As filed with the Securities and Exchange Commission on September 25, 2017

Registration No. 333-218650

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 6

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

PQ GROUP HOLDINGS INC.

(Exact name of registrant as specified in its charter)

| Delaware | 2800 | 81-3406833 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

300 Lindenwood Drive

Valleybrooke Corporate Center

Malvern, Pennsylvania 19355

(610) 651-4400

(Address, including zip code, and telephone number, including

area code, of registrant’s principal executive offices)

James F. Gentilcore

President and Chief Executive Officer

PQ Group Holdings Inc.

300 Lindenwood Drive

Valleybrooke Corporate Center

Malvern, Pennsylvania 19355

(Name, address, including zip code, and telephone number, including

area code, of agent for service)

Copies to:

| Craig E. Marcus Ropes & Gray LLP Prudential Tower 800 Boylston Street Boston, MA 02199 (617) 951-7000 |

Jason M. Licht Latham & Watkins LLP 555 Eleventh Street, NW Washington, DC 20004 (202) 637-2200 |

Approximate date of commencement of proposed sale to public: As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||||

| Non-accelerated filer | ☒ | (Do not check if a smaller reporting company) | Smaller reporting company | ☐ | ||||

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated September 25, 2017

PROSPECTUS

29,000,000 Shares

PQ Group Holdings Inc.

Common Stock

This is the initial public offering of the common stock of PQ Group Holdings Inc., a Delaware corporation. PQ Group Holdings Inc. is offering 29,000,000 shares of common stock to be sold in the offering.

Prior to this offering, there has been no public market for our common stock. The initial public offering price is expected to be between $21.00 and $23.00 per share. We have applied to list our common stock on the New York Stock Exchange under the symbol “PQG.”

See “Risk Factors” beginning on page 28 to read about factors you should consider before buying shares of our common stock.

| Per Share |

Total |

|||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions (1) |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

| (1) | See “Underwriters” for additional information regarding underwriter compensation. |

To the extent that the underwriters sell more than 29,000,000 shares of our common stock, the underwriters have the option for a period of 30 days from the date of this prospectus to purchase up to an additional 4,350,000 shares of our common stock from us at the initial public offering price less the underwriting discount.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of our common stock on or about , 2017.

| Morgan Stanley | Goldman Sachs & Co. LLC | Citigroup | Credit Suisse |

| J.P. Morgan | Jefferies | Deutsche Bank Securities | KeyBanc Capital Markets |

| Evercore ISI | Nomura | |||||

, 2017

We have not authorized any person to provide you with any information or represent anything about us or this offering that is not contained in this prospectus or in any free writing prospectus we have prepared. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

i

SUPPLY SHARE AND INDUSTRY INFORMATION

Certain statistical information used throughout this prospectus is based on independent industry publications, reports by research firms or other published independent sources. Some statistical information is also based on our good faith estimates, which are derived from management’s knowledge of our industry and such independent sources referred to above. Certain supply share statistics, ranking and industry information included in this prospectus, including the size of certain markets and our estimated supply share position and the supply share positions of our competitors, are based on management estimates. These estimates have been derived from our management’s knowledge and experience in the industry and end uses into which we sell our products, as well as information obtained from surveys, reports by research firms, our customers, distributors, suppliers, trade and business organizations and other contacts in the industries into which we sell our products. We believe these data to be accurate as of the date of this prospectus. However, this information may prove to be inaccurate because this information cannot always be verified with complete certainty due to the limitations on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties. Unless otherwise noted, all of our supply share position information presented in this prospectus is an approximation based on management’s knowledge and is based on our, or, in the case of our zeolite catalysts product group, our Zeolite Joint Venture’s, sales volumes relative to the estimated sales volumes for the year ended December 31, 2016 in relevant products or end uses into which we sell our products. In the case of our refining services product group, including the products and services thereof, such supply share position information excludes volume attributable to manufacturers who produce primarily for their own consumption. References to our being a leader in a supply share position or product group refer to our belief that we have one of the leading supply share positions, unless otherwise indicated or the context otherwise requires. In addition, references to various end uses into which we sell our products are based on how we define the end uses for our products.

Certain monetary amounts, percentages and other figures included in this prospectus have been subject to rounding adjustments. Accordingly, numerical figures shown as totals in certain tables or charts may not be the arithmetic aggregation of the figures that precede them. In addition, we round certain percentages presented in this prospectus to the nearest whole number. As a result, figures expressed as percentages in the text may not total 100% or, as applicable, when aggregated may not be the arithmetic aggregation of the percentages that precede them.

TRADEMARKS AND TRADENAMES

We own or have rights to trademarks or trade names that we use in conjunction with the operation of our business. In addition, our name, logo and website name and address are our service marks or trademarks. Each trademark, trade name or service mark by any other company appearing in this prospectus belongs to its holder. Some of the more important trade names and trademarks that we use include Potters, PQ, Zeolyst, Zeolyst International and EcoServices. We also own or have the rights to copyrights that protect the content of our products. Solely for convenience, the trademarks, service marks, trade names and copyrights referred to in this prospectus are listed without the ™, SM, ® and © symbols, but we will assert, to the fullest extent under applicable law, our rights to these trademarks, service marks, trade names and copyrights.

THE BUSINESS COMBINATION

On May 4, 2016, we consummated a series of transactions (the “Business Combination”) to reorganize and combine the businesses of PQ Holdings Inc. (“PQ Holdings”) and Eco Services Operations LLC (“Eco”) under a new holding company, PQ Group Holdings Inc. (“PQ Group Holdings” or the “company”), pursuant to a reorganization and transaction agreement, dated August 17, 2015, as amended, by and among PQ Group Holdings, PQ Holdings, PQ Corporation, Eco, Eco Services Holdings LLC, Eco Services Group Holdings LLC and certain investment funds affiliated with CCMP Capital Advisors, LLC (now known as CCMP Capital Advisors, LP; “CCMP”). We refer to the business of PQ Holdings prior to the Business Combination as “legacy PQ” and the business of Eco prior to the Business Combination as “legacy Eco.”

ii

BASIS OF FINANCIAL PRESENTATION

Legacy Eco operated as a business unit of Solvay USA Inc. (“Solvay”) until the acquisition of substantially all of the assets of Solvay’s Eco Services business unit by Eco on December 1, 2014 (the “2014 Acquisition”). References in this prospectus to “Predecessor” include each of the periods from January 1, 2012 to November 30, 2014. For 2014, the results include 11 months of legacy Eco operating activity (January 1, 2014 to November 30, 2014) and include amounts that have been “carved out” from Solvay’s financial statements using assumptions and allocations made by Solvay to reflect Solvay’s Eco Services business unit on a stand-alone basis. References in this prospectus to “Successor” refer to the period from inception of Eco (July 30, 2014) to December 31, 2014, but only include one month of legacy Eco operating activity (December 1, 2014 to December 31, 2014), because there was no operating activity for the period from inception (July 30, 2014) to November 30, 2014, and reflect legacy Eco on a stand-alone basis.

On May 4, 2016, we consummated the Business Combination to reorganize and combine the businesses of PQ Holdings and Eco under a new holding company. In accordance with United States generally accepted accounting principles (“GAAP”), legacy Eco was the accounting acquirer in the Business Combination and, as such, legacy Eco is treated as our predecessor and therefore the financial information through May 3, 2016 only includes the results of legacy Eco. The financial information presented in this prospectus subsequent to May 3, 2016 is of PQ Group Holdings, which includes the operating results of legacy Eco and legacy PQ.

The following table summarizes, for each of the periods specified below and for which financial information is included for the issuer, PQ Group Holdings, in this prospectus, the portion, if any, of the financial results of legacy PQ and legacy Eco that is included in the financial results for such periods presented in accordance with GAAP.

| Successor | Predecessor | |||||||||||||||||||||||||||||||||||||||||||||||

| Six months ended June 30, |

Pro forma year ended December 31, 2016 |

Years ended December 31, |

Period from inception (July 30, 2014) to December 31, 2014 |

Period from January 1, 2014 to November 30, 2014 |

||||||||||||||||||||||||||||||||||||||||||||

| 2017 | 2016 | 2016 | 2015 | |||||||||||||||||||||||||||||||||||||||||||||

| Operations of legacy Eco |

|

Included |

|

|

Included |

|

|

Included |

|

|

Included |

|

|

Included |

|

|

Partially included |

|

|

Included |

| |||||||||||||||||||||||||||

| Operations of legacy PQ |

|

Included |

|

|

Partially included |

|

|

Included |

|

|

Partially included |

|

|

Not included |

|

|

Not included |

|

|

Not included |

| |||||||||||||||||||||||||||

The financial statements of our accounting predecessor contained in this prospectus for periods prior to the 2014 Acquisition are not necessarily indicative of what legacy Eco’s financial position, results of operations and cash flows would have been had legacy Eco operated as a separate, standalone entity independent of Solvay.

Additional information regarding our financial performance and non-GAAP measures, including reconciliations of non-GAAP measures to their most directly comparable GAAP measure, is included in “Summary Historical and Unaudited Pro Forma Financial and Other Data.” In addition, such financial information should be read in conjunction with the disclosures set forth under “Unaudited Pro Forma Financial Information of PQ Group Holdings” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and related notes appearing elsewhere in this prospectus.

iii

THE RECLASSIFICATION

In connection with this offering, on September 22, 2017, we reclassified our Class A common stock into common stock and then effected a 8.8275-for-1 split of our common stock. Immediately prior to this offering, we will convert each outstanding share of our Class B common stock into 8.8275 shares of our common stock plus an additional number of shares determined by dividing the unreturned paid-in capital amount of such share of Class B common stock, or $113.74 per share, by the initial public offering price of a share of our common stock in this offering, rounded to the nearest whole share. Holders of our Class B common stock will not receive any cash payments from us in connection with the conversion of the Class B common stock. References to the “Reclassification” throughout this prospectus refer to the reclassification of our Class A common stock into our common stock, the 8.8275-for-1 split of our common stock and the conversion of our Class B common stock into our common stock. Unless otherwise indicated, all share and per share data gives effect to the Reclassification, including the conversion of all shares of our Class B common stock into shares of our common stock, based upon an estimated Class B conversion factor determined by reference to an assumed initial public offering price of $22.00 per share, which is the midpoint of the price range set forth on the cover of this prospectus. Such share data is subject to change based on the actual number of shares of our common stock issued in connection with the conversion of our Class B common stock into our common stock. See “The Reclassification.”

iv

This summary highlights information appearing elsewhere in this prospectus. This summary is not complete and does not contain all of the information that you should consider before investing in our common stock. You should carefully read the entire prospectus, including the historical financial statements and related notes and the pro forma financial information and related notes included elsewhere in this prospectus and the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements,” before deciding whether to invest in our common stock. Unless otherwise indicated or the context otherwise requires, references to “we,” “us,” “our,” “PQ Group Holdings,” or the “company” refer to PQ Group Holdings Inc. and its consolidated subsidiaries, including PQ Holdings Inc., Eco Services Operations Corp. and PQ Corporation, our primary operating company. We refer to the business of PQ Holdings Inc. prior to the Business Combination as “legacy PQ” and we refer to the business of Eco Services Operations LLC prior to the Business Combination as “legacy Eco.” See “Basis of Financial Presentation.” All information in this prospectus assumes no exercise of the underwriters’ option to purchase additional shares, unless otherwise noted.

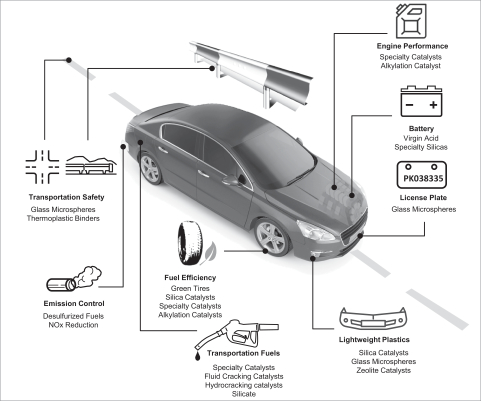

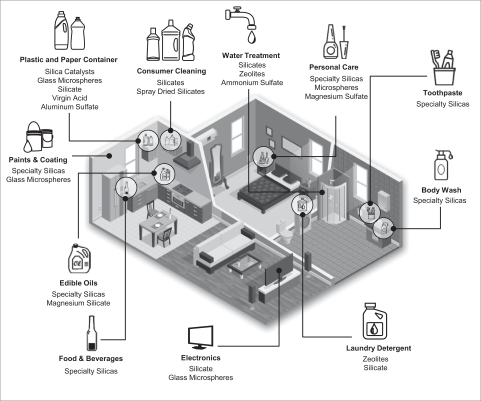

Our Company

We are a leading global provider of catalysts, specialty materials and chemicals, and services that enable environmental improvements, enhance consumer products, and increase personal safety. Our products and solutions help companies produce vehicles with improved fuel efficiency and cleaner emissions. Our materials are critical ingredients in consumer products that make teeth brighter, skin softer, and wounds heal faster. We produce highly engineered materials that make highways and airports safer for drivers and pilots. Because our products are predominantly inorganic and carbon-free, we believe we contribute to improving the sustainability of our planet.

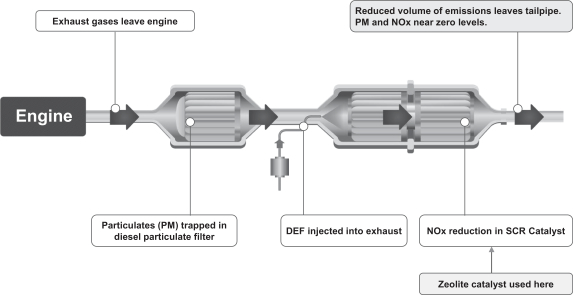

We believe our products deliver significant value to our customers, as demonstrated by our profit margins. Our products, which are mostly additives, catalysts, and services, typically constitute a small portion of our customers’ overall end-product costs yet are critical to product performance. For example, our catalysts are highly technical, customized products that require customer collaboration and significant lead time, resources, and intellectual property to develop. Through this collaborative innovation process, we have developed zeolite-based catalysts that are an effective and efficient method to reduce pollutants in diesel engines and enable our customers to meet increasingly stringent vehicle emission standards worldwide. In personal care applications, we have collaborated with leading consumer products companies over a number of years to develop a family of gentle silica-based dentifrice abrasives that produce more effective cleaning toothpastes. These collaborative efforts with our customers continue to drive our product innovation process.

Our value-added products seek to address global issues that are often either the subject of significant regulations or are driven by consumer preferences, which we believe positions us to grow in excess of gross domestic product growth rates. Consumer preferences and global regulations requiring environmentally friendlier products are at the core of many of our value-added products and, we believe, provide us with high-margin growth opportunities. For example, our products and services facilitate improvement in vehicle fuel efficiency and emissions, enable vehicles to be lighter, and allow tires to roll and engines to run with less friction. The production of higher octane gasoline, which is needed for certain smaller turbocharged engines, has generated additional demand for the alkylation units that use our refinery services.

For the year ended December 31, 2016, we generated sales of $1,064.2 million and pro forma sales of $1,403.0 million, a net loss of $(79.7) million and a pro forma net loss of $(57.7) million, and pro forma Adjusted EBITDA of $420.8 million, which represented a pro forma Adjusted EBITDA margin of approximately 30%. In addition, our zeolite catalysts product group operates through Zeolyst International and Zeolyst C.V. (our 50% owned joint ventures that we refer to collectively as our “Zeolyst Joint Venture”). For the year ended December 31, 2016, 50% of the total net sales of our Zeolyst Joint Venture totaled $131.3 million. Additional information regarding our financial performance and non-GAAP measures, including pro forma Adjusted EBITDA, together with a reconciliation of non-GAAP measures to their most directly comparable GAAP measure, is included in “Summary Historical and Unaudited Pro Forma Financial and Other Data.” See footnote (4) to

1

“Summary Historical and Unaudited Pro Forma Financial and Other Data” for a description of the treatment of our Zeolyst Joint Venture in our consolidated financial information.

We have two reporting segments: environmental catalysts and services and performance materials and chemicals. In our environmental catalysts and services segment, we have three product groups: silica catalysts, zeolite catalysts, and refining services. In our performance materials and chemicals segment, we have two product groups: performance materials and performance chemicals.

In 2016, we served over 4,000 customers globally across many end uses and, as of June 30, 2017, operated out of 72 manufacturing facilities, which are strategically located across six continents. We believe we are a leader in each of our product groups, holding what we estimate to be a number one or number two supply share position for products that generated more than 90% of our 2016 pro forma sales. We believe that our global footprint and efficient network of strategically located manufacturing facilities provide us with a strong competitive advantage in serving our customers. We serve these customers both regionally as well as globally. We believe that we hold our leading supply share positions in the key regions that we serve while also benefiting from leading global presence and capabilities. Within our performance chemicals product group, we estimate that we had approximately three times the sodium silicate supply share of our closest competitor based on 2016 sales volume. This product group, which is the backbone across our additives and catalyst platform, is highly regionalized because of the expense of shipping sodium silicates extended distances due to their water content. Our refining services product group is also a highly regionalized business due to shipping costs and customer integration requirements, and in 2016 we estimate that we had a regenerated sulfuric acid supply share in excess of 50% in the United States, which we believe is substantially larger than our closest competitor. We recently reorganized our business to be market-based rather than product-based in order to better align our product groups with similar end uses to meet our customers’ needs.

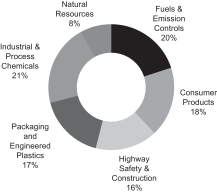

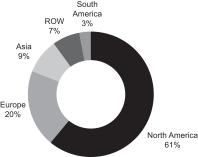

We are highly diversified by business, geography, and end use, and in 2016 the majority of our pro forma sales were into applications that have historically had relatively predictable, consistent demand patterns driven by consumption or frequent replacement cycles.

| 2016 Pro Forma Sales and Zeolyst Joint Venture Total Net Sales by End Use (1)(2) |

2016 Pro Forma Sales and Zeolyst Joint Venture Total Net Sales by Geography (1)(2)(3) | |

|

| |

| (1) | Pro forma information gives effect to the consummation of the Business Combination and the related financing transactions as if they occurred on January 1, 2015. |

| (2) | Percentage calculations include $131.3 million of total net sales attributable to our Zeolyst Joint Venture, which represents 50% of its total net sales for the year ended December 31, 2016. See footnote (4) to “Summary Historical and Unaudited Pro Forma Financial and Other Data” for a description of the treatment of our Zeolyst Joint Venture in our consolidated financial information. |

| (3) | Based on the delivery destination for products sold in 2016. |

2

Our Industry

We compete in the specialty chemicals and materials industry. Our industry is characterized by constant development of new products and the need to support customers with new product innovation and technical services to meet their challenges. In addition, customers demand consistent product quality and a reliable source of supply. Products sold to our customers can be highly value-added even when they represent only a small portion of the overall end product costs, and success can be achieved by helping customers improve their product performance, value, and quality. As a result, operating margins in this sector have historically been high and generally stable through economic cycles. In addition, many products in the specialty chemicals and materials industry benefit from economics that favor incumbent producers because the capital cost to expand existing capacity is typically significantly less than the capital cost necessary to build a new plant. The combination of attractive operating margins and moderate and generally predictable maintenance capital expenditure requirements can produce attractive cash flows. Our industry is also characterized by the need to produce consistent quality in a safe and environmentally sustainable manner.

The table below summarizes our key end use applications and products as well as the significant growth drivers in those applications.

| Key End Uses | 2016 Forma Sales |

Significant Growth Drivers | Key PQ Products | |||||

|

Fuels & Emissions Controls |

20 | % | • Global regulatory requirements to:

• Remove nitrogen oxides from emissions

• Remove sulfur from diesel and gasoline

• Increase gasoline octane in order to improve fuel efficiency while lowering vapor pressure to regulated levels for premium fuels

• Improve lubricant characteristics to improve fuel efficiencies |

• Refinery catalysts

• Emissions control catalysts

• Catalyst recycling services | ||||

|

Consumer Products |

18 | % |

• Substitution of silicate materials for less environmentally friendly chemical additives in detergent and cleaning end uses

• Demand for improved quality and shelf life of beverages

• Demand for improved oral hygiene and appearance |

• Silica gels for edible oil and beer clarification

• Precipitated silicas and zeolites for the surface coating, dentifrice, and dishwasher and laundry detergent applications | ||||

| Highway Safety & Construction |

|

16 |

% |

• Demand for enhanced “dry and wet” visibility of road and airport markings to improve safety

• Drive for weight reduction in cements |

• Reflective markings for roadways and airports

• Hollow glass beads, or microspheres, for cement additives | |||

3

| Key End Uses | 2016 Forma Sales |

Significant Growth Drivers | Key PQ Products | |||||

|

Packaging & Engineered Plastics |

|

17

|

%

|

• Demand for increased process efficiency and reduction of by-products in production of chemicals

• Demand for high-density polyethylene lightweighting of automotive components

• Enhanced properties in plastic composites for the automotive and electronics industries |

• Catalysts for high-density polyethylene and chemicals syntheses

• Antiblocks for film packaging

• Solid and hollow microspheres for composite plastics | |||

|

Industrial & Process Chemicals |

21 | % | • Demand in the tire industry for reduced rolling resistance

• Usage of silicate in municipal water treatment to inhibit corrosion in aging pipelines

• Growth in manufacturing in North America driving demand for metal finishing |

• Silicate precursors for the tire industry

• Silicate for water treatment

• Glass beads, or microspheres, for metal finishing end uses | ||||

|

Natural Resources |

8 | % | • More environmentally friendly drilling fluids for oil and gas production

• Recovery in global oil drilling / U.S. copper production

• Growing demand for lighter weight cements in oil and natural gas wells |

• Silicates for drilling muds

• Hollow glass beads, or microspheres, for oil well cements

• Sulfur derivatives for copper mining

• Bleaching aids for paper | ||||

| (1) | Pro forma information gives effect to the consummation of the Business Combination and the related financing transactions as if they occurred on January 1, 2015. |

| (2) | Percentage calculations include $131.3 million of total net sales attributable to our Zeolyst Joint Venture, which represents 50% of its total net sales for the year ended December 31, 2016. See footnote (4) to “Summary Historical and Unaudited Pro Forma Financial and Other Data” for a description of the treatment of our Zeolyst Joint Venture in our consolidated financial information. |

4

Our Business

The table below summarizes certain information regarding our two reporting segments and our five product groups for the year ended December 31, 2016.

| Year ended December 31, 2016 | ||||||||||||||||||||||||||||||||||||

| (Dollars in millions) Segments and Product |

Sales | % of Total Sales |

Pro Forma Sales(1) |

Zeolyst Joint Venture Total Net Sales(2) |

% of Total Pro Forma Sales and Zeolyst Joint Venture Total Net Sales(1)(2)(3) |

Net Loss |

Pro Forma Adjusted EBITDA(1)(2) |

% of Total Pro Forma Adjusted EBITDA(1)(2)(4) |

Estimated Supply Share Position(5) |

|||||||||||||||||||||||||||

| Environmental Catalysts and Services: |

||||||||||||||||||||||||||||||||||||

| Silica Catalysts |

$ | 53.0 | 5.0 | % | $ | 84.2 | $ | — | 5.5 | % | #2 | |||||||||||||||||||||||||

| Zeolite Catalysts |

— | — | — | 131.3 | 8.5 | % | Primarily #1 or #2 | |||||||||||||||||||||||||||||

| Refining Services |

373.7 | 35.0 | % | 373.7 | — | 24.3 | % | #1 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

| Subtotal |

$ | 426.7 | 40.0 | % | $ | 457.9 | $ | 131.3 | 38.3 | % | $ | 221.8 | 48.9 | % | ||||||||||||||||||||||

| Performance Materials and Chemicals: |

||||||||||||||||||||||||||||||||||||

| Performance Chemicals |

$ | 437.5 | 41.0 | % | $ | 663.9 | $ | — | 43.2 | % | Primarily #1(6) | |||||||||||||||||||||||||

| Performance Materials |

206.5 | 19.4 | % | 291.3 | — | 19.0 | % | Primarily #1(7) | ||||||||||||||||||||||||||||

| Sales Eliminations |

(5.0 | ) | (0.4 | %) | (8.0 | ) | — | (0.5 | %) | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

| Subtotal |

$ | 639.0 | 60.0 | % | $ | 947.2 | $ | — | 61.7 | % | $ | 231.8 | 51.1 | % | ||||||||||||||||||||||

| Eliminations / Corporate |

(1.5 | ) | (2.1 | ) | — | (32.8 | ) | |||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Total |

$ | 1,064.2 | 100.0 | % | $ | 1,403.0 | $ | 131.3 | 100.0 | % | $ | (79.7 | ) | $ | 420.8 | 100.0 | % | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| (1) | Pro forma information gives effect to the consummation of the Business Combination and the related financing transactions as if they occurred on January 1, 2015. |

| (2) | Percentage calculations include $131.3 million of total net sales attributable to our Zeolyst Joint Venture, which represents 50% of its total net sales for the year ended December 31, 2016. See footnote (4) to “Summary Historical and Unaudited Pro Forma Financial and Other Data” for a description of the treatment of our Zeolyst Joint Venture in our consolidated financial information. |

| (3) | Percentage calculations exclude $2.1 million in intersegment sales eliminations. |

| (4) | Percentage calculations exclude $32.8 million in corporate expenses. |

| (5) | Estimated supply share positions are based on management’s estimates based on 2016 sales volume and represent our estimated global supply share positions for each of our product groups, except that the estimated supply share position for our refining services product group reflects our estimate of only our supply share position in the United States and excludes volume attributable to manufacturers who produce primarily for their own consumption. |

| (6) | We believe we hold #1 supply share positions with respect to products that accounted for approximately 73% of our performance chemicals product group’s 2016 pro forma sales, and that we hold #2 supply share positions with respect to products that accounted for the remaining approximately 27% of our performance chemicals product group’s 2016 pro forma sales. |

| (7) | We believe we hold #1 supply share positions with respect to products that accounted for approximately 89% of our performance materials product group’s 2016 pro forma sales, and that we hold #2 supply share positions with respect to products that accounted for the remaining approximately 11% of our performance materials product group’s 2016 pro forma sales. |

We are an integrated, global provider of catalysts, specialty materials and chemicals, and services that share common end uses, manufacturing techniques, and process technology. For example, all of our product groups address challenges faced by global automotive companies to meet increasingly strict fuel efficiency standards.

5

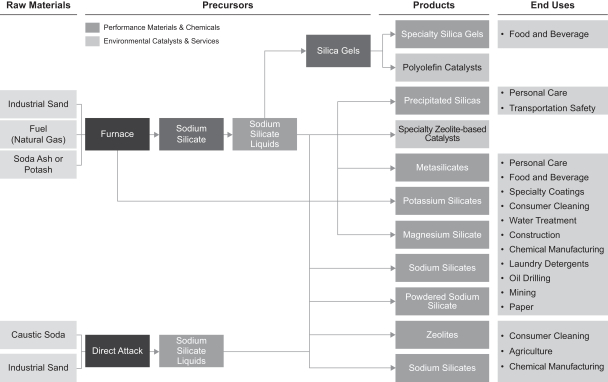

Our manufacturing platform is based on furnace technology and proprietary knowledge developed from almost two centuries of combined experience at legacy PQ and legacy Eco applying silicates chemistry production and the development of applications across a broadening set of end uses. All of our product groups produce materials through our furnace process, other than our silica catalysts and zeolite catalysts product groups, which are derivatives of our performance chemicals product group. We believe we have a differentiated capability around furnace operations that enables us to operate more efficiently than most of our competitors.

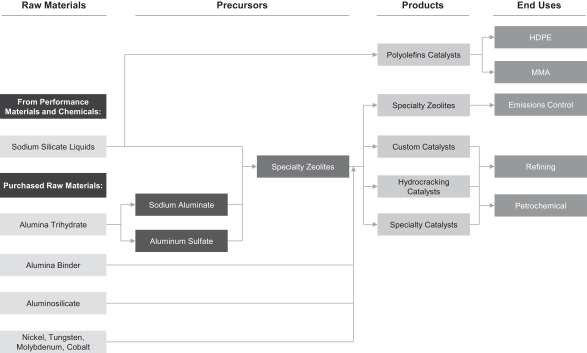

Environmental Catalysts and Services

Our environmental catalysts and services business is a leading global innovator and producer of catalysts for the refinery, emissions control, and petrochemical industries and is also a leading provider of catalyst recycling services to the North American refining industry. We believe our products are mission critical for our customers in these growing applications and impart essential functionality in chemical and refining production processes and in emissions control for engines. Our catalysts are highly technical and customized for our customers and can require up to ten years of development and collaboration with customers in order to commercialize. Catalyst specifications are constantly evolving in order to address changing customer demands and requirements for lower cost and improved quality. As a result, we must continuously collaborate with our customers to create new and more efficient pathways for the production of chemicals and fuels. Our environmental catalysts and services business consists of three product groups: silica catalysts, zeolite catalysts, and refining services.

Silica Catalysts. In our silica catalysts product group, we sell both the finished catalyst and catalyst supports, which are critical catalyst components, for the production of high-density polyethylene (“HDPE”), a high strength and high stiffness plastic used in packaging films, bottles and containers, and other molded applications. We also produce a catalyst that is used globally for the production of methyl methacrylate, the monomer for acrylic engineering resins, a clear scratch-resistant plastic used in sheet or molded form to replace glass and as a durable surface coating.

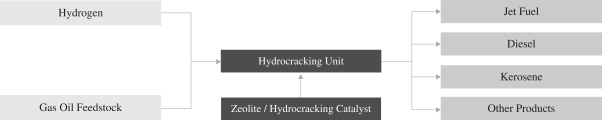

Zeolite Catalysts. Our zeolite catalysts product group is a leading global supplier of emissions control catalysts as well as a supplier of specialty catalysts, precursors, and formulations to refineries and downstream petrochemicals and chemical companies. We operate through our Zeolyst Joint Venture with CRI Zeolites Inc., which is an affiliate of Royal Dutch Shell (“CRI”). Our Zeolyst Joint Venture is a long-standing partnership dating back to 1988, which combines our expertise in zeolites supply and technology and our partner’s expertise in global refinery catalyst sales and technology. These specialty zeolite-based catalysts are sold to the emissions control industry for use in diesel emission control units in both on-road and non-road diesel engines. In addition, our zeolite catalysts product group is a leading supplier of hydrocracking catalysts as a direct seller and supplier to other catalyst suppliers. This product group also produces other specialty catalysts, including aromatic catalysts that upgrade aromatic by-product streams, dewaxing catalysts that improve lube oil performance and diesel cold flow performance, and paraffin isomerization catalysts that upgrade olefins to high octane gasoline blending components, for refinery and petrochemical customers. From 2015 to 2020, global heavy- and light-duty diesel vehicle production is expected to grow at a compound annual growth rate of 4.1% and 2.8%, respectively. We believe that this estimated vehicle production growth combined with the continuing evolution of governmental regulation and product innovation involving emissions control will afford us with opportunities for growth in our zeolite catalysts product group.

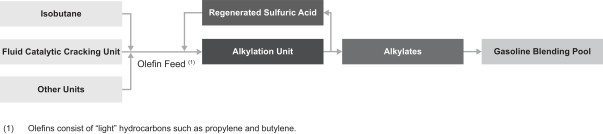

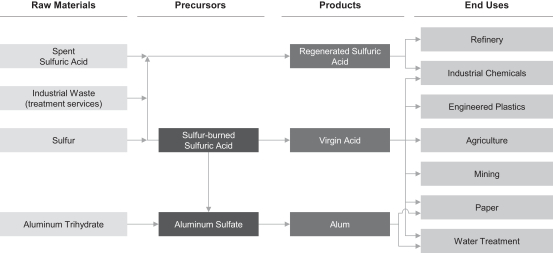

Refining Services. Sulfuric acid is the primary catalyst used in the production of alkylates for gasoline production at refineries. Alkylates are a critical additive that increase octane in gasoline at low vapor pressure, and currently are used in most gasoline in the United States. Alkylate demand is expected to grow because its benefits are needed in certain smaller turbocharged engines to meet increasingly stringent fuel efficiency standards. The number of these turbocharged light-duty vehicles in the United States is expected to make up approximately 83% of all light-duty vehicles by 2025, a significant increase from approximately 18% in 2014,

6

which we believe will increase the demand for higher-octane gasoline. Premium gasoline production grew at a compound annual growth rate of 6.1% between 2011 and 2016 according to the United States Energy Information Administration. Our refining services product group provides recycling and end-to-end logistics for refiners who use sulfuric acid in their alkylation units. These recycling units also produce virgin sulfuric acid and sodium bisulfate, which we sell into the water treatment, mining, and general industrial and chemicals industries.

We estimate that we hold the number one supply share position in the United States for these sulfuric acid recycling services based upon our 2016 sales volume. Our refining services product group is highly regionalized due to shipping costs and customer integration requirements. Our facilities are located near or, in some cases, within our customers’ refineries and our products are often supplied directly to our customers by pipeline. In addition, product can be shipped by barge, rail, and truck. As a result, we believe that our integrated and strategically located network of facilities and end-to-end logistics assets in the United States provides us with a significant competitive advantage and would be costly for our competitors to replicate.

Performance Materials and Chemicals

Our performance materials and chemicals business is a silicates and specialty materials producer with leading supply positions for the majority of our products sold in North America, Europe, South America, Australia and Asia (excluding China) serving diverse and growing end uses such as personal and industrial cleaning products, fuel efficient tires (“green tires”), surface coatings, and food and beverage products. Our products are essential additives, ingredients, and precursors that are critical to the performance characteristics of our customers’ products, yet typically represent only a small portion of our customers’ overall end-product costs. We believe that our global footprint enables us to compete more effectively on a global basis due to the costs associated with shipping these products over extended distances and that our network of strategically located manufacturing facilities allows us to serve our customers at a lower cost than our competitors and with quicker delivery times for our products. Our performance materials are also being used in some cases as a substitute for less environmentally friendly materials. For example, specialty silicates are displacing phosphates in dish detergents, precipitated silicas are displacing carbon black in tires, and hollow and solid microspheres are displacing plastic volumes in transportation lightweighting applications. Our performance materials and chemicals business consists of two product groups: performance chemicals and performance materials.

Performance Chemicals. Our performance chemicals product group includes silicate products and derivatives, which are used in a variety of applications such as adsorbents for surface coatings, clarifying agents for edible oils and beverages, precursors for green tires, and additives for cleaning and personal care products. Silicates are a family of products manufactured primarily from readily available materials, such as industrial sand and soda ash. These raw materials are typically fused in a furnace and then dissolved in water under pressure to form water-soluble silicates for use in our downstream products, such as precipitated silica and silica gels. We sell our performance chemicals products to customers who use silicates as precursors, such as sodium silicates that are used in the growing precipitated silica applications, as well as for downstream derivative products, such as silicas used as additives in toothpaste formulation and silica gels that are used as adsorbents in food and beverage manufacturing. Our network of regional silicate plants is strategically located to support the customers that we serve. In addition, we maintain a few larger dedicated facilities to service our derivative products. Our performance chemicals product technology requires significant know-how and scale in order to be able to operate in a cost effective manner. We believe that we are the only global silicates producer who can supply all of the major regions, and we estimate that we have three times the sodium silicates supply share as our nearest competitor based on 2016 sales volume. Key end uses for our performance chemicals products include catalyst precursors, food and beverage, personal care, cleaning products, coatings, tires, soil stabilization, paper de-inking, and sequestration. According to Notch Consulting, global demand for precipitated silica is estimated to grow at a compound annual growth rate of 5.8% between 2015 and 2020, driven primarily by expected increases in demand from tires, footwear and other rubber applications.

7

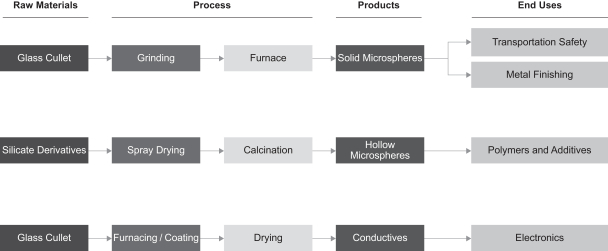

Performance Materials. Our performance materials product group includes specialty glass products, such as highly engineered microspheres made from either recycled glass or fresh batch material using our proprietary furnace operations. We believe that we are an industry leader in North America, Europe, South America, and Asia (excluding China) in microspheres. These products are used in the reflective markings used on roads and runways to enhance visibility at night and in poor weather to improve safety. Our microspheres, which can be solid or hollow, are also used as additives in plastics for lightweighting and as abrasive media, where they are used to clean, peen, and debur metal surfaces, such as for turbine blades used in aerospace and power generation industries.

Our Competitive Strengths

Leading Global and Regional Positions in Attractive End Uses

We believe that we maintain a leading supply position in each of our major product groups, holding what we estimate to be the number one or two supply share position in 2016 for products that generated more than 90% of our pro forma sales. We believe that our global footprint and efficient network of strategically located manufacturing facilities provides us with a strong competitive advantage in serving our customers both globally and regionally, and that it would be costly for our competitors to replicate our network.

In our environmental catalysts and services business, we primarily compete on a global basis, with the exception of our refining services product group, where we compete on a more regional basis due to the costs associated with shipping these products over extended distances. We are a leading supplier of refinery hydrocracking catalysts and emissions control catalysts that are used in the heavy- and light-duty diesel industries to reduce nitrogen oxides emissions. We are also a global leader in specialty catalysts, such as catalysts for methyl methacrylate and for lube oil and diesel fuel dewaxing. In these applications, we primarily compete with other global producers such as W.R. Grace, BASF, UOP, and Albemarle, as well as other niche competitors such as Tosoh, Axens, and Haldor Topsoe.

In our refining services product group, we compete in a number of regions where our facilities are required to be close to our refinery customers, and in some cases located within the refinery with a direct pipeline to deliver our product. We estimate that our refining services product group holds the number one supply share position in the United States in sulfuric acid regeneration based on 2016 sales volume with an estimated 53% supply share. We also estimate that we had a 64% supply share in each of the West Coast and Gulf Coast areas based on 2016 sales volume, which we believe was greater than three times the supply share of our largest competitor. In our performance chemicals product group, where we also compete primarily on a regional basis due to the costs associated with shipping sodium silicates, we estimate that we had approximately three times the sodium silicates supply share of our nearest competitor based on 2016 sales volume. We believe that we are the only global silicates producer with operations in North America, Europe, and Australia. We believe that we have technical, cost, and proximity advantages in all of these regions as compared to our competitors as a result of the scale and breadth of our product offerings and operations.

These leadership positions serve industries that are attractive due to the need for customized and innovative products, stability of demand, and growth potential driven by the regulatory environment and consumer preferences. Our products generally require close customer collaboration to address end use challenges that are constantly evolving. We produce value-added products that are critical to the performance characteristics of our customers’ products. In addition, in 2016, a majority of our pro forma sales were to end uses such as fuels and emission controls, consumer products, and highway safety and construction that generally do not exhibit as pronounced cyclicality as other applications. Further, many of these end uses are growing due to increased global regulations, such as regulations regarding sulfur content in transportation fuel and particulate matter and nitrogen

8

oxides emissions from on-road and non-road diesel engines. Increasingly stringent automotive fuel efficiency standards are also expected to lead to an increase in the demand for higher-octane gasoline. While we believe increasing regulatory standards provide attractive growth opportunities, we may be required to develop new products in response to such regulations in order to fully capture such opportunities. In addition, our products are ingredients in consumer products, which includes personal care and consumer cleaning products, where customers are seeking more environmentally friendly products without loss of effectiveness or performance. We believe that our products have the environmental and safety profile to address these evolving customer demands.

Long-Term, High-Quality Customer Relationships and Innovation Track Record

Many of our products require close customer collaboration to address application challenges that are constantly evolving. As a result, we work with our customers over many years in order to develop products to meet customized specifications and performance characteristics while also maintaining strict quality standards. While we are unable to predict future shifts in customer demand, the long lead-time required for product development and commercialization, which can be up to ten years in our environmental catalysts and services business, provides the opportunity for us to build long-term relationships with customers.

We collaborate with leading multinational companies that often seek global solutions. Our customers include large industrial companies such as BASF, Honeywell, and 3M, and global catalyst producers such as Albemarle and W.R. Grace. We also supply catalysts to leading chemical and petrochemical producers such as BASF, Dow Chemical, Lucite, LyondellBasell, and Shell. We supply personal care ingredients and additives to leading consumer products companies such as Unilever and Colgate-Palmolive. We have long-term relationships with our top ten customers, based on 2016 pro forma sales, that average more than 50 years. In addition, our customer base is diversified, with our top ten customers in 2016 representing approximately 24% of our pro forma sales for the year ended December 31, 2016 and no customer representing more than 4% of our pro forma sales during this period. However, the percentage of our sales generated by our top customers may increase in the future as a result of changes in industry dynamics, shifts in customer demands and contracts or other factors.

These long-term relationships have allowed us to innovate together with our customers to meet evolving demands. For example, we have developed zeolite-based catalysts that are an effective and efficient method to reduce pollutants from heavy- and light-duty diesel engines and enable our customers to meet increasingly stringent vehicle emission standards worldwide. In personal care applications, we have collaborated with leading consumer products companies over a number of years to develop a family of gentle silica-based dentifrice abrasives that produce more effective cleaning toothpastes. In addition, our proprietary silica catalyst has enabled development of a high strength HDPE resin that is used for making lightweight plastic gasoline tanks for automobiles. While we believe we are well positioned to capitalize on future innovation opportunities, the constantly evolving needs of our customers make it difficult to predict the pace or scope of future innovation opportunities.

9

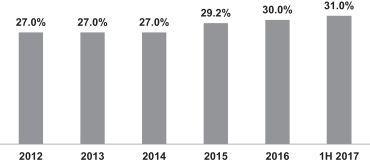

Attractive and Stable Margins and Cash Flow

We have demonstrated the ability to maintain stable margins while continuing to grow our business in different macroeconomic environments. Our Adjusted EBITDA margins have averaged approximately 28% between 2012 and 2016. We believe that the stability of our margins and cash flows during this period is because our value-added products, which are critical to the performance of our customers’ products, typically represent only a small portion of our customers’ overall end-product costs.

| Adjusted EBITDA Margin (1) |

|

| (1) | Legacy Eco Adjusted EBITDA margin is presented for 2012 through 2014, pro forma Adjusted EBITDA margin is presented for 2015 and 2016 and Adjusted EBITDA margin is presented for the first half of 2017. As a result, Adjusted EBITDA margin for 2012 through 2014 consists only of the results of our accounting predecessor and may not be representative of margins for our entire business for such periods. See footnote (4) to “Summary Historical and Unaudited Pro Forma Financial and Other Data” for a description of the treatment of our Zeolyst Joint Venture in our consolidated financial information. |

Our products are predominantly inorganic and carbon-free, and are produced from readily available raw materials such as industrial sand and soda ash, which prices have historically been less volatile than oil. We also use natural gas in our furnaces where our North American facilities have benefited from the plentiful supplies of shale gas. In addition, we have long-term supply contracts with many of our key raw materials suppliers across our product groups. We have also been able to mitigate the impact of raw material or energy price volatility using a variety of mechanisms, including hedging and raw material cost pass-through clauses in our sales contracts and other adjustment provisions. For the year ended December 31, 2016, approximately 45% of our North American silicate pro forma sales, which is a significant portion of our performance chemicals product group sales, and approximately 94% of our refining services product group pro forma sales were sold under contracts that included raw material pass-through clauses.

Our cash flow generation is driven, in part, by our disciplined capital investment and tax attributes that may provide cash flow benefits in the future. We have invested in our infrastructure and growth over the last three years and we expect to realize returns on these investments in the future with limited additional investment requirements, although there is no assurance that we will be able to realize any returns on these investments or that significant additional investments will not be required. As of December 31, 2016, we had $383.2 million of net operating losses for U.S. federal income tax purposes, along with related net operating losses for state tax purposes, and $671.4 million of identified intangibles and goodwill from the Business Combination transaction, both of which may provide us with additional cash tax savings in future years in which we generate taxable income.

Strong Growth Potential Across the Portfolio

We focus on serving end use applications where we believe significant future growth potential exists. Our products address our customers’ needs, which are typically driven either by regulatory regimes or consumer

10

preferences, on a global basis. In addition, our product sales and development efforts are driven by regional infrastructure and development trends. In vehicles, we address regulated heavy- and light-duty diesel emission standards and sulfur content and vapor pressure requirements in gasoline, with a majority of the 2016 total net sales of emissions control catalysts products in our zeolite catalysts product group addressing heavy-duty diesel engines. We expect that these regulations will create growth opportunities in excess of gross domestic product growth rates due to the constantly evolving standards that our customers need to address with new and improved products.

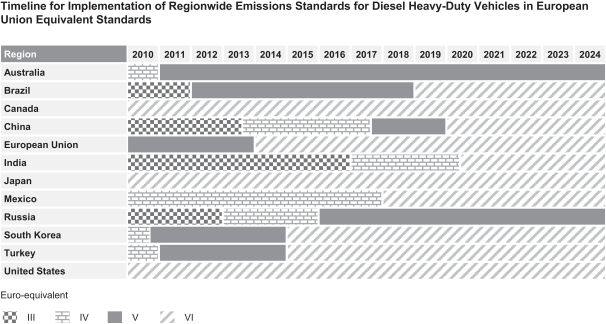

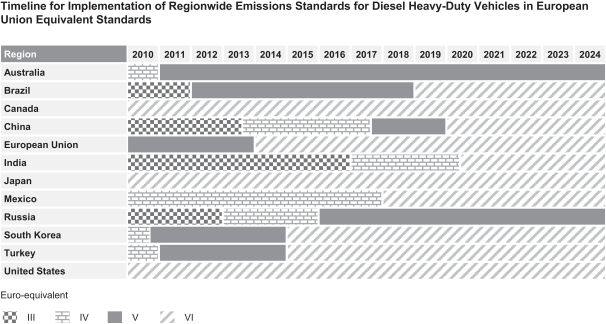

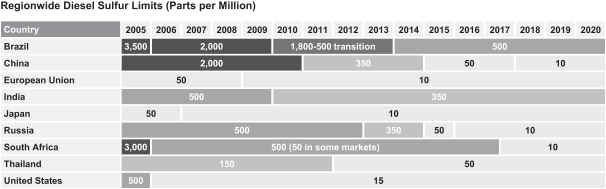

Light- and heavy-duty diesel engines are subject to a broad set of regulatory requirements, and we expect that these increasingly stringent standards will offer opportunities for our Zeolyst Joint Venture to develop products to assist our customers in meeting these standards. Countries typically adopt a set of standards that limit the amount of nitrogen oxides, carbon dioxide, and other emissions allowed for diesel engines. In many cases countries have established regulations that generally follow United States Environmental Protection Agency or European Union standards, but typically on a later implementation timeline. In addition, even more restrictive regulations are expected to be adopted in the future in many jurisdictions, such as EU VII, which would further reduce permitted emissions levels in the European Union. We believe that compliance with existing regulations as well as any future regulations provides us with opportunities to grow our sales of emissions control catalysts.

The following chart identifies the regulatory requirements for certain countries and regions in relation to the most comparable European Union standard for ease of comparability. See “Industry—Fuels & Emissions Controls” for more information regarding the European Union standards referred to in the chart below.

Source: The International Council on Clean Transportation

Given the fuel efficiency standards that are driving the design of new engines and the resulting higher-octane gasoline requirements that can be achieved through alkylate blending, we believe that our refining services product group is well positioned to benefit from any related growth in demand for alkylates.

We produce catalysts for HDPE and methyl methacrylate production in the packaging and engineered plastics applications. According to an industry source, North American HDPE capacity is expected to grow at a

11

compound annual growth rate of approximately 5.1% between 2016 and 2020, driven by North America’s global cost position in petrochemicals and increased use of these plastics as a substitute for heavier and less versatile materials such as glass and metal. Methyl methacrylate is the monomer for acrylic engineering resins, a clear scratch-resistant plastic used in sheet form to replace glass and as a surface coating. We believe that we have an opportunity to grow our methyl methacrylate catalysts sales in the future as methyl methacrylate production increases as a result of, in part, increased production efficiencies enabled by our catalysts.

We believe that additional demand for retroreflectivity (or visibility) for roadway and aviation markings could provide us with significant growth opportunities. We benefit from increased use and density per mile of road markings that include our products. The most recent innovation from our performance materials product group is our ThermoDrop product, which simplifies the road striping operations for our customers by using a new durable thermal plastic road marking material. We have also introduced a new faster-drying road marking system, Visilok, which can reduce traffic disruption during striping operations and improve road worker safety by reducing the amount of time needed to complete the road marking process.

We also expect to benefit from trends towards the use of more environmentally friendly products where we believe we have opportunities to displace other less environmentally friendly materials. While there is no assurance that such trends will continue in the future, we believe our product offerings position us to capitalize on this growth opportunity. For example, our Ambosol magnesium silicate is used to eliminate color and odors in polyols, which are used in the production of polyurethane for, among other things, household products such as scratch-resistant coatings and foam insulation. In addition, our specialty silicates are displacing phosphates in dish detergents, precipitated silicas are displacing carbon black in tires, and solid and hollow microspheres are displacing plastic volumes in lightweighting applications. Most of our products are manufactured from commonly found materials such as industrial sand and soda ash, which are more environmentally friendly than carbon-based products. We have also developed a family of gentle silica-based dentifrice abrasives that produce more effective cleaning toothpastes and we have developed a product family, Britesil silicates, which improves convenience while eliminating phosphates in automatic dishwashing applications.

Experienced Management Team

Our senior management team has substantial industry experience and a proven track record. They average over 30 years of experience in our product groups, and their cumulative industry experience extends to a broad range of execution capabilities, including acquisition integration, strategic management, operations, sales and marketing, and new product and application development. In 2016, our management team integrated legacy Eco into our environmental catalysts and services business while also growing the business and successfully implementing cost initiatives. Our senior management team has also reorganized our company from a products-based business to a markets-based business to better align our offerings with the needs of our customers. There is a renewed focus on serving our customers by developing solutions through technical sales, services, and product development, and we have added additional management personnel experienced in innovation and market driven organizations. Our management owns approximately 11% of our outstanding common stock immediately prior to this offering, which we believe creates an alignment of interest with our shareholders.

Our Business Strategy

Our business strategy is to capitalize on our strong foundation, market-based approach, and management team to grow sales profitably, deploy capital efficiently, and generate free cash flow in order to create shareholder value. We believe that our history of operational excellence, technology leadership, and strong business execution developed from our almost two centuries of combined industry experience at legacy PQ and legacy Eco positions us well to execute on our business strategy. In the last two years, we have added senior

12

executives to our management team, including our chief executive officer, Jim Gentilcore, and chief financial officer, Mike Crews, who bring significant public company leadership experience and a track record of customer-focused innovation and disciplined capital allocation to our business. We believe that Mr. Gentilcore’s experience in the electronics industry is particularly relevant to our innovation efforts as we pursue new product innovation across our product groups. In addition, we believe that our recent reorganization better aligns our management structure with our customer needs to enable us to make more focused sales and product innovation investments. We believe there are significant opportunities to profitably grow our business, generate free cash flow and deliver shareholder value by executing on the following strategies:

Shift from a Products-based to a Markets-based Company

Our reorganization from a products-based to a markets-based company is fundamental to our growth strategy. Following the consummation of the Business Combination in May 2016, we have further realigned our product groups around critical markets that we serve. The combination of the legacy Eco and legacy PQ businesses expanded our presence in the refinery industry and provided us with valuable insight into key success factors for serving our refining and petrochemical customers. We have undertaken a similar approach in other important end uses that we serve such as personal care, highway safety, oil and gas, surface coatings, and electronics.

Our solution-oriented process starts with our customer’s specific needs, which are then identified as a product or service opportunity that is defined, sized, and evaluated to determine if it is within the core strength of our global development team. If not within our core capabilities, but determined to be a strategically important opportunity, we initiate a search for outside technology, partnerships, or acquisition targets that can deliver a cost-effective and profitable solution. This approach is in contrast to our prior approach developing products or new formulations first and then seeking to identify applications into which to sell that product or new formulation. We believe that our markets-based approach will result in product innovation that better meets our customers’ needs and supports our profitable growth.

Our sales and marketing organization has a broad base of customer and marketing experience. Since our business reorganization, we believe each of our operating segments has simplified its customer contact points and increased knowledge about the industries we serve. We have been able to eliminate duplicate sales calls that would occur among our previous business divisions and can prioritize our efforts around our most influential customer contacts. We have also removed the silos that previously impeded our ability to share important customer information within our organization. This integrated marketing effort allows for more rapid analysis and decision-making for our major strategic customers who are often served by multiple product groups. We believe these operational improvements will enable us to reduce product commercialization time and increase our return on marketing investment.

Prioritize Investment and Development to Innovate and Profitably Grow Sales

We have been able to successfully grow our sales into new applications through our innovation and development of new products to address evolving customer needs. For example, our zeolite catalysts product group developed new products to address new regulatory standards regarding vehicle emissions, and our performance chemicals product group collaborated with our customers to develop precipitated silica products to address their demands for more green tires. We will continue to focus on collaboration with our customers through our technical sales and research and development teams to better understand and address our customers’ evolving needs and invest in our growth by prioritizing innovation driven by these identified needs.

Within our innovation and product development process, our technology teams work closely with our customer facing teams to identify compelling customer needs that can be addressed through innovation or new

13

product development. We seek to assess technology and commercialization hurdles early on in the development process so that we can quickly and efficiently evaluate our opportunity and, where appropriate, deprioritize, or abandon projects before expending significant resources. We are improving the way our research and development team shares information by removing silos and holding regular senior-level project reviews to ensure best practices are shared and consistent metrics are used to determine a project’s merit and the size of the potential opportunity. We have already begun to see the benefits of our new processes with the successful commercialization of ThermoDrop, which we launched in February 2017. We collaborated with key customers to develop the ThermoDrop technology, which uses our highway safety microspheres and a proprietary striping application technology to enable our customers to more efficiently stripe highways. This technology has received strong customer acceptance since launch, and we are increasing our production to meet anticipated demand.

We will also selectively consider acquisitions as part of our growth strategy. We believe that our integration of legacy Eco demonstrates our ability to successfully execute on acquisitions and realize available synergies and other benefits. We have identified a number of potential acquisition targets with complementary fits across both of our operating segments and, consistent with our markets-based focus, these targets also include downstream-focused businesses. We will seek to use acquisitions to increase our geographic presence, diversify our product offerings, and further secure our leadership positions with our customer base. We intend to focus our acquisition efforts on opportunities in our higher value-added solutions within or adjacent to our current product offerings. We intend to pursue these transactions in a disciplined manner by rigorously evaluating return on capital against our cost of capital in addition to the potential strategic benefits. However, as of June 30, 2017, we had cash and cash equivalents of $50.5 million and total outstanding indebtedness of approximately $2,728.4 million, which may limit our ability to pursue acquisition transactions or other aspects of our growth strategy.

Maintain Strong Margins and Cash Flow with Continuous Improvement Initiatives

Our margins historically have been stable due to our strong and long-standing value proposition to our customers and our strong technological, operational, and product capabilities. We intend to maintain and improve upon these margins by leveraging our operational excellence and continuing our approach to raw material cost pass-through and other appropriate cost sharing arrangements with our customers. We believe that our new organizational structure will allow us to better leverage distribution channels across our products in order to address end uses such as paints and coatings, personal care, and oil and gas, and we have also integrated our continuous improvement teams across our operating segments. For example, we have established a new global furnace operations team, a global engineering team, and a global sales and operations planning team to share best practices across all of our product groups. We have also formalized our sharing of best practices across many functional disciplines, such as supply chain, technology, working capital, and capital expenditure management. From these efforts, we expect to be able to reduce costs in our operations in order to increase our cash flow.

Recent Developments

On August 7, 2017, PQ Corporation repriced its existing senior secured term loan facility, which consists of a $927.8 million U.S. dollar-denominated tranche and a €283.3 million Euro-denominated tranche, to reduce the applicable interest rates. The repriced term loan facility has substantially identical terms to the prior facility, except that (a) U.S. dollar-denominated borrowings bear interest at the rate equal to, at our option (1) a margin of 2.25% plus a base rate or (2) a margin of 3.25% plus a LIBOR rate (subject to a floor of 0%) determined by reference to the cost of funds for U.S. dollar deposits, subject to certain adjustments and other events, and (b) Euro-denominated borrowings bear interest at a rate equal to, at our option (1) a margin of 2.25% plus a base rate or (2) a margin of 3.25% plus a EURIBOR rate (subject to a floor of 0.75%) determined by reference to the cost of funds for Euro deposits, subject to certain adjustments and other events. The repriced term loan facility is expected to reduce our annual interest expense by approximately $12.5 million. See “Description of Certain Indebtedness—Senior Secured Credit Facilities” for additional information regarding the senior secured term loan facility.

14

Risk Factors

An investment in our common stock involves a high degree of risk. Any of the factors set forth under “Risk Factors” may limit our ability to successfully execute on our business strategy. You should carefully consider all of the information set forth in this prospectus and, in particular, should evaluate the specific factors set forth under “Risk Factors” in deciding whether to invest in our common stock. Among these important risks are the following:

| • | as a global business, we are exposed to local business risks in different countries, which could have a material adverse effect on our financial condition, results of operations and cash flows; |

| • | as of June 30, 2017, we had total outstanding indebtedness of approximately $2,728.4 million and our substantial debt could adversely affect our liquidity and ability to raise additional capital to fund our operations and limit our ability to pursue our growth strategy or react to changes in the economy or our industry; |

| • | we are affected by general economic conditions and an economic downturn could adversely affect our operations and financial results; |

| • | alternative technology or other changes in our customers’ products may reduce or eliminate the need for certain of our products and limit our ability to capitalize on our long-term customer relationships; |

| • | if we are unable to pass on increases in raw material prices, including natural gas, to our customers or to retain or replace key suppliers, our business strategy to maintain and improve upon our margins as well as our results of operations and cash flows may be negatively affected; |

| • | certain of our product groups are subject to government regulation and future government regulation could limit our growth potential; and |

| • | upon completion of this offering, CCMP and INEOS will continue to have significant influence over us and will be able to strongly influence or effectively control our business and affairs, including the election of all of the members of our board of directors, which could limit your ability to influence the outcome of key transactions, including a change of control. |

15

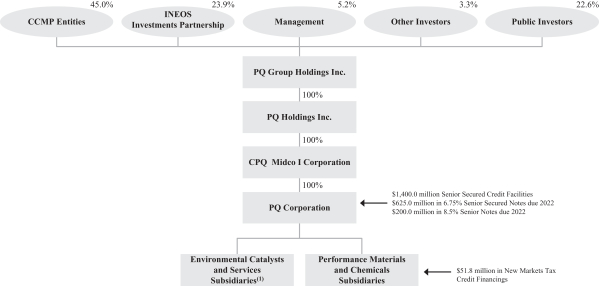

Our Corporate Structure

The following chart illustrates our ownership structure as of September 1, 2017 after giving effect to this offering and the application of the net proceeds therefrom:

| (1) | Our zeolite catalysts product group within our environmental catalysts and services reporting segment operates through our Zeolyst Joint Venture. |

Our Principal Stockholders

Investment funds affiliated with CCMP, INEOS Investments Partnership (“INEOS”) and members of management and our board of directors acquired their respective ownership of PQ Group Holdings as a result of the following series of transactions:

| • | In December 2014, investment funds affiliated with CCMP acquired an approximate 49% equity interest in PQ Holdings. INEOS and members of management owned the remaining approximate 51% equity interest in PQ Holdings. |

| • | Also in December 2014, investment funds affiliated with CCMP acquired an approximate 95% equity interest in Eco Services Group Holdings LLC, the indirect parent of Eco. Members of Eco’s management owned the remaining approximate 5% equity interest in Eco Services Group Holdings LLC. |

| • | In May 2016, we completed the Business Combination, in which the equity interests of PQ Holdings and Eco Services Group Holdings LLC were converted into equity interests in PQ Group Holdings. |

As of June 30, 2017, and prior to giving effect to this offering and the Reclassification, investment funds affiliated with CCMP, INEOS, and current and former members of management and our board of directors and other investors owned equity securities representing approximately 58%, 31%, and 11%, respectively, of our voting power. Investment funds affiliated with CCMP and INEOS will continue to have significant influence over us and decisions made by our stockholders upon completion of this offering and may have interests that differ from yours. See “Risk Factors—Risks Related to this Offering and to our Common Stock.” Following the completion of this offering, we will not be a “controlled company” within the meaning of the corporate governance standards of the New York Stock Exchange and will therefore not be able to rely on exemptions from certain corporate governance requirements available to controlled companies.

16

CCMP is a leading global private equity firm specializing in buyouts and growth equity investments in companies ranging from $250 million to more than $3 billion in assets. CCMP’s founders have invested over $16 billion since 1984, which includes their activities at J.P. Morgan Partners, LLC (a private equity division of JPMorgan Chase & Co.) and its predecessor firms. CCMP was formed in August 2006 when the buyout and growth equity investment professionals of J.P. Morgan Partners, LLC separated from JPMorgan Chase & Co. to commence operations as an independent firm. The foundation of CCMP’s investment approach is to leverage the combined strengths of its deep industry expertise and proprietary operating resources to create value by investing in three targeted industries—Industrial, Consumer and Healthcare.

INEOS is a leading manufacturer of petrochemicals, specialty chemicals and oil products. Comprising 18 businesses, with a production network spanning 105 manufacturing facilities in 22 countries, it produces more than 60 million tonnes of petrochemicals, 20 million tons per annum of crude oil refined products (fuels) and in 2016 it had sales of approximately $40 billion. Worldwide, INEOS employs 18,500 people. Its management philosophy is to operate a simple and decentralized organizational structure.

Additional Information

PQ Group Holdings Inc. was incorporated in Delaware on August 7, 2015. PQ Holdings Inc., a manufacturer of catalysts, specialty materials and chemicals, was incorporated in Delaware on June 22, 2007. Eco Services Operations LLC, which acquired substantially all of the assets of Solvay USA Inc.’s sulfuric acid refining services business unit on December 1, 2014, was incorporated in Delaware on July 30, 2014. On May 4, 2016, we consummated the Business Combination to reorganize and combine the businesses of PQ Holdings Inc. and Eco Services Operations LLC under a new holding company, PQ Group Holdings Inc. We refer to the business of PQ Holdings Inc. prior to the Business Combination as “legacy PQ” and we refer to the business of Eco Services Operations LLC prior to the Business Combination as “legacy Eco.”