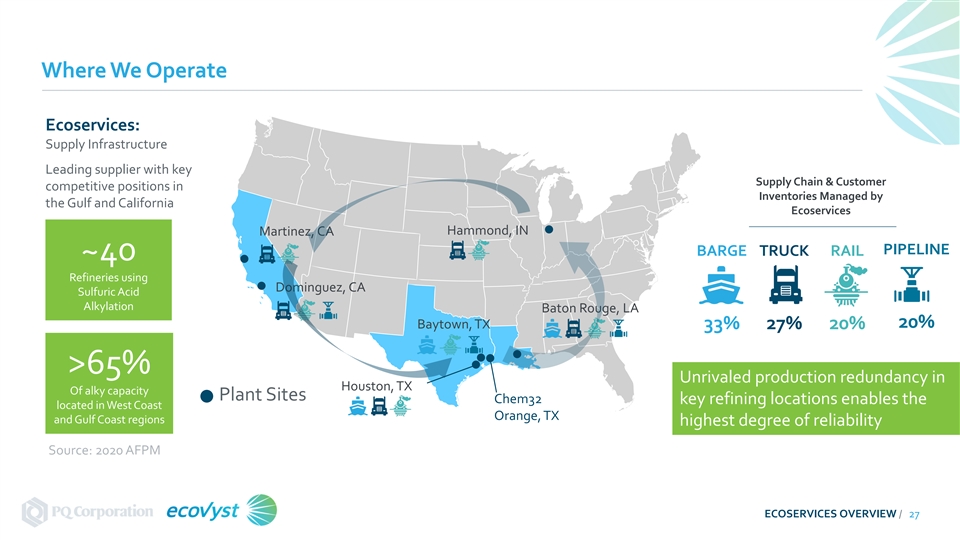

Where We Operate Ecoservices: Supply Infrastructure Leading supplier with key Supply Chain & Customer competitive positions in Inventories Managed by the Gulf and California Ecoservices Hammond, IN Martinez, CA PIPELINE BARGE TRUCK RAIL ~40 Refineries using Dominguez, CA Sulfuric Acid Alkylation Baton Rouge, LA 20% Baytown, TX 33% 27% 20% >65% Unrivaled production redundancy in Houston, TX Of alky capacity Plant Sites Chem32 key refining locations enables the located in West Coast Orange, TX and Gulf Coast regions highest degree of reliability Source: 2020 AFPM ECOSERVICES OVERVIEW / 27Where We Operate Ecoservices: Supply Infrastructure Leading supplier with key Supply Chain & Customer competitive positions in Inventories Managed by the Gulf and California Ecoservices Hammond, IN Martinez, CA PIPELINE BARGE TRUCK RAIL ~40 Refineries using Dominguez, CA Sulfuric Acid Alkylation Baton Rouge, LA 20% Baytown, TX 33% 27% 20% >65% Unrivaled production redundancy in Houston, TX Of alky capacity Plant Sites Chem32 key refining locations enables the located in West Coast Orange, TX and Gulf Coast regions highest degree of reliability Source: 2020 AFPM ECOSERVICES OVERVIEW / 27

Virgin Sulfuric Acid Sources Ecoservices Metals Smelting Captive – Fertilizer Merchant Sulfur Produced • Only one strength and lowest • No merchant sales • Numerous grades quality • Sulfur Derived • High quality • Primarily rail shipments • Only one strength and quality • Most reliable • Long distance from consumers • Consume merchant Sulfuric Acid ECOSERVICES OVERVIEW / 28Virgin Sulfuric Acid Sources Ecoservices Metals Smelting Captive – Fertilizer Merchant Sulfur Produced • Only one strength and lowest • No merchant sales • Numerous grades quality • Sulfur Derived • High quality • Primarily rail shipments • Only one strength and quality • Most reliable • Long distance from consumers • Consume merchant Sulfuric Acid ECOSERVICES OVERVIEW / 28

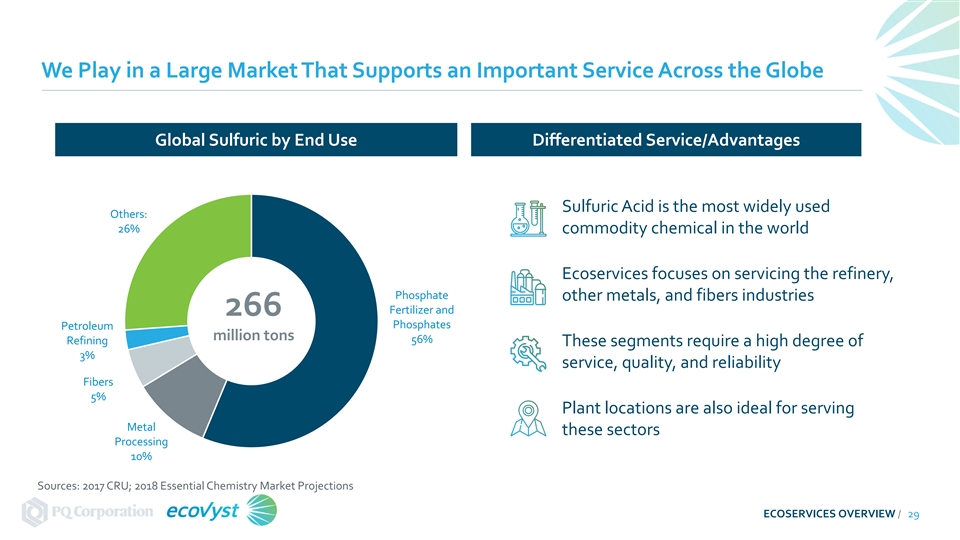

We Play in a Large Market That Supports an Important Service Across the Globe Global Sulfuric by End Use Differentiated Service/Advantages Sulfuric Acid is the most widely used Others: 26% commodity chemical in the world Ecoservices focuses on servicing the refinery, Phosphate other metals, and fibers industries Fertilizer and 266 Phosphates Petroleum million tons 56% Refining These segments require a high degree of 3% service, quality, and reliability Fibers 5% Plant locations are also ideal for serving Metal these sectors Processing 10% Sources: 2017 CRU; 2018 Essential Chemistry Market Projections ECOSERVICES OVERVIEW / 29We Play in a Large Market That Supports an Important Service Across the Globe Global Sulfuric by End Use Differentiated Service/Advantages Sulfuric Acid is the most widely used Others: 26% commodity chemical in the world Ecoservices focuses on servicing the refinery, Phosphate other metals, and fibers industries Fertilizer and 266 Phosphates Petroleum million tons 56% Refining These segments require a high degree of 3% service, quality, and reliability Fibers 5% Plant locations are also ideal for serving Metal these sectors Processing 10% Sources: 2017 CRU; 2018 Essential Chemistry Market Projections ECOSERVICES OVERVIEW / 29

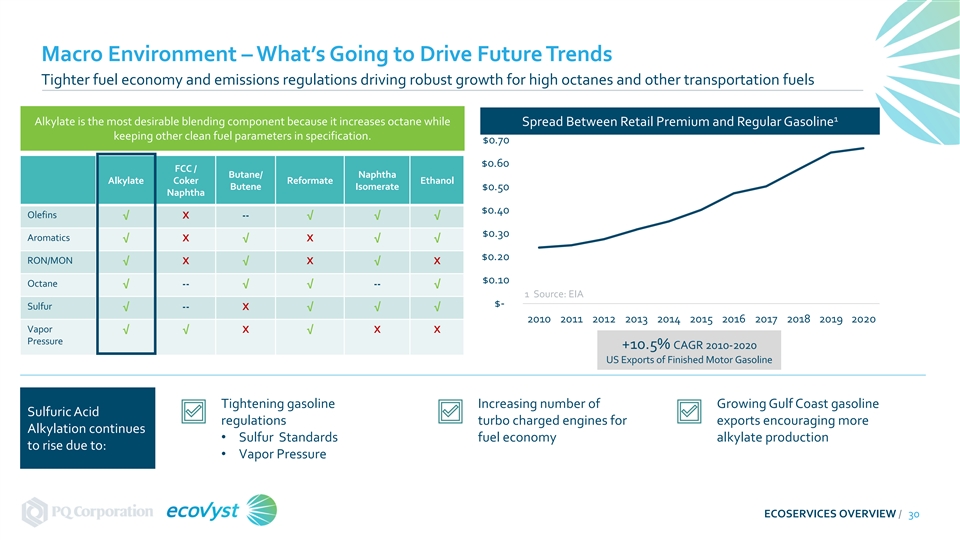

Macro Environment – What’s Going to Drive Future Trends Tighter fuel economy and emissions regulations driving robust growth for high octanes and other transportation fuels 1 Alkylate is the most desirable blending component because it increases octane while Spread Between Retail Premium and Regular Gasoline keeping other clean fuel parameters in specification. $0.70 $0.60 FCC / Butane/ Naphtha Alkylate Coker Reformate Ethanol Butene Isomerate $0.50 Naphtha $0.40 Olefins √ X -- √ √ √ $0.30 Aromatics √ X √ X √ √ $0.20 RON/MON √ X √ X √ X $0.10 Octane √ -- √ √ -- √ 1 Source: EIA $- Sulfur √ -- X √ √ √ 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Vapor √ √ X √ X X Pressure +10.5% CAGR 2010-2020 US Exports of Finished Motor Gasoline Tightening gasoline Increasing number of Growing Gulf Coast gasoline Sulfuric Acid regulations turbo charged engines for exports encouraging more Alkylation continues • Sulfur Standards fuel economy alkylate production to rise due to: • Vapor Pressure ECOSERVICES OVERVIEW / 30Macro Environment – What’s Going to Drive Future Trends Tighter fuel economy and emissions regulations driving robust growth for high octanes and other transportation fuels 1 Alkylate is the most desirable blending component because it increases octane while Spread Between Retail Premium and Regular Gasoline keeping other clean fuel parameters in specification. $0.70 $0.60 FCC / Butane/ Naphtha Alkylate Coker Reformate Ethanol Butene Isomerate $0.50 Naphtha $0.40 Olefins √ X -- √ √ √ $0.30 Aromatics √ X √ X √ √ $0.20 RON/MON √ X √ X √ X $0.10 Octane √ -- √ √ -- √ 1 Source: EIA $- Sulfur √ -- X √ √ √ 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Vapor √ √ X √ X X Pressure +10.5% CAGR 2010-2020 US Exports of Finished Motor Gasoline Tightening gasoline Increasing number of Growing Gulf Coast gasoline Sulfuric Acid regulations turbo charged engines for exports encouraging more Alkylation continues • Sulfur Standards fuel economy alkylate production to rise due to: • Vapor Pressure ECOSERVICES OVERVIEW / 30

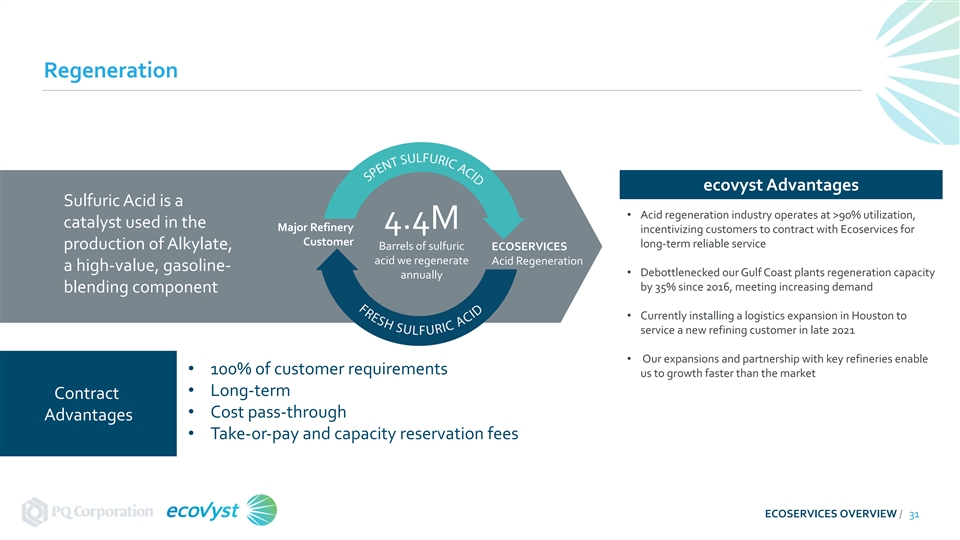

Regeneration ecovyst Advantages Sulfuric Acid is a • Acid regeneration industry operates at >90% utilization, catalyst used in the 4.4M Major Refinery incentivizing customers to contract with Ecoservices for Customer long-term reliable service production of Alkylate, Barrels of sulfuric ECOSERVICES acid we regenerate Acid Regeneration a high-value, gasoline- • Debottlenecked our Gulf Coast plants regeneration capacity annually by 35% since 2016, meeting increasing demand blending component • Currently installing a logistics expansion in Houston to service a new refining customer in late 2021 • Our expansions and partnership with key refineries enable • 100% of customer requirements us to growth faster than the market • Long-term Contract • Cost pass-through Advantages • Take-or-pay and capacity reservation fees ECOSERVICES OVERVIEW / 31Regeneration ecovyst Advantages Sulfuric Acid is a • Acid regeneration industry operates at >90% utilization, catalyst used in the 4.4M Major Refinery incentivizing customers to contract with Ecoservices for Customer long-term reliable service production of Alkylate, Barrels of sulfuric ECOSERVICES acid we regenerate Acid Regeneration a high-value, gasoline- • Debottlenecked our Gulf Coast plants regeneration capacity annually by 35% since 2016, meeting increasing demand blending component • Currently installing a logistics expansion in Houston to service a new refining customer in late 2021 • Our expansions and partnership with key refineries enable • 100% of customer requirements us to growth faster than the market • Long-term Contract • Cost pass-through Advantages • Take-or-pay and capacity reservation fees ECOSERVICES OVERVIEW / 31

Virgin Acid – Differentiated by Strength, Quality and Reliability Sulfuric Acid Product Oleum High Strength Electrolyte Segment Nylon Mining Industrial End Use • Vehicle lightweighting • Electrification • Pet Chem and Chemical • Construction • Construction/Infrastructure • Lead Acid Batteries • Coatings and Packaging • Personal Devices • Water Treatment • Semiconductors High strength acid is used in mining High purity acid is used for Lead Acid Largest producer of Oleum, a super applications for copper leaching and Batteries, water treatment, and other ecovyst Advantages saturated sulfuric acid primarily used Borate production (electric vehicles, growing industrial segments including for Nylon production tech devices, and construction) pet chem and semiconductors ECOSERVICES OVERVIEW / 32Virgin Acid – Differentiated by Strength, Quality and Reliability Sulfuric Acid Product Oleum High Strength Electrolyte Segment Nylon Mining Industrial End Use • Vehicle lightweighting • Electrification • Pet Chem and Chemical • Construction • Construction/Infrastructure • Lead Acid Batteries • Coatings and Packaging • Personal Devices • Water Treatment • Semiconductors High strength acid is used in mining High purity acid is used for Lead Acid Largest producer of Oleum, a super applications for copper leaching and Batteries, water treatment, and other ecovyst Advantages saturated sulfuric acid primarily used Borate production (electric vehicles, growing industrial segments including for Nylon production tech devices, and construction) pet chem and semiconductors ECOSERVICES OVERVIEW / 32

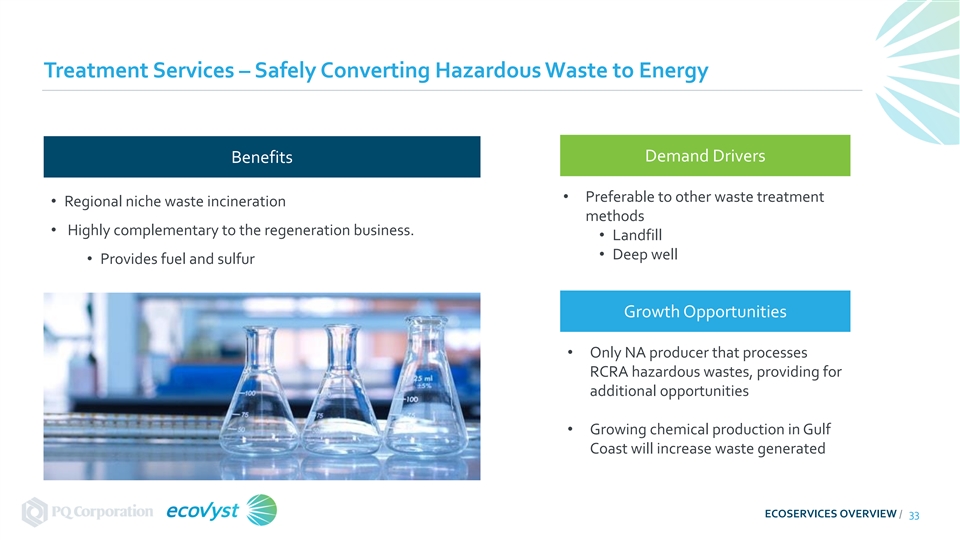

Treatment Services – Safely Converting Hazardous Waste to Energy Demand Drivers Benefits • Preferable to other waste treatment • Regional niche waste incineration methods • Highly complementary to the regeneration business. • Landfill • Deep well • Provides fuel and sulfur Growth Opportunities • Only NA producer that processes RCRA hazardous wastes, providing for additional opportunities • Growing chemical production in Gulf Coast will increase waste generated ECOSERVICES OVERVIEW / 33Treatment Services – Safely Converting Hazardous Waste to Energy Demand Drivers Benefits • Preferable to other waste treatment • Regional niche waste incineration methods • Highly complementary to the regeneration business. • Landfill • Deep well • Provides fuel and sulfur Growth Opportunities • Only NA producer that processes RCRA hazardous wastes, providing for additional opportunities • Growing chemical production in Gulf Coast will increase waste generated ECOSERVICES OVERVIEW / 33

Chem32: Pre-Activation Services Benefits Demand Drivers • Enables refineries to outsource difficult task of sulfiding • International • Quicker reactor startups • Renewable Fuels • Growth in renewables • Leverage our refining relationships and sulfur knowhow Growth Opportunities • Strong existing relationships with producers ECOSERVICES OVERVIEW / 34Chem32: Pre-Activation Services Benefits Demand Drivers • Enables refineries to outsource difficult task of sulfiding • International • Quicker reactor startups • Renewable Fuels • Growth in renewables • Leverage our refining relationships and sulfur knowhow Growth Opportunities • Strong existing relationships with producers ECOSERVICES OVERVIEW / 34

How We Support Our Customers Through Sustainability Regeneration Virgin Acid Treatment Services Chem 32 • Recover 99% of Sulfuric • Virgin Acid production • Treatment services • Activated catalysts used Acid in the regeneration enables lower natural gas provides fuel source to remove contaminants process usage and GHG emissions • Sulfur • Avoids Deep Wells / • Mercury • Efficient transportation • Sulfuric Acid made from Land Fills • Back Haul by product Sulfur • Renewable Fuels • Barge / Pipeline catalysts • 17MWh of electricity • Alkylation promotes produced with process • Reduces on-site HSE risks cleaner fuels steam • Sulfur co-products recycled for used in water treatment and agriculture ECOSERVICES OVERVIEW / 35How We Support Our Customers Through Sustainability Regeneration Virgin Acid Treatment Services Chem 32 • Recover 99% of Sulfuric • Virgin Acid production • Treatment services • Activated catalysts used Acid in the regeneration enables lower natural gas provides fuel source to remove contaminants process usage and GHG emissions • Sulfur • Avoids Deep Wells / • Mercury • Efficient transportation • Sulfuric Acid made from Land Fills • Back Haul by product Sulfur • Renewable Fuels • Barge / Pipeline catalysts • 17MWh of electricity • Alkylation promotes produced with process • Reduces on-site HSE risks cleaner fuels steam • Sulfur co-products recycled for used in water treatment and agriculture ECOSERVICES OVERVIEW / 35

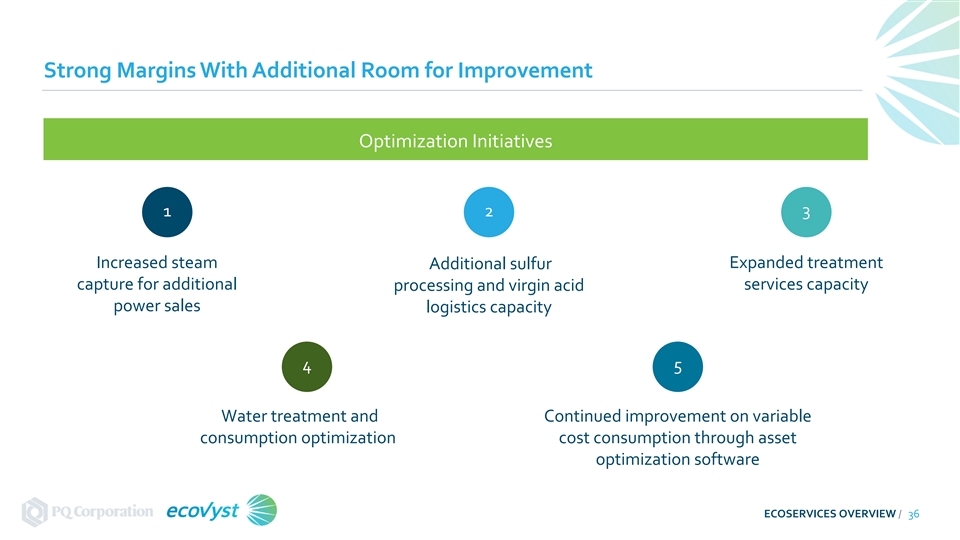

Strong Margins With Additional Room for Improvement Optimization Initiatives 1 2 3 Increased steam Expanded treatment Additional sulfur capture for additional services capacity processing and virgin acid power sales logistics capacity 4 5 Water treatment and Continued improvement on variable consumption optimization cost consumption through asset optimization software ECOSERVICES OVERVIEW / 36Strong Margins With Additional Room for Improvement Optimization Initiatives 1 2 3 Increased steam Expanded treatment Additional sulfur capture for additional services capacity processing and virgin acid power sales logistics capacity 4 5 Water treatment and Continued improvement on variable consumption optimization cost consumption through asset optimization software ECOSERVICES OVERVIEW / 36

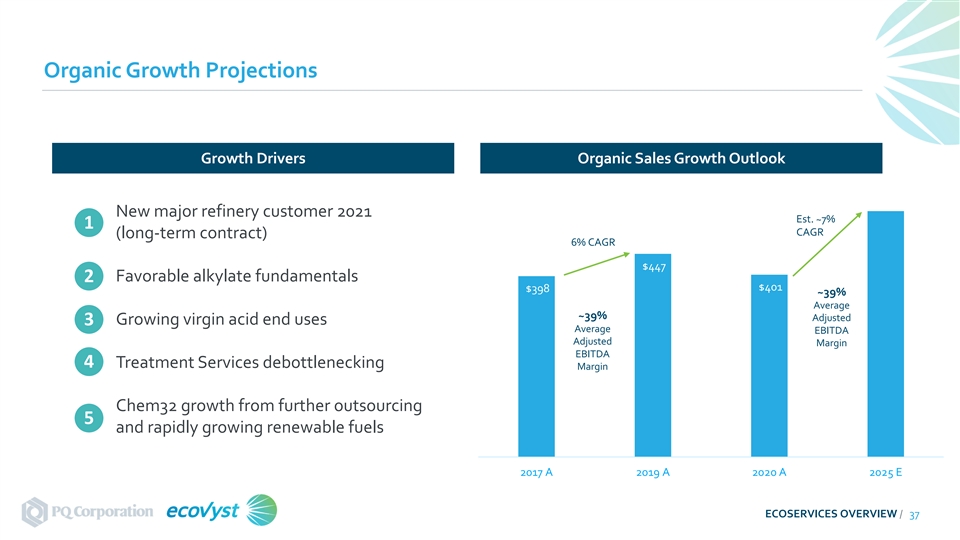

Organic Growth Projections Growth Drivers Organic Sales Growth Outlook New major refinery customer 2021 Est. ~7% 1 CAGR (long-term contract) 6% CAGR $447 2 Favorable alkylate fundamentals $401 $398 ~39% Average ~39% Adjusted 3 Growing virgin acid end uses Average EBITDA Adjusted Margin EBITDA 4 Treatment Services debottlenecking Margin Chem32 growth from further outsourcing 5 and rapidly growing renewable fuels 2017 A 2019 A 2020 A 2025 E ECOSERVICES OVERVIEW / 37Organic Growth Projections Growth Drivers Organic Sales Growth Outlook New major refinery customer 2021 Est. ~7% 1 CAGR (long-term contract) 6% CAGR $447 2 Favorable alkylate fundamentals $401 $398 ~39% Average ~39% Adjusted 3 Growing virgin acid end uses Average EBITDA Adjusted Margin EBITDA 4 Treatment Services debottlenecking Margin Chem32 growth from further outsourcing 5 and rapidly growing renewable fuels 2017 A 2019 A 2020 A 2025 E ECOSERVICES OVERVIEW / 37

Key Takeaways We have the ability to deliver profitable growth across diverse end uses We have superior process technology and logistics capabilities We are enabling sustainable solutions EC ECO OS SER ERV VI IC CES ES O OV VER ERV VI IEW EW / / 38 38Key Takeaways We have the ability to deliver profitable growth across diverse end uses We have superior process technology and logistics capabilities We are enabling sustainable solutions EC ECO OS SER ERV VI IC CES ES O OV VER ERV VI IEW EW / / 38 38

Catalyst Technologies Tom Schneberger President, Catalyst Technologies YOUR CATALYST FOR POSITIVE CHANGE CATALYST TECHNOLOGIES / 39Catalyst Technologies Tom Schneberger President, Catalyst Technologies YOUR CATALYST FOR POSITIVE CHANGE CATALYST TECHNOLOGIES / 39

Key Takeaways We provide innovative technologies in growing markets We selectively invest where we can grow faster than the market Customers rely on our customized offerings resulting in predictable growth and strong margins CA CAT TA AL LY YS ST T T TE ECH CHN NO OL LO OG GI IE ES S / / 40 40Key Takeaways We provide innovative technologies in growing markets We selectively invest where we can grow faster than the market Customers rely on our customized offerings resulting in predictable growth and strong margins CA CAT TA AL LY YS ST T T TE ECH CHN NO OL LO OG GI IE ES S / / 40 40

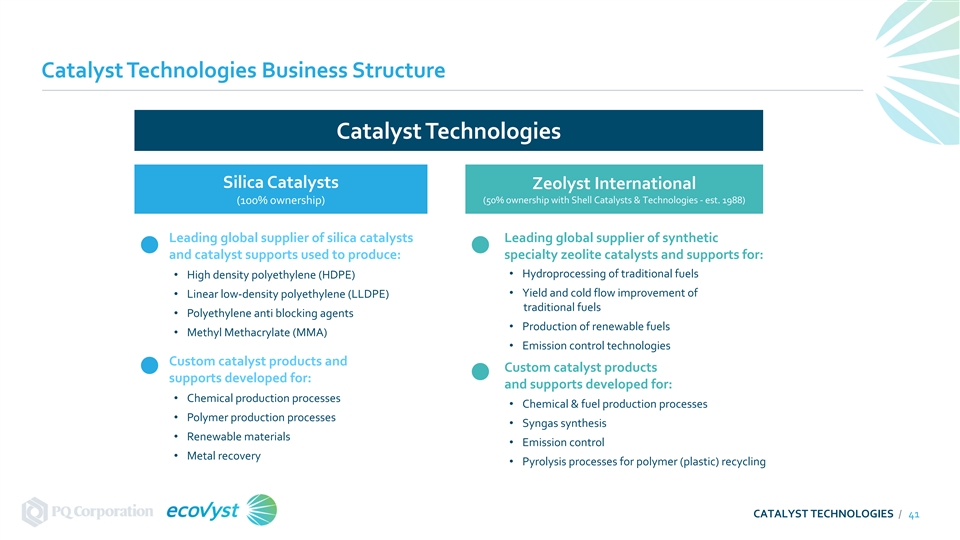

Catalyst Technologies Business Structure Catalyst Technologies Silica Catalysts Zeolyst International (50% ownership with Shell Catalysts & Technologies - est. 1988) (100% ownership) Leading global supplier of silica catalysts Leading global supplier of synthetic and catalyst supports used to produce: specialty zeolite catalysts and supports for: • Hydroprocessing of traditional fuels • High density polyethylene (HDPE) • Yield and cold flow improvement of • Linear low-density polyethylene (LLDPE) traditional fuels • Polyethylene anti blocking agents • Production of renewable fuels • Methyl Methacrylate (MMA) • Emission control technologies Custom catalyst products and Custom catalyst products supports developed for: and supports developed for: • Chemical production processes • Chemical & fuel production processes • Polymer production processes • Syngas synthesis • Renewable materials • Emission control • Metal recovery • Pyrolysis processes for polymer (plastic) recycling CATALYST TECHNOLOGIES / 41Catalyst Technologies Business Structure Catalyst Technologies Silica Catalysts Zeolyst International (50% ownership with Shell Catalysts & Technologies - est. 1988) (100% ownership) Leading global supplier of silica catalysts Leading global supplier of synthetic and catalyst supports used to produce: specialty zeolite catalysts and supports for: • Hydroprocessing of traditional fuels • High density polyethylene (HDPE) • Yield and cold flow improvement of • Linear low-density polyethylene (LLDPE) traditional fuels • Polyethylene anti blocking agents • Production of renewable fuels • Methyl Methacrylate (MMA) • Emission control technologies Custom catalyst products and Custom catalyst products supports developed for: and supports developed for: • Chemical production processes • Chemical & fuel production processes • Polymer production processes • Syngas synthesis • Renewable materials • Emission control • Metal recovery • Pyrolysis processes for polymer (plastic) recycling CATALYST TECHNOLOGIES / 41

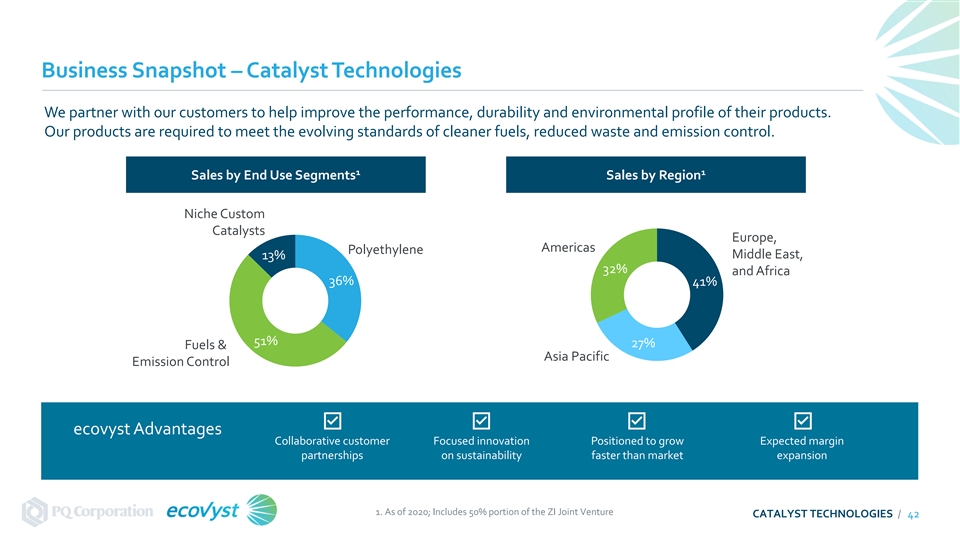

Business Snapshot – Catalyst Technologies We partner with our customers to help improve the performance, durability and environmental profile of their products. Our products are required to meet the evolving standards of cleaner fuels, reduced waste and emission control. 1 1 Sales by End Use Segments Sales by Region Niche Custom Catalysts Europe, Americas Polyethylene 13% Middle East, 32% and Africa 36% 41% 51% 27% Fuels & Asia Pacific Emission Control ecovyst Advantages Collaborative customer Focused innovation Positioned to grow Expected margin partnerships on sustainability faster than market expansion 1. As of 2020; Includes 50% portion of the ZI Joint Venture CATALYST TECHNOLOGIES / 42Business Snapshot – Catalyst Technologies We partner with our customers to help improve the performance, durability and environmental profile of their products. Our products are required to meet the evolving standards of cleaner fuels, reduced waste and emission control. 1 1 Sales by End Use Segments Sales by Region Niche Custom Catalysts Europe, Americas Polyethylene 13% Middle East, 32% and Africa 36% 41% 51% 27% Fuels & Asia Pacific Emission Control ecovyst Advantages Collaborative customer Focused innovation Positioned to grow Expected margin partnerships on sustainability faster than market expansion 1. As of 2020; Includes 50% portion of the ZI Joint Venture CATALYST TECHNOLOGIES / 42

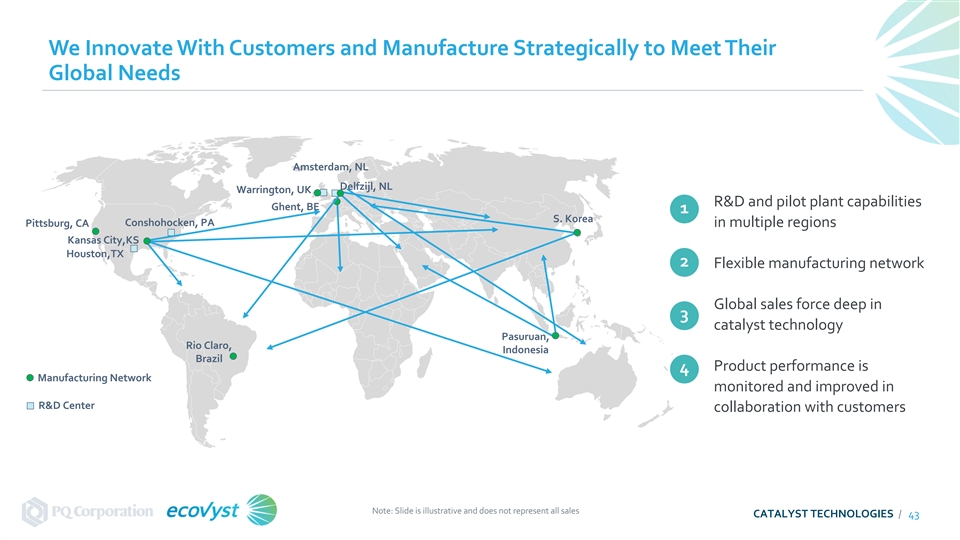

We Innovate With Customers and Manufacture Strategically to Meet Their Global Needs Amsterdam, NL Delfzijl, NL Warrington, UK R&D and pilot plant capabilities Ghent, BE 1 S. Korea Conshohocken, PA Pittsburg, CA in multiple regions Kansas City,KS Houston,TX 2 Flexible manufacturing network Global sales force deep in 3 catalyst technology Pasuruan, Rio Claro, Indonesia Brazil Product performance is 4 Manufacturing Network monitored and improved in R&D Center collaboration with customers Note: Slide is illustrative and does not represent all sales CATALYST TECHNOLOGIES / 43We Innovate With Customers and Manufacture Strategically to Meet Their Global Needs Amsterdam, NL Delfzijl, NL Warrington, UK R&D and pilot plant capabilities Ghent, BE 1 S. Korea Conshohocken, PA Pittsburg, CA in multiple regions Kansas City,KS Houston,TX 2 Flexible manufacturing network Global sales force deep in 3 catalyst technology Pasuruan, Rio Claro, Indonesia Brazil Product performance is 4 Manufacturing Network monitored and improved in R&D Center collaboration with customers Note: Slide is illustrative and does not represent all sales CATALYST TECHNOLOGIES / 43

We Enable Our Customers to Address the Sustainability of Their Products Polyethylene Fuels & Emission Control Niche Custom Catalysts • Strengthening and • Increasingly efficient and • Novel production processes lightweighting cleaner fuels with increased efficiencies • Increasingly efficient • Increasingly efficient • Inherently safer and cleaner production processes production processes processes • Recycling of polymers • Renewable fuels • Renewable materials CATALYST TECHNOLOGIES / 44We Enable Our Customers to Address the Sustainability of Their Products Polyethylene Fuels & Emission Control Niche Custom Catalysts • Strengthening and • Increasingly efficient and • Novel production processes lightweighting cleaner fuels with increased efficiencies • Increasingly efficient • Increasingly efficient • Inherently safer and cleaner production processes production processes processes • Recycling of polymers • Renewable fuels • Renewable materials CATALYST TECHNOLOGIES / 44

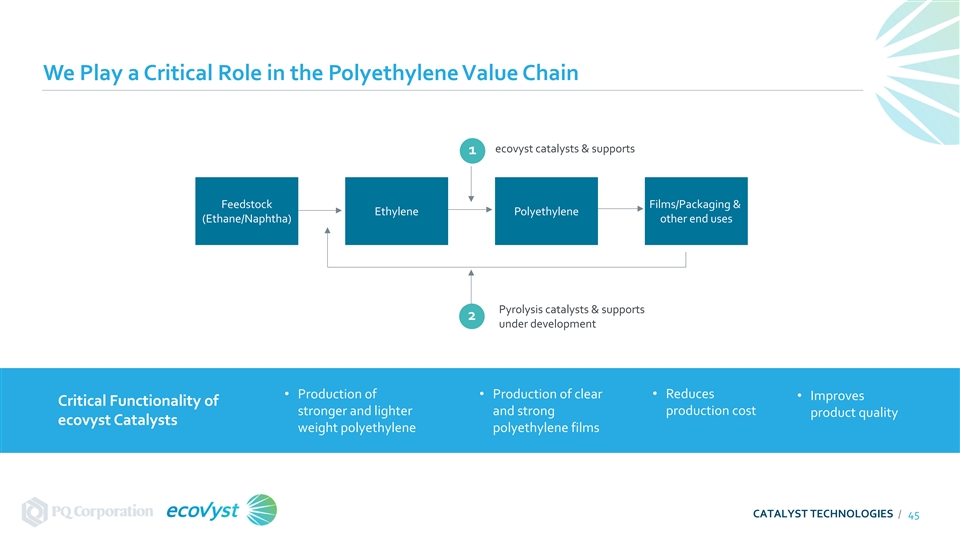

We Play a Critical Role in the Polyethylene Value Chain ecovyst catalysts & supports 1 Feedstock Films/Packaging & Ethylene Polyethylene (Ethane/Naphtha) other end uses Pyrolysis catalysts & supports 2 under development • Production of • Production of clear • Reduces • Improves Critical Functionality of stronger and lighter and strong production cost product quality ecovyst Catalysts weight polyethylene polyethylene films CATALYST TECHNOLOGIES / 45We Play a Critical Role in the Polyethylene Value Chain ecovyst catalysts & supports 1 Feedstock Films/Packaging & Ethylene Polyethylene (Ethane/Naphtha) other end uses Pyrolysis catalysts & supports 2 under development • Production of • Production of clear • Reduces • Improves Critical Functionality of stronger and lighter and strong production cost product quality ecovyst Catalysts weight polyethylene polyethylene films CATALYST TECHNOLOGIES / 45

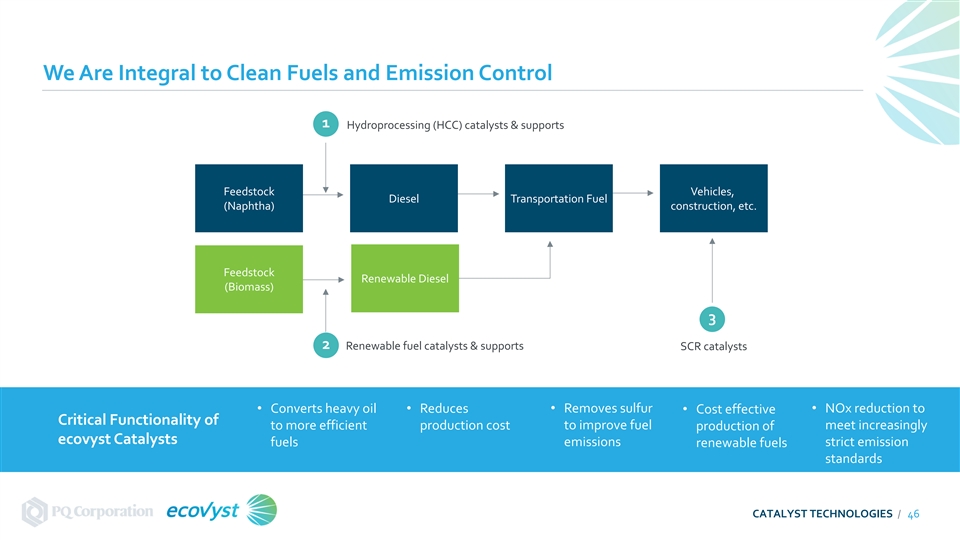

We Are Integral to Clean Fuels and Emission Control 1 Hydroprocessing (HCC) catalysts & supports Feedstock Vehicles, Diesel Transportation Fuel (Naphtha) construction, etc. Feedstock Renewable Diesel (Biomass) 3 2 Renewable fuel catalysts & supports SCR catalysts • Converts heavy oil • Reduces • Removes sulfur • NOx reduction to • Cost effective Critical Functionality of to improve fuel meet increasingly to more efficient production cost production of ecovyst Catalysts fuels emissions strict emission renewable fuels standards CATALYST TECHNOLOGIES / 46We Are Integral to Clean Fuels and Emission Control 1 Hydroprocessing (HCC) catalysts & supports Feedstock Vehicles, Diesel Transportation Fuel (Naphtha) construction, etc. Feedstock Renewable Diesel (Biomass) 3 2 Renewable fuel catalysts & supports SCR catalysts • Converts heavy oil • Reduces • Removes sulfur • NOx reduction to • Cost effective Critical Functionality of to improve fuel meet increasingly to more efficient production cost production of ecovyst Catalysts fuels emissions strict emission renewable fuels standards CATALYST TECHNOLOGIES / 46

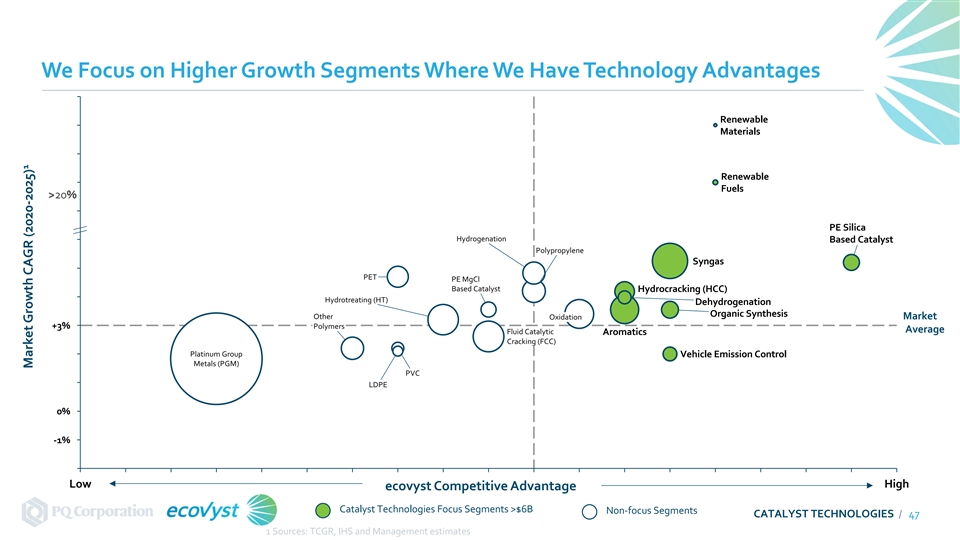

We Focus on Higher Growth Segments Where We Have Technology Advantages Renewable Materials Renewable Fuels >20% PE Silica Hydrogenation Based Catalyst Polypropylene Syngas PET PE MgCl Based Catalyst Hydrocracking (HCC) Hydrotreating (HT) Dehydrogenation Organic Synthesis Other Market Oxidation +3% Polymers Average Fluid Catalytic Aromatics Cracking (FCC) Platinum Group Vehicle Emission Control Metals (PGM) PVC LDPE 0% -1% Low High ecovyst Competitive Advantage Catalyst Technologies Focus Segments >$6B Non-focus Segments CATALYST TECHNOLOGIES / 47 1 Sources: TCGR, IHS and Management estimates 1 Market Growth CAGR (2020-2025)We Focus on Higher Growth Segments Where We Have Technology Advantages Renewable Materials Renewable Fuels >20% PE Silica Hydrogenation Based Catalyst Polypropylene Syngas PET PE MgCl Based Catalyst Hydrocracking (HCC) Hydrotreating (HT) Dehydrogenation Organic Synthesis Other Market Oxidation +3% Polymers Average Fluid Catalytic Aromatics Cracking (FCC) Platinum Group Vehicle Emission Control Metals (PGM) PVC LDPE 0% -1% Low High ecovyst Competitive Advantage Catalyst Technologies Focus Segments >$6B Non-focus Segments CATALYST TECHNOLOGIES / 47 1 Sources: TCGR, IHS and Management estimates 1 Market Growth CAGR (2020-2025)

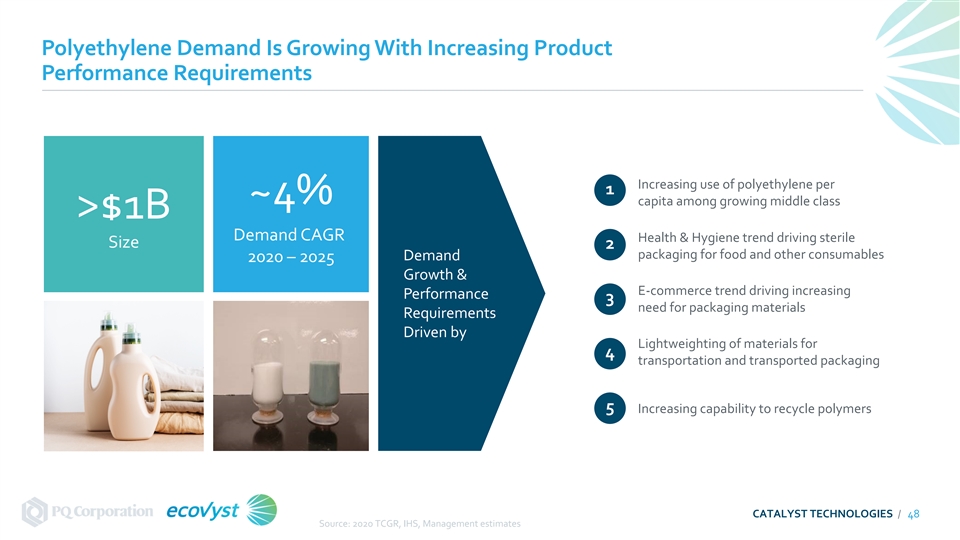

Polyethylene Demand Is Growing With Increasing Product Performance Requirements Increasing use of polyethylene per 1 ~4% capita among growing middle class >$1B Demand CAGR Health & Hygiene trend driving sterile Size 2 packaging for food and other consumables Demand 2020 – 2025 Growth & E-commerce trend driving increasing Performance 3 need for packaging materials Requirements Driven by Lightweighting of materials for 4 transportation and transported packaging 5 Increasing capability to recycle polymers CATALYST TECHNOLOGIES / 48 Source: 2020 TCGR, IHS, Management estimatesPolyethylene Demand Is Growing With Increasing Product Performance Requirements Increasing use of polyethylene per 1 ~4% capita among growing middle class >$1B Demand CAGR Health & Hygiene trend driving sterile Size 2 packaging for food and other consumables Demand 2020 – 2025 Growth & E-commerce trend driving increasing Performance 3 need for packaging materials Requirements Driven by Lightweighting of materials for 4 transportation and transported packaging 5 Increasing capability to recycle polymers CATALYST TECHNOLOGIES / 48 Source: 2020 TCGR, IHS, Management estimates

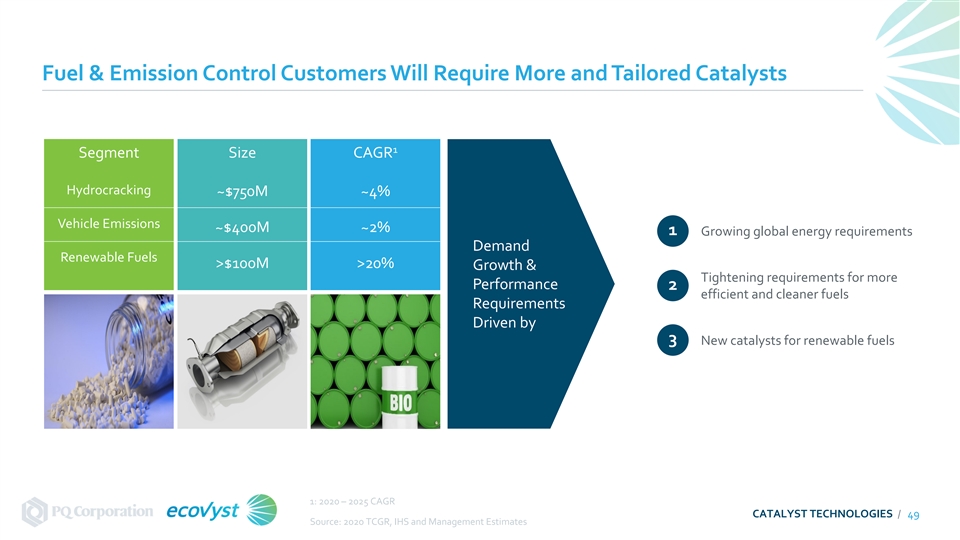

Fuel & Emission Control Customers Will Require More and Tailored Catalysts 1 Segment Size CAGR Hydrocracking ~$750M ~4% Vehicle Emissions ~$400M ~2% 1 Growing global energy requirements Demand Renewable Fuels >$100M >20% Growth & Tightening requirements for more Performance 2 efficient and cleaner fuels Requirements Driven by 3 New catalysts for renewable fuels 1: 2020 – 2025 CAGR CATALYST TECHNOLOGIES / 49 Source: 2020 TCGR, IHS and Management EstimatesFuel & Emission Control Customers Will Require More and Tailored Catalysts 1 Segment Size CAGR Hydrocracking ~$750M ~4% Vehicle Emissions ~$400M ~2% 1 Growing global energy requirements Demand Renewable Fuels >$100M >20% Growth & Tightening requirements for more Performance 2 efficient and cleaner fuels Requirements Driven by 3 New catalysts for renewable fuels 1: 2020 – 2025 CAGR CATALYST TECHNOLOGIES / 49 Source: 2020 TCGR, IHS and Management Estimates

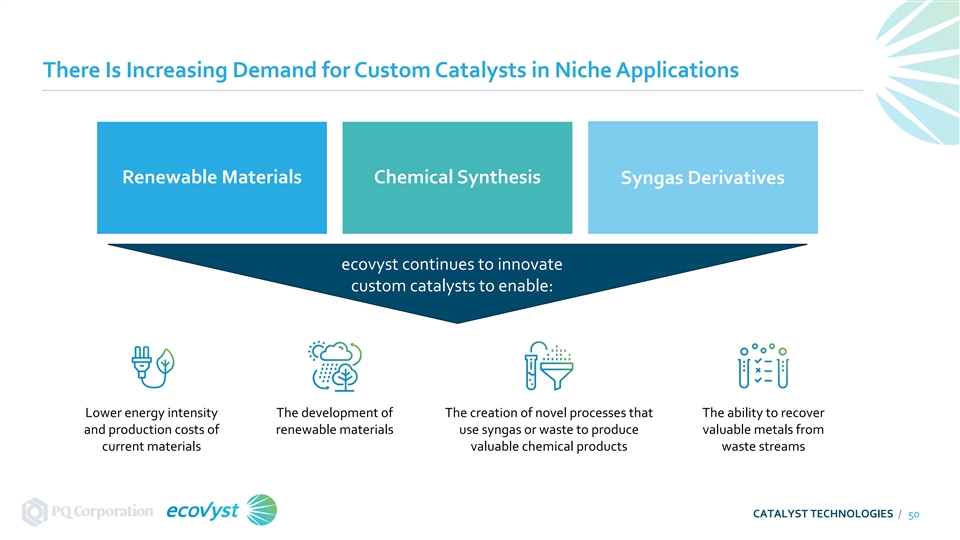

There Is Increasing Demand for Custom Catalysts in Niche Applications Renewable Materials Chemical Synthesis Syngas Derivatives ecovyst continues to innovate custom catalysts to enable: Lower energy intensity The development of The creation of novel processes that The ability to recover and production costs of renewable materials use syngas or waste to produce valuable metals from current materials valuable chemical products waste streams CATALYST TECHNOLOGIES / 50There Is Increasing Demand for Custom Catalysts in Niche Applications Renewable Materials Chemical Synthesis Syngas Derivatives ecovyst continues to innovate custom catalysts to enable: Lower energy intensity The development of The creation of novel processes that The ability to recover and production costs of renewable materials use syngas or waste to produce valuable metals from current materials valuable chemical products waste streams CATALYST TECHNOLOGIES / 50

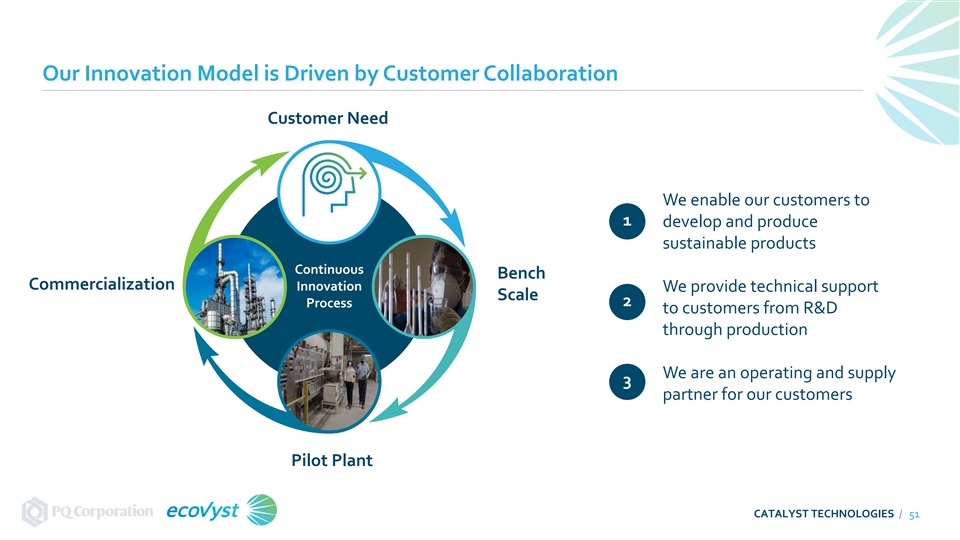

Our Innovation Model is Driven by Customer Collaboration Customer Need We enable our customers to 1 develop and produce sustainable products Continuous Bench Commercialization Innovation We provide technical support Scale 2 Process to customers from R&D through production We are an operating and supply 3 partner for our customers Pilot Plant CATALYST TECHNOLOGIES / 51Our Innovation Model is Driven by Customer Collaboration Customer Need We enable our customers to 1 develop and produce sustainable products Continuous Bench Commercialization Innovation We provide technical support Scale 2 Process to customers from R&D through production We are an operating and supply 3 partner for our customers Pilot Plant CATALYST TECHNOLOGIES / 51

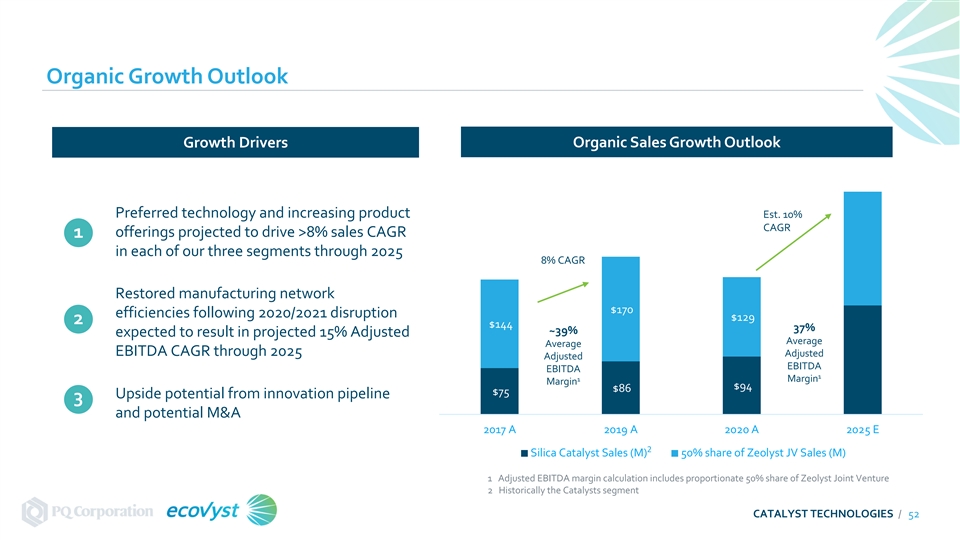

Organic Growth Outlook Organic Sales Growth Outlook Growth Drivers Preferred technology and increasing product Est. 10% CAGR offerings projected to drive >8% sales CAGR 1 in each of our three segments through 2025 8% CAGR Restored manufacturing network $170 efficiencies following 2020/2021 disruption $129 2 $144 37% ~39% expected to result in projected 15% Adjusted Average Average EBITDA CAGR through 2025 Adjusted Adjusted EBITDA EBITDA 1 1 Margin Margin $94 $86 $75 Upside potential from innovation pipeline 3 and potential M&A 2017 A 2019 A 2020 A 2025 E 2 Silica Catalyst Sales (M) 50% share of Zeolyst JV Sales (M) 1 Adjusted EBITDA margin calculation includes proportionate 50% share of Zeolyst Joint Venture 2 Historically the Catalysts segment CATALYST TECHNOLOGIES / 52Organic Growth Outlook Organic Sales Growth Outlook Growth Drivers Preferred technology and increasing product Est. 10% CAGR offerings projected to drive >8% sales CAGR 1 in each of our three segments through 2025 8% CAGR Restored manufacturing network $170 efficiencies following 2020/2021 disruption $129 2 $144 37% ~39% expected to result in projected 15% Adjusted Average Average EBITDA CAGR through 2025 Adjusted Adjusted EBITDA EBITDA 1 1 Margin Margin $94 $86 $75 Upside potential from innovation pipeline 3 and potential M&A 2017 A 2019 A 2020 A 2025 E 2 Silica Catalyst Sales (M) 50% share of Zeolyst JV Sales (M) 1 Adjusted EBITDA margin calculation includes proportionate 50% share of Zeolyst Joint Venture 2 Historically the Catalysts segment CATALYST TECHNOLOGIES / 52

Key Takeaways We provide innovative technologies in growing markets We selectively invest where we can grow faster than the market Customers rely on our customized offerings resulting in predictable growth and strong margins CA CAT TA AL LY YS ST T T TE ECH CHN NO OL LO OG GI IE ES S / / 53 53Key Takeaways We provide innovative technologies in growing markets We selectively invest where we can grow faster than the market Customers rely on our customized offerings resulting in predictable growth and strong margins CA CAT TA AL LY YS ST T T TE ECH CHN NO OL LO OG GI IE ES S / / 53 53

Innovation Overview Dr. Ray Kolberg Vice President, Technology & Business Development YOUR CATALYST FOR POSITIVE CHANGE INNOVATION OVERVIEW/ 54Innovation Overview Dr. Ray Kolberg Vice President, Technology & Business Development YOUR CATALYST FOR POSITIVE CHANGE INNOVATION OVERVIEW/ 54

Key Takeaways We collaborate with customers to develop and produce sustainable products We innovate and support customers from lab to production scale We take a structured approach to innovation with a rich and relevant pipeline IN INN NO OV VA AT TIO ION N O OV VE ER RV VIE IEW W/ / 55 55Key Takeaways We collaborate with customers to develop and produce sustainable products We innovate and support customers from lab to production scale We take a structured approach to innovation with a rich and relevant pipeline IN INN NO OV VA AT TIO ION N O OV VE ER RV VIE IEW W/ / 55 55

Innovation Ecosystem Depth in product development and 1 science competency Significant expertise in silica, zeolites, 2 and catalyst technologies Chemistry Technical Expertise to tailor and scale specialty 3 grades to meet changing demands Customer Collaborations Scale Up Know-how Disciplined innovation process to 4 reduce time to market Rich and relevant product development 5 pipeline to drive new growth INNOVATION OVERVIEW/ 56Innovation Ecosystem Depth in product development and 1 science competency Significant expertise in silica, zeolites, 2 and catalyst technologies Chemistry Technical Expertise to tailor and scale specialty 3 grades to meet changing demands Customer Collaborations Scale Up Know-how Disciplined innovation process to 4 reduce time to market Rich and relevant product development 5 pipeline to drive new growth INNOVATION OVERVIEW/ 56

Extensive Capabilities Driving Growth Conshohocken, PA Houston, TX R&D Center & Pilot Plant Shell R&D Center Strengths of ecovyst R&D Strong customer Global collaboration Source: Shell technical service between R&D Novel Catalysts Development for Refining Catalysts Development support centers Finished Catalysts & Supports for the Zeolyst JV with Shell Amsterdam, NL Warrington, UK Houston, TX Ecoservices Houston Site Shell R&D Center R&D Center Fit for purpose product Pilot plant set up to development with close speed time to collaboration with market customers Source: Shell Analytical and Refining Catalysts Development Novel Catalysts Development for for the Zeolyst JV with Shell Finished Catalysts & Supports Development Center INNOVATION OVERVIEW/ 57Extensive Capabilities Driving Growth Conshohocken, PA Houston, TX R&D Center & Pilot Plant Shell R&D Center Strengths of ecovyst R&D Strong customer Global collaboration Source: Shell technical service between R&D Novel Catalysts Development for Refining Catalysts Development support centers Finished Catalysts & Supports for the Zeolyst JV with Shell Amsterdam, NL Warrington, UK Houston, TX Ecoservices Houston Site Shell R&D Center R&D Center Fit for purpose product Pilot plant set up to development with close speed time to collaboration with market customers Source: Shell Analytical and Refining Catalysts Development Novel Catalysts Development for for the Zeolyst JV with Shell Finished Catalysts & Supports Development Center INNOVATION OVERVIEW/ 57

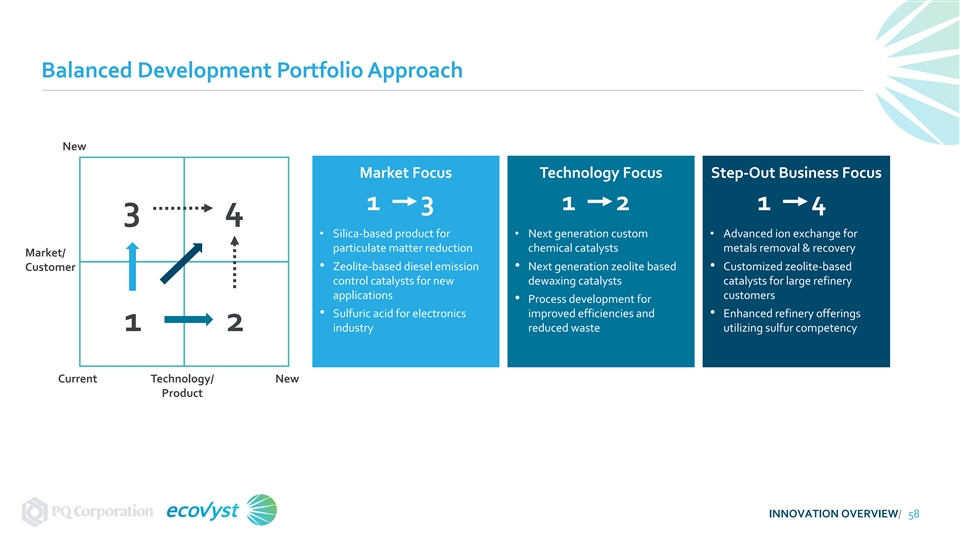

Balanced Development Portfolio Approach New Market Focus Technology Focus Step-Out Business Focus 1 3 1 2 1 4 3 4 • Silica-based product for • Next generation custom • Advanced ion exchange for particulate matter reduction chemical catalysts metals removal & recovery Market/ • Zeolite-based diesel emission • Next generation zeolite based • Customized zeolite-based Customer control catalysts for new dewaxing catalysts catalysts for large refinery applications customers • Process development for • Sulfuric acid for electronics improved efficiencies and • Enhanced refinery offerings 1 2 industry reduced waste utilizing sulfur competency Current Technology/ New Product INNOVATION OVERVIEW/ 58Balanced Development Portfolio Approach New Market Focus Technology Focus Step-Out Business Focus 1 3 1 2 1 4 3 4 • Silica-based product for • Next generation custom • Advanced ion exchange for particulate matter reduction chemical catalysts metals removal & recovery Market/ • Zeolite-based diesel emission • Next generation zeolite based • Customized zeolite-based Customer control catalysts for new dewaxing catalysts catalysts for large refinery applications customers • Process development for • Sulfuric acid for electronics improved efficiencies and • Enhanced refinery offerings 1 2 industry reduced waste utilizing sulfur competency Current Technology/ New Product INNOVATION OVERVIEW/ 58

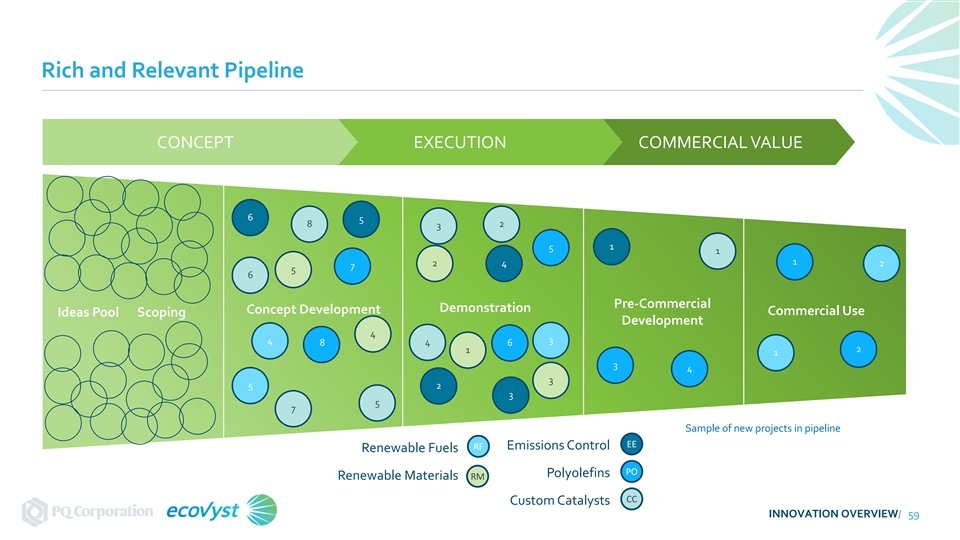

Rich and Relevant Pipeline CONCEPT EXECUTION COMMERCIAL VALUE 6 5 8 2 3 1 5 1 1 2 4 2 7 5 6 Pre-Commercial Demonstration Concept Development Commercial Use Ideas Pool Scoping Development 4 3 4 4 8 6 2 1 1 3 4 3 5 2 3 5 7 Sample of new projects in pipeline EE RF Emissions Control Renewable Fuels PO Polyolefins Renewable Materials RM CC Custom Catalysts INNOVATION OVERVIEW/ 59Rich and Relevant Pipeline CONCEPT EXECUTION COMMERCIAL VALUE 6 5 8 2 3 1 5 1 1 2 4 2 7 5 6 Pre-Commercial Demonstration Concept Development Commercial Use Ideas Pool Scoping Development 4 3 4 4 8 6 2 1 1 3 4 3 5 2 3 5 7 Sample of new projects in pipeline EE RF Emissions Control Renewable Fuels PO Polyolefins Renewable Materials RM CC Custom Catalysts INNOVATION OVERVIEW/ 59

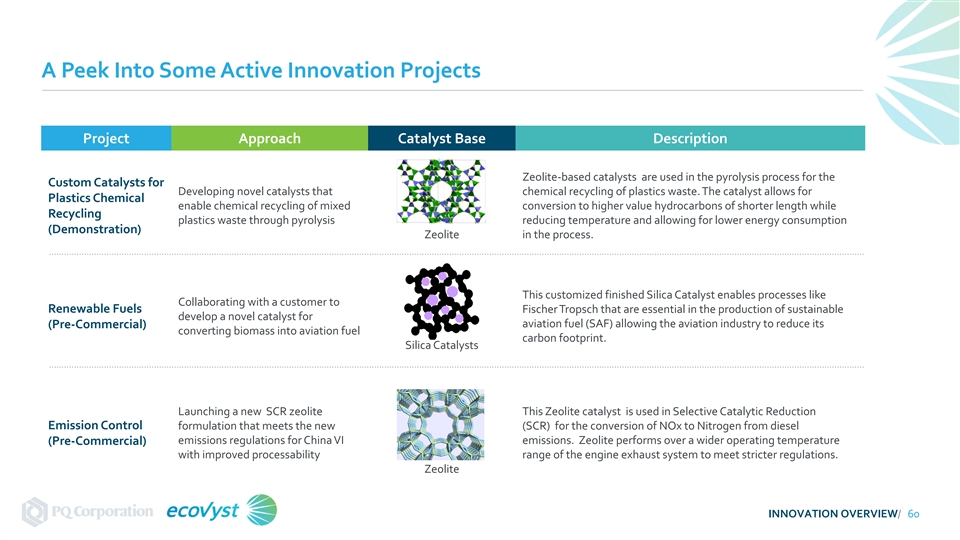

A Peek Into Some Active Innovation Projects Project Approach Catalyst Base Description Zeolite-based catalysts are used in the pyrolysis process for the Custom Catalysts for Developing novel catalysts that chemical recycling of plastics waste. The catalyst allows for Plastics Chemical enable chemical recycling of mixed conversion to higher value hydrocarbons of shorter length while Recycling plastics waste through pyrolysis reducing temperature and allowing for lower energy consumption (Demonstration) Zeolite in the process. This customized finished Silica Catalyst enables processes like Collaborating with a customer to Renewable Fuels Fischer Tropsch that are essential in the production of sustainable develop a novel catalyst for aviation fuel (SAF) allowing the aviation industry to reduce its (Pre-Commercial) converting biomass into aviation fuel carbon footprint. Silica Catalysts Enca Encaps psu ula lation tion Launching a new SCR zeolite This Zeolite catalyst is used in Selective Catalytic Reduction Emission Control formulation that meets the new (SCR) for the conversion of NOx to Nitrogen from diesel emissions regulations for China VI emissions. Zeolite performs over a wider operating temperature (Pre-Commercial) with improved processability range of the engine exhaust system to meet stricter regulations. Zeolite INNOVATION OVERVIEW/ 60A Peek Into Some Active Innovation Projects Project Approach Catalyst Base Description Zeolite-based catalysts are used in the pyrolysis process for the Custom Catalysts for Developing novel catalysts that chemical recycling of plastics waste. The catalyst allows for Plastics Chemical enable chemical recycling of mixed conversion to higher value hydrocarbons of shorter length while Recycling plastics waste through pyrolysis reducing temperature and allowing for lower energy consumption (Demonstration) Zeolite in the process. This customized finished Silica Catalyst enables processes like Collaborating with a customer to Renewable Fuels Fischer Tropsch that are essential in the production of sustainable develop a novel catalyst for aviation fuel (SAF) allowing the aviation industry to reduce its (Pre-Commercial) converting biomass into aviation fuel carbon footprint. Silica Catalysts Enca Encaps psu ula lation tion Launching a new SCR zeolite This Zeolite catalyst is used in Selective Catalytic Reduction Emission Control formulation that meets the new (SCR) for the conversion of NOx to Nitrogen from diesel emissions regulations for China VI emissions. Zeolite performs over a wider operating temperature (Pre-Commercial) with improved processability range of the engine exhaust system to meet stricter regulations. Zeolite INNOVATION OVERVIEW/ 60

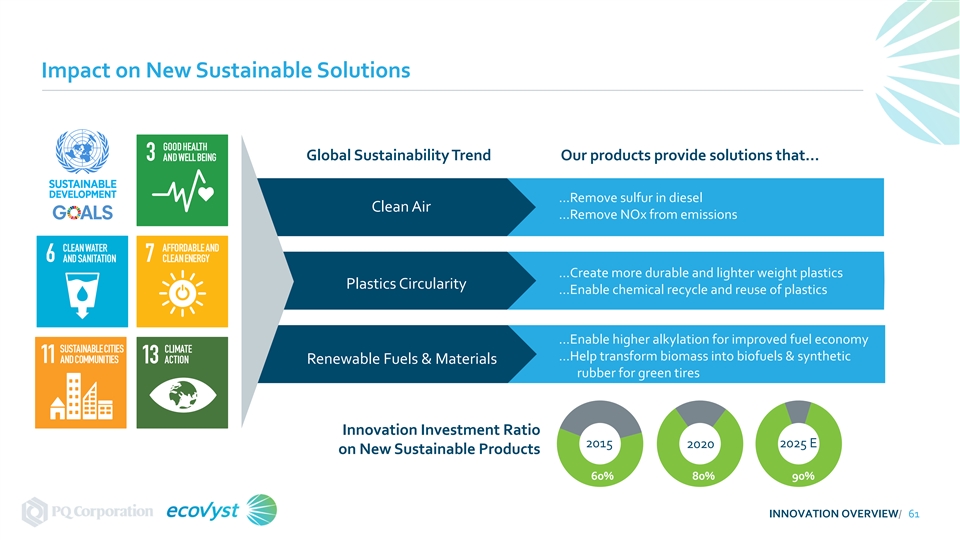

Impact on New Sustainable Solutions Global Sustainability Trend Our products provide solutions that… …Remove sulfur in diesel Clean Air …Remove NOx from emissions …Create more durable and lighter weight plastics Plastics Circularity …Enable chemical recycle and reuse of plastics …Enable higher alkylation for improved fuel economy …Help transform biomass into biofuels & synthetic Renewable Fuels & Materials rubber for green tires Innovation Investment Ratio 2015 2025 E 2020 on New Sustainable Products 60% 80% 90% INNOVATION OVERVIEW/ 61Impact on New Sustainable Solutions Global Sustainability Trend Our products provide solutions that… …Remove sulfur in diesel Clean Air …Remove NOx from emissions …Create more durable and lighter weight plastics Plastics Circularity …Enable chemical recycle and reuse of plastics …Enable higher alkylation for improved fuel economy …Help transform biomass into biofuels & synthetic Renewable Fuels & Materials rubber for green tires Innovation Investment Ratio 2015 2025 E 2020 on New Sustainable Products 60% 80% 90% INNOVATION OVERVIEW/ 61

Key Takeaways We collaborate with customers to develop and produce sustainable products We innovate and support customers from lab to production scale We take a structured approach to innovation with a rich and relevant pipeline IN INN NO OV VA AT TIO ION N O OV VE ER RV VIE IEW W/ / 62 62Key Takeaways We collaborate with customers to develop and produce sustainable products We innovate and support customers from lab to production scale We take a structured approach to innovation with a rich and relevant pipeline IN INN NO OV VA AT TIO ION N O OV VE ER RV VIE IEW W/ / 62 62

Financial Performance & Goals Overview Mike Crews Executive Vice President and Chief Financial Officer YOUR CATALYST FOR POSITIVE CHANGEFinancial Performance & Goals Overview Mike Crews Executive Vice President and Chief Financial Officer YOUR CATALYST FOR POSITIVE CHANGE

Key Takeaways Strong and Proven topline sustainable growth margins Superior metrics Secure high free warrant expanded cash conversion multiple FINANCIAL PERFORMANCE & GOALS OVERVIEW / 64Key Takeaways Strong and Proven topline sustainable growth margins Superior metrics Secure high free warrant expanded cash conversion multiple FINANCIAL PERFORMANCE & GOALS OVERVIEW / 64

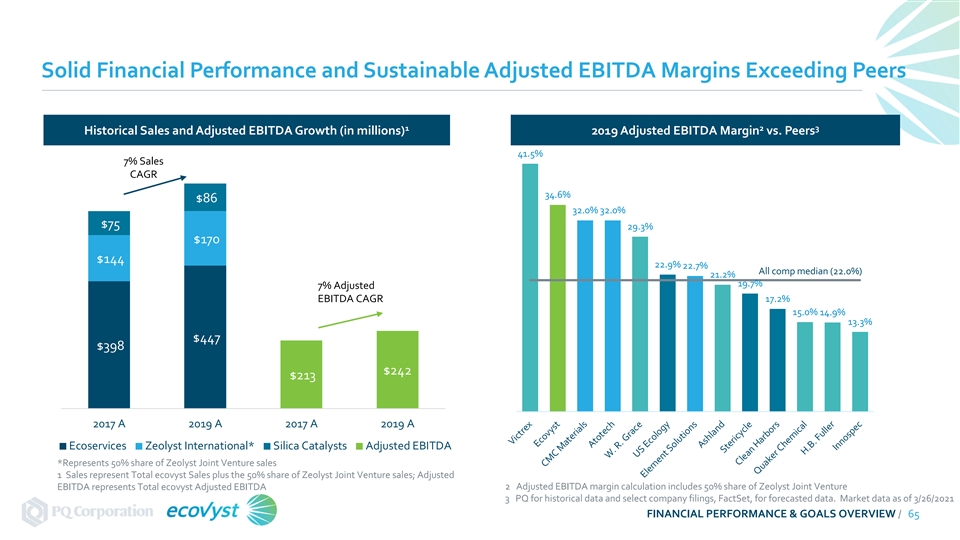

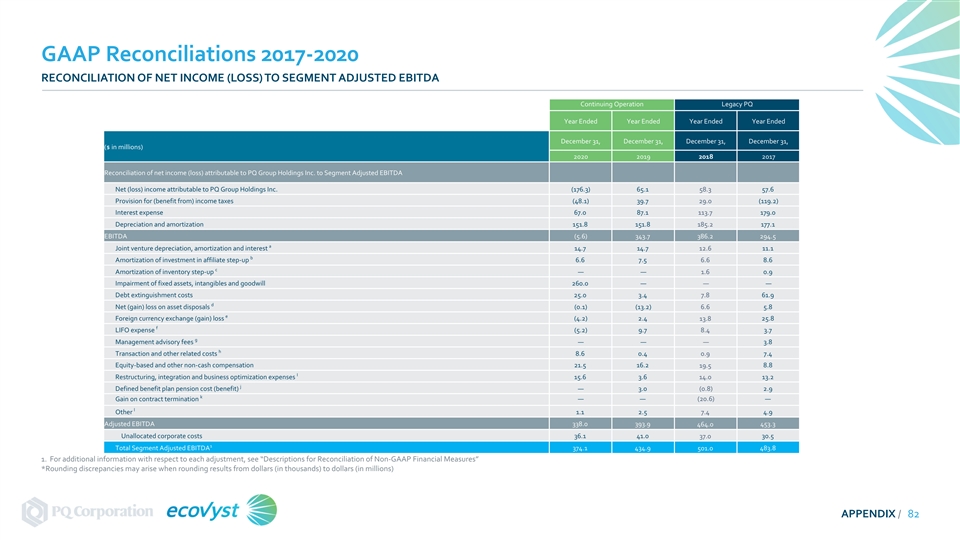

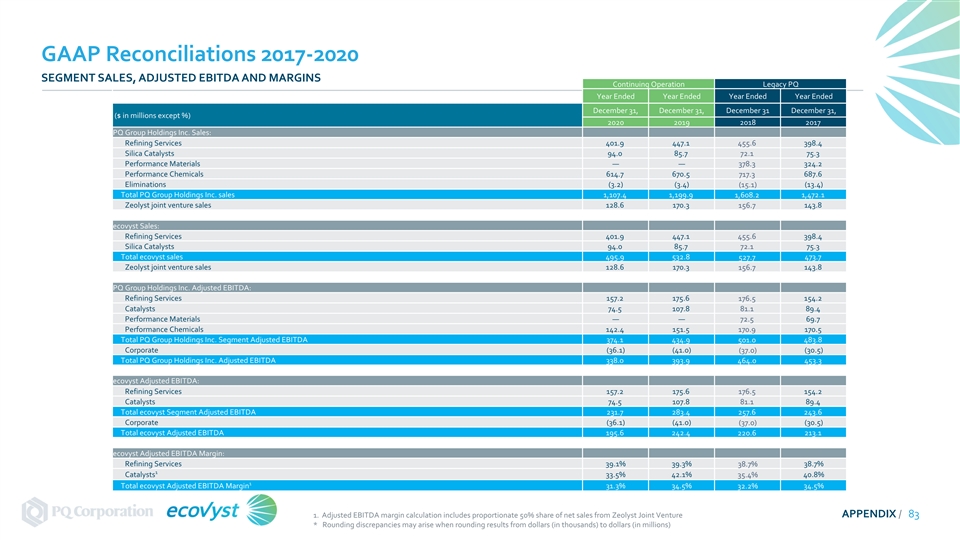

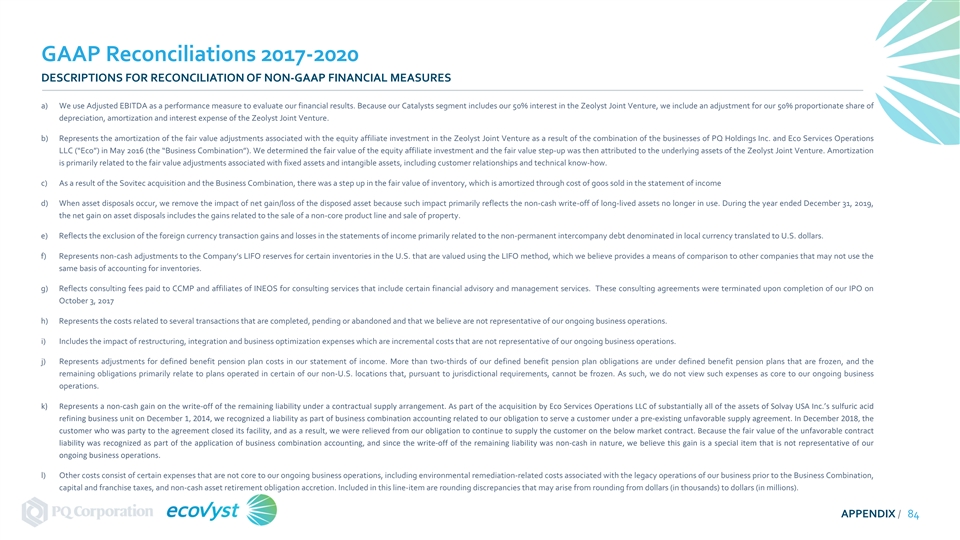

Solid Financial Performance and Sustainable Adjusted EBITDA Margins Exceeding Peers 1 2 3 Historical Sales and Adjusted EBITDA Growth (in millions) 2019 Adjusted EBITDA Margin vs. Peers 41.5% 7% Sales CAGR 34.6% $86 32.0% 32.0% $75 29.3% $170 $144 22.9% 22.7% 35% 35% All comp median (22.0%) 21.2% 19.7% 7% Adjusted EBITDA CAGR 17.2% 15.0% 14.9% 13.3% $447 $398 $242 $213 2017 A 2019 A 2017 A 2019 A Ecoservices Zeolyst International* Silica Catalysts Adjusted EBITDA *Represents 50% share of Zeolyst Joint Venture sales 1 Sales represent Total ecovyst Sales plus the 50% share of Zeolyst Joint Venture sales; Adjusted EBITDA represents Total ecovyst Adjusted EBITDA 2 Adjusted EBITDA margin calculation includes 50% share of Zeolyst Joint Venture 3 PQ for historical data and select company filings, FactSet, for forecasted data. Market data as of 3/26/2021 FINANCIAL PERFORMANCE & GOALS OVERVIEW / 65 Victrex Ecovyst CMC Materials Atotech W. R. Grace US Ecology Element Solutions Ashland Stericycle Clean Harbors Quaker Chemical H.B. Fuller InnospecSolid Financial Performance and Sustainable Adjusted EBITDA Margins Exceeding Peers 1 2 3 Historical Sales and Adjusted EBITDA Growth (in millions) 2019 Adjusted EBITDA Margin vs. Peers 41.5% 7% Sales CAGR 34.6% $86 32.0% 32.0% $75 29.3% $170 $144 22.9% 22.7% 35% 35% All comp median (22.0%) 21.2% 19.7% 7% Adjusted EBITDA CAGR 17.2% 15.0% 14.9% 13.3% $447 $398 $242 $213 2017 A 2019 A 2017 A 2019 A Ecoservices Zeolyst International* Silica Catalysts Adjusted EBITDA *Represents 50% share of Zeolyst Joint Venture sales 1 Sales represent Total ecovyst Sales plus the 50% share of Zeolyst Joint Venture sales; Adjusted EBITDA represents Total ecovyst Adjusted EBITDA 2 Adjusted EBITDA margin calculation includes 50% share of Zeolyst Joint Venture 3 PQ for historical data and select company filings, FactSet, for forecasted data. Market data as of 3/26/2021 FINANCIAL PERFORMANCE & GOALS OVERVIEW / 65 Victrex Ecovyst CMC Materials Atotech W. R. Grace US Ecology Element Solutions Ashland Stericycle Clean Harbors Quaker Chemical H.B. Fuller Innospec