Exhibit 99.1

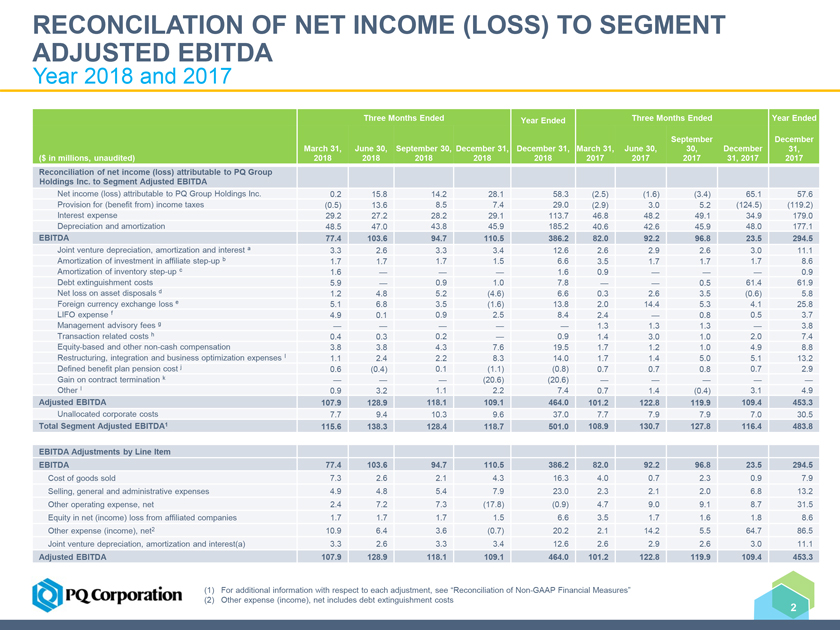

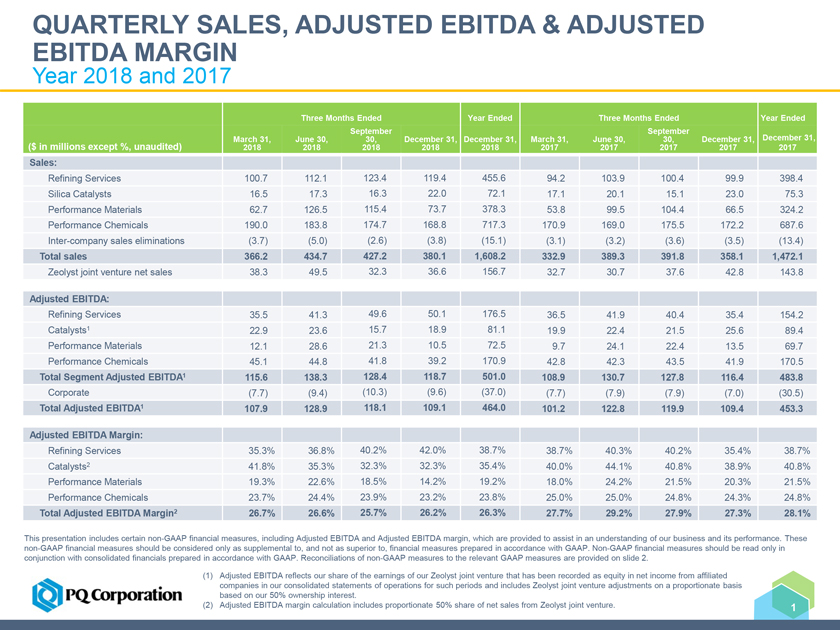

QUARTERLY SALES, ADJUSTED EBITDA & ADJUSTED EBITDA MARGIN Year 2018 and 2017 Three Months Ended Year Ended Three Months Ended Year Ended September September ($ in millions except %, unaudited) March 31, June 30, 30, December 31, December 31, March 31, June 30, 30, December 31, December 31, 2018 2018 2018 2018 2018 2017 2017 2017 2017 2017 Sales: Refining Services 100.7 112.1 123.4 119.4 455.6 94.2 103.9 100.4 99.9 398.4 Silica Catalysts 16.5 17.3 16.3 22.0 72.1 17.1 20.1 15.1 23.0 75.3 Performance Materials 62.7 126.5 115.4 73.7 378.3 53.8 99.5 104.4 66.5 324.2 Performance Chemicals 190.0 183.8 174.7 168.8 717.3 170.9 169.0 175.5 172.2 687.6 Inter-company sales eliminations (3.7) (5.0) (2.6) (3.8) (15.1) (3.1) (3.2) (3.6) (3.5) (13.4) Total sales 366.2 434.7 427.2 380.1 1,608.2 332.9 389.3 391.8 358.1 1,472.1 Zeolyst joint venture net sales 38.3 49.5 32.3 36.6 156.7 32.7 30.7 37.6 42.8 143.8 Adjusted EBITDA: Refining Services 35.5 41.3 49.6 50.1 176.5 36.5 41.9 40.4 35.4 154.2 Catalysts1 22.9 23.6 15.7 18.9 81.1 19.9 22.4 21.5 25.6 89.4 Performance Materials 12.1 28.6 21.3 10.5 72.5 9.7 24.1 22.4 13.5 69.7 Performance Chemicals 45.1 44.8 41.8 39.2 170.9 42.8 42.3 43.5 41.9 170.5 Total Segment Adjusted EBITDA1 115.6 138.3 128.4 118.7 501.0 108.9 130.7 127.8 116.4 483.8 Corporate (7.7) (9.4) (10.3) (9.6) (37.0) (7.7) (7.9) (7.9) (7.0) (30.5) Total Adjusted EBITDA1 107.9 128.9 118.1 109.1 464.0 101.2 122.8 119.9 109.4 453.3 Adjusted EBITDA Margin: Refining Services 35.3% 36.8% 40.2% 42.0% 38.7% 38.7% 40.3% 40.2% 35.4% 38.7% Catalysts2 41.8% 35.3% 32.3% 32.3% 35.4% 40.0% 44.1% 40.8% 38.9% 40.8% Performance Materials 19.3% 22.6% 18.5% 14.2% 19.2% 18.0% 24.2% 21.5% 20.3% 21.5% Performance Chemicals 23.7% 24.4% 23.9% 23.2% 23.8% 25.0% 25.0% 24.8% 24.3% 24.8% Total Adjusted EBITDA Margin2 26.7% 26.6% 25.7% 26.2% 26.3% 27.7% 29.2% 27.9% 27.3% 28.1% This presentation includes certain non-GAAP financial measures, including Adjusted EBITDA and Adjusted EBITDA margin, which are provided to assist in an understanding of our business and its performance. These non-GAAP financial measures should be considered only as supplemental to, and not as superior to, financial measures prepared in accordance with GAAP. Non-GAAP financial measures should be read only in conjunction with consolidated financials prepared in accordance with GAAP. Reconciliations of non-GAAP measures to the relevant GAAP measures are provided on slide 2. (1) Adjusted EBITDA reflects our share of the earnings of our Zeolyst joint venture that has been recorded as equity in net income from affiliated companies in our consolidated statements of operations for such periods and includes Zeolyst joint venture adjustments on a proportionate basis based on our 50% ownership interest. (2) Adjusted EBITDA margin calculation includes proportionate 50% share of net sales from Zeolyst joint venture. 1