ROPES & GRAY LLP

PRUDENTIAL TOWER

800 BOYLSTON STREET

BOSTON, MA 02199-3600

WWW.ROPESGRAY.COM

|

|

ROPES & GRAY LLP |

|||

| PRUDENTIAL TOWER 800 BOYLSTON STREET |

||||

| BOSTON, MA 02199-3600 |

||||

| WWW.ROPESGRAY.COM |

July 18, 2017

VIA EDGAR

Securities and Exchange Commission

Division of Corporation Finance

100 F. Street, N.E.

Washington, D.C. 20549

| Attention: | Asia Timmons-Pierce/Chris Ronne—Legal | |||

| Anne McConnell/Melinda Hooker—Accounting | ||||

| Re: | PQ Group Holdings Inc. | |||

| Registration Statement on Form S-1, filed June 9, 2017 | ||||

| File No. 333-218650 | ||||

| SEC Comment Letter dated July 7, 2017 | ||||

Ladies and Gentleman:

On behalf of PQ Group Holdings Inc. (the “Company”), and pursuant to the applicable provisions of the Securities Act of 1933, as amended (the “Securities Act”), and the rules and regulations promulgated thereunder, we submit via EDGAR for review by the Securities and Exchange Commission (the “SEC”) the accompanying Amendment No. 1 (including certain exhibits) to the Company’s above-referenced Registration Statement on Form S-1 (the “Registration Statement”). A copy of Amendment No. 1 to the Registration Statement has been manually signed in accordance with Rule 302 of Regulation S-T and the signature pages thereto will be retained by the Company for a period of five years.

Amendment No. 1 to the Registration Statement reflects the Company’s responses to the comments received from the staff of the SEC (the “Staff”) contained in the Staff’s letter dated July 7, 2017 (the “Comment Letter”) and certain other updated information. For your convenience, the Company is supplementally providing to the Staff a typeset copy of Amendment No. 1 marked to indicate the changes from the Registration Statement that was filed on June 9, 2017.

The Staff’s comments as reflected in the Comment Letter are reproduced in italics in this letter, and the corresponding responses of the Company are shown below each comment. All references to page numbers in the Company’s responses are to the page numbers in Amendment No. 1 to the Registration Statement. All capitalized terms used herein that are not defined herein shall have the meanings assigned to such terms in Amendment No. 1 to the Registration Statement.

Securities and Exchange Commission

Division of Corporation Finance

July 18, 2017

General

| 1. | Please be advised that we may have additional comments when your IPO price range is disclosed and when missing information is completed. |

Response to Comment 1:

The Company acknowledges the Staff’s comment and will, in subsequent amendments to the Registration Statement, complete the remaining missing information as well as provide the Staff with supplemental information regarding its IPO price range in order to enable the Staff to review such information.

| 2. | Please provide updated financial statements and related disclosures to the extent required by Rule 3-12 of Regulation S-X. |

Response to Comment 2:

The Company acknowledges the Staff’s comment and confirms that it will provide updated financial statements and related disclosures to the extent required by Rule 3-12 of Regulation S-X in subsequent amendments to the Registration Statement.

| 3. | Please provide supplemental support for the following statements: |

| • | Your belief that you hold “a number one or number two supply share position for products that generated more than 90% of [y]our 2016 pro forma sales” [page 2]; |

| • | “From 2015 to 2020, global heavy- and light-duty diesel vehicle production is expected to grow at a compound annual growth rate of 4.1% and 2.8%, respectively” [page 6]; |

| • | “The number of these turbo-charged light-duty vehicles in the United States is expected to make up approximately 83% of all light-duty vehicles by 2025” [page 6]; |

| • | That your performance materials and chemicals business holds leading supply share positions in North America, Europe, South American and Asia [page 123]; |

| • | “[W]e are the industry leader in North America, Europe, South America, and Asia (excluding China) in microspheres” [page 124]; and, |

| • | “We are the only global silicates producer with operations in North America, Europe, and Asia. . . .” [page 126]. |

Please mark copies of these supplemental materials to highlight the information you are using to support your disclosures.

2

Securities and Exchange Commission

Division of Corporation Finance

July 18, 2017

Response to Comment 3:

In response to the Staff’s comment, the Company is separately providing the Staff with supplemental materials that contain the Company’s support for each statement noted in the Staff’s comment. Pursuant to Rule 418(b) under the Securities Act, the Company requests that these supplemental materials be returned to the Company upon completion of the Staff’s review. In addition, the Registration Statement has been revised on pages 7, 8, 73, 128, 129, 131 and F-33 in response to this comment.

| 4. | We note references throughout your prospectus to third-party sources, such as Notch Consulting and ACT Research, for statistical, qualitative and comparative statements contained in your prospectus. Please provide us with copies of any materials that support third-party statements, appropriately marked to highlight the sections relied upon. Please also tell us if any reports were commissioned by you for use in connection with this registration statement and, if so, please file the consent as an exhibit. See Rule 436 of Regulation C of the Securities Act of 1933. |

Response to Comment 4:

In response to the Staff’s comment, the Company is separately providing the Staff with copies of the relevant portions of the third-party materials that support the statements attributable to third parties that are included in the Registration Statement, including the statements attributable to Notch Consulting and ACT Research. Pursuant to Rule 418(b) under the Securities Act, the Company requests that these separately provided materials be returned to the Company upon completion of the Staff’s review. The Company supplementally advises the Staff that no reports were commissioned by the Company for use in connection with the Company’s initial public offering.

Supply Share and Industry Information, page ii

| 5. | We note your statements that “you should be aware that industry data included in this prospectus, and estimates and beliefs based on that data, may not be reliable” and “we cannot guarantee the accuracy or completeness of any such information contained in this prospectus.” Please revise to remove any implication that you are not responsible for disclosure you have included in this prospectus. |

Response to Comment 5:

The Registration Statement has been revised on page ii in response to this comment.

Prospectus Summary, page 1

| 6. | Please ensure that the information you include in your summary is balanced, such as disclosing that you will remain a controlled company and more prominent disclosure of your indebtedness. To the extent you cite competitive strengths and strategies in your summary, please review each one and revise as necessary to provide balancing information rather than merely listing generalized risk factors at the end of this section. |

3

Securities and Exchange Commission

Division of Corporation Finance

July 18, 2017

Response to Comment 6:

The Registration Statement has been revised on pages 9, 10 , 12, 14 and 15 in response to this comment to provide a more balanced discussion of the Company’s risks in relation to the Company’s competitive strengths and strategies, including by adding clarifying disclosure to the competitive strengths and strategies described under the headings “Our Competitive Strengths” and “Our Business Strategy” and by expanding the summary risk factor discussion to address certain of the Company’s key risks in greater detail, including that the Company will remain a controlled company following the offering. The Company has further revised the Registration Statement on pages 14 and 15 to provide more prominent disclosure of the Company’s indebtedness.

| 7. | Please include an organization chart with your next amendment. |

Response to Comment 7:

The Registration Statement has been revised on page 15 in response to this comment to include the Company’s organizational structure chart.

Summary Historical and Unaudited Pro Forma Financial and Other Data, page 18

| 8. | We note that you present non-GAAP financial measures you identify as adjusted sales, pro forma adjusted sales, combined adjusted sales, constant currency pro forma adjusted sales, and constant currency combined adjusted sales which include sales representing your proportionate share of the total net sales of an equity investee. We also note that you provide graphic and tabular presentations based on pro forma adjusted sales. It appears to us that all of these non-GAAP financial measures essentially represent tailored accounting measures that are not consistent with the guidance in our response to Question 100.04 of the updated Non-GAAP Financial Measures Compliance and Disclosure Interpretations issued on May 17, 2016. Please revise your disclosures accordingly. |

Response to Comment 8:

The Registration Statement has been revised in response to this comment to remove all references to adjusted sales, pro forma adjusted sales, combined adjusted sales, constant currency pro forma adjusted sales and constant currency combined adjusted sales, each of which included sales representing the Company’s proportionate share of the total net sales of an equity investee, and instead the Company has included separate disclosure on pages 1, 2, 3, 4, 5, 10, 22, 24, 25, 26, 84, 93, 111, 112 and 122 to provide readers with information regarding its proportionate share of the total net sales of its Zeolyst Joint Venture and certain other information regarding its Zeolyst Joint Venture.

4

Securities and Exchange Commission

Division of Corporation Finance

July 18, 2017

| 9. | We note that you present non-GAAP financial measures you identify as combined adjusted EBITDA, constant currency combined adjusted EBITDA, combined adjusted EBITDA margin, and combined adjusted free cash flow conversion for the years ended December 31, 2015 and 2014. Please be advised that we do not believe it is appropriate to present any combined financial measures for the years ended December 31, 2015 and 2014. Please revise your disclosures accordingly. Based on the business combination that occurred in 2016, we would not object if you present pro forma non-GAAP financial measures for the year ended December 31, 2015; however, we do not believe that any combined financial measures or pro forma financial measures for periods prior to the year ended December 31, 2015 are appropriate. |

Response to Comment 9:

The Registration Statement has been revised in response to this comment to remove all combined financial measures and to present pro forma non-GAAP financial measures for the year ended December 31, 2015 in addition to the pro forma financial measures for the year ended December 31, 2016.

| 10. | In regard to your presentation of the non-GAAP financial measures, historical and pro forma adjusted EBITDA, presented throughout your filing, please address the following: |

| • | adjustments (b), (e - in regard to other related costs), (f), (h), (i), and defined benefit pension plan cost appear to eliminate normal, recurring cash operating expenses. It is not clear to us how or why eliminating these costs is useful or appropriate. |

| • | adjustment (d) eliminates management fees. More fully explain the specific nature of the services provided, including what the fees actually represent. To the extent you expect to incur costs for similar services subsequent to the offering, it is not clear to us how or why eliminating the fees is useful or appropriate. |

| • | adjustments (a) and (g) relate to an equity investee. It is not clear to us how or why these adjustments are appropriate. |

Response to Comment 10:

The Registration Statement has been revised on pages 24, 25, 26, 84, 85, 93 and 94 in response to this comment to include further detail regarding the nature of the adjustments included in the calculation of Adjusted EBITDA and to address why such adjustments are useful and appropriate. The Company believes that these adjustments are related to various one-time transactions or events that are not expected to recur with such magnitude and transactions or events that are not representative of the Company’s ongoing business operations. In addition, the Company has reorganized the ordering of the adjustments within its EBITDA reconciliation tables to increase the prominence of its amortization adjustments and conform to a consistent presentation throughout the Registration Statement. The Company supplementally advises the Staff that Adjusted EBITDA, as presented in the Registration Statement, is a metric used by the Company to evaluate the Company’s business and its operating performance and to determine executive compensation. The Company’s management believes that this Adjusted EBITDA metric is useful to investors as it provides a presentation based on the same manner in which management assesses performance of the business. In addition, Adjusted EBITDA, as presented in the Registration Statement, is the metric used in the Company’s credit agreements to evaluate compliance with certain covenants and the adjustments made in the Registration Statement are consistent with the definition of such measure therein.

5

Securities and Exchange Commission

Division of Corporation Finance

July 18, 2017

| 11. | Refer to page 24. It does not appear to us that amounts presented as Legacy PQ for the year ended December 31, 2016 are actually for the stated period. Please clarify or revise. |

Response to Comment 11:

The Registration Statement has been revised on page 25 in response to this comment to clarify that the amounts identified in this comment are for the period from January 1, 2016 through May 3, 2016.

| 12. | It is not clear to us how the non-GAAP financial measure you identify as adjusted free cash flow conversion, which is clearly meant to be a liquidity measure, complies with Item 10(e) of Regulation S-K. It is not clear to us why this measure appears to exclude charges or liabilities that require cash settlement, is not based on cash flows from operating activities, and is not reconciled to the most directly comparable GAAP measure, cash flows from operating activities. |

Response to Comment 12:

The Registration Statement has been revised in response to this comment to remove all references to the non-GAAP financial measure identified as adjusted free cash flow conversion.

6

Securities and Exchange Commission

Division of Corporation Finance

July 18, 2017

Risk Factors, page 26

| 13. | We note your disclosure on page 176 that your certificate of incorporation will provide that you renounce any interest or expectancy of the company in the business opportunities of CCMP and INEOS. Please include a separate risk factor discussing the conflict of interests presented by your company renouncing any interest or expectancy in the business opportunities of CCMP and INEOS. |

Response to Comment 13:

The Registration Statement has been revised on page 49 in response to this comment to include a risk factor discussing the conflict of interests presented by the Company renouncing any interest or expectancy in certain corporate opportunities of CCMP and INEOS.

| 14. | We note that your certificate of incorporation will contain an exclusive forum provision. Please tell us what consideration you gave to including a risk factor discussing the effects of such a provision on your stockholders, including the possibility that the exclusive forum provision may discourage shareholder lawsuits, or limit shareholders’ ability to obtain a favorable judicial forum for disputes with the company, its officers and directors. |

Response to Comment 14:

The Registration Statement has been revised on pages 47 and 48 in response to this comment to include a risk factor discussing the effects of an exclusive forum provision on the Company’s stockholders.

The Reclassification, page 51

| 15. | We note your disclosure that each share of Class B common stock was entitled to a preferential payment. Please clarify whether you intend to distribute any cash to the Class B common stockholders in conjunction with the offering and, if applicable, please tell us how you intend to reflect that payment in your filing. |

Response to Comment 15:

The Registration Statement has been revised on pages iv and 53 in response to this comment to clarify that holders of the Company’s Class B common stock will not receive any cash payments from the Company in connection with the conversion of each share of Class B common stock into common stock. The Company supplementally advises the Staff that, as disclosed on pages iv and 53 of the Registration Statement, the unreturned paid-in capital amount of each share of Class B common stock will be used to determine the number of shares of the Company’s common stock to be issued in connection with the conversion of the Class B common stock (and will not be paid in cash).

7

Securities and Exchange Commission

Division of Corporation Finance

July 18, 2017

Use of Proceeds, page 52

| 16. | Please disclose whether any of your underwriters or affiliates of your underwriters is a lender under any credit facility to which you will apply any of the proceeds from this offering. We note your disclosure on pages 184 and 185. |

Response to Comment 16:

The Company acknowledges the Staff’s comment and supplementally advises the Staff that it has not yet determined the specific indebtedness that it intends to repay with the net proceeds from the sale of its common stock in the offering. If the Company determines to use any portion of the net proceeds to repay outstanding indebtedness under its senior secured credit facilities, it will disclose in a subsequent amendment to the Registration Statement any underwriters, or affiliates of any underwriters, that are lenders under such senior secured credit facilities. The Company has revised the Registration Statement on page 201 to remove the sentence stating that certain of the underwriters or their affiliates may receive a portion of the net proceeds from the offering. The Company will further revise its disclosure on page 201 in a subsequent amendment to the Registration Statement if it determines to use any portion of the net proceeds to repay outstanding indebtedness under its senior secured credit facilities.

| 17. | You list the discharge of outstanding debt as your first priority for use of the proceeds of this offering. Please indicate the interest rate and maturity of the indebtedness to which you intend to apply these proceeds, or a cross-reference to such discussion elsewhere in your registration statement, and any other information required by Instruction 4 to Item 504 of Regulation S-K. |

Response to Comment 17:

The Company acknowledges the Staff’s comment and supplementally advises the Staff that the Company has not yet determined the specific indebtedness that it intends to repay with the net proceeds from the sale of its common stock in the offering. Once the Company has made such determination it will include in a subsequent amendment to the Registration Statement the disclosure required by Instruction 4 to Item 504 of Regulation S-K.

Unaudited Pro Forma Condensed Combined Financial Information of PQ Group Holdings, page 59

| 18. | Refer to notes (2), (3), (5), and (6) on pages 61 and 62. Please revise your disclosures related to the pro forma adjustments related to depreciation and amortization expense to clarify how amounts were calculated, similar to disclosures you provide in note (9). |

Response to Comment 18:

The Registration Statement has been revised on pages 63 through 65 in response to this comment to include the requested disclosure regarding depreciation and amortization expense.

8

Securities and Exchange Commission

Division of Corporation Finance

July 18, 2017

| 19. | Refer to note (5) on page 62. Please clarify how you determined the adjustments related to stock compensation expense under the new and prior capital structures and more fully explain why these pro forma adjustments are appropriate. |

Response to Comment 19:

The Company supplementally advises the Staff that the Company believes that adjustments related to stock compensation expense under the new and prior capital structures are appropriate as they are based on the modification accounting applied at the time of the Business Combination comparing the fair value of the awards directly before and after the modification and are consistent with Article 11 of Regulation S-X adjusting for items that are (i) directly attributable to the transaction, (ii) expected to have a continuing impact and (iii) factually supportable. Pro forma adjustments for stock-based compensation expense represent an overall reduction to expense as a result of (a) the partial acceleration of previously unrecognized compensation cost related to the cancelation and replacement (including a cash component) of legacy Eco equity awards in connection with the Business Combination, and (b) the modification of legacy PQ equity awards as a result of the Business Combination, which led to the recognition of compensation cost related to pre-Business Combination services as part of the consideration transferred in the Business Combination. Because there is no recurring compensation cost related to these transactions, the Company believes it is appropriate to reflect them as pro forma adjustments in the statement of operations.

| 20. | Refer to note (8) on page 63. Please clarify how the adjustment related to the step-up in fair value of inventory for the Zeolyst Joint Venture was calculated. |

Response to Comment 20:

The Registration Statement has been revised on page 66 in response to this comment to clarify how the adjustment related to the step-up in fair value of inventory for the Zeolyst Joint Venture was calculated.

| 21. | Refer to note (13) on page 63. Please clarify and more fully explain to us why you believe the pro forma tax provision is reasonable. |

Response to Comment 21:

The Registration Statement has been revised on page 67 in response to this comment to clarify the calculation of the pro forma tax provision. The Company supplementally advises the Staff that each pro forma adjustment in the Company’s unaudited pro forma consolidated statements of operations was tax effected at the Company’s statutory rate in effect for the applicable jurisdiction as of

9

Securities and Exchange Commission

Division of Corporation Finance

July 18, 2017

December 31, 2016. For pro forma adjustments affecting transactions that occurred in the United States, a blended U.S. federal and state statutory tax rate of 38.1% was used to determine the tax provision consistent with the guidance included in Section 3270 of the SEC’s Division of Corporation Finance Financial Reporting Manual. The total income tax expense recorded in the Company’s unaudited pro forma consolidated statement of operations is not equal to such a rate, however, as the Company operates in multiple tax jurisdictions including Brazil, Canada, France, Germany, Indonesia, Japan, Mexico, the Netherlands and the United Kingdom, and pro forma adjustments affecting transactions that occurred within such tax jurisdictions were tax effected at the Company’s statutory rate in effect for the applicable jurisdiction as of December 31, 2016.

| 22. | Refer to note (14) on page 63. Please confirm that pro forma earnings per share will be revised to reflect the Reclassification disclosed on page 51. |

Response to Comment 22:

The Company acknowledges the Staff’s comment and confirms that it will revise pro forma earnings per share in a subsequent amendment to the Registration Statement to reflect the Reclassification.

Selected Consolidated Financial Data of PQ Group Holdings, page 64

| 23. | To the extent you provide the non-GAAP financial measure, total segment adjusted EBITDA, please reconcile it to the most directly comparable GAAP measure, net income, as required by Item 10(e) of Regulation S-K. |

Response to Comment 23:

The Registration Statement has been revised on page 70 in response to this comment to remove the presentation of total segment adjusted EBITDA. The Company supplementally advises the Staff that the total segment adjusted EBITDA financial measures presented on pages 83, 91, F-34 and F-106 of the Registration Statement are reconciled to net income (loss) on pages 84, 93, F-35 and F-107, respectively.

Management’s Discussion and Analysis of Financial Condition and Results of Operations, page 70

Financial Condition, Liquidity and Capital Resources, page 93

| 24. | Given your foreign operations, please quantify the amount of cash and cash equivalents held in foreign jurisdictions as of the most recent period end, and address the potential impact on your liquidity of holding cash outside the US. |

10

Securities and Exchange Commission

Division of Corporation Finance

July 18, 2017

Response to Comment 24:

The Registration Statement has been revised on page 96 in response to this comment to include the requested disclosure.

Critical Accounting Policies, page 100

| 25. | Please disclose and discuss the critical accounting policies and estimates that required significant management judgement. It appears to us, at a minimum, you should enhance disclosures related to business combination, intangible assets, taxes, and stock compensation. |

Response to Comment 25:

The Registration Statement has been revised on pages 103 through 108 in response to this comment to include the requested disclosure.

Business, page 117

| 26. | Please provide the information required by Item 101(a)(1) of Regulation S-K with respect to the May 4, 2016 business combination and the predecessor entities. |

Response to Comment 26:

The Registration Statement has been revised on page 16 in response to this comment to include the information required by Item 101(a)(1) of Regulation S-K with respect to the Business Combination and each of the predecessor entities.

| 27. | Please provide financial information about segments called for by Item 101(b) of Regulation S-K, or provide a cross-reference to your financial statements. |

Response to Comment 27:

The Registration Statement has been revised on page 122 in response to this comment to include a cross reference to Note 12, Reportable Segments and Geographical Information, to the audited consolidated financial statements of PQ Group Holdings Inc. and subsidiaries.

| 28. | Please provide financial information about geographic areas called for by Item 101(d) of Regulation S-K, or provide a cross reference to the graph on page 2. |

11

Securities and Exchange Commission

Division of Corporation Finance

July 18, 2017

Response to Comment 28:

The Registration Statement has been revised on page 135 in response to this comment to include a cross reference to Note 12, Reportable Segments and Geographical Information, to the audited consolidated financial statements of PQ Group Holdings Inc. and subsidiaries.

Research and Development, page 130

| 29. | To the extent material, please provide the amount spent during each of the last three years on (i) company-sponsored research and development; and (ii) customer-sponsored research. See Item 101(c)(xi) of Regulation S-K. |

Response to Comment 29:

The Company supplementally advises the Staff that it has not engaged in any material customer-sponsored research and development activity during the last three years. In response to this comment, the Company has revised the Registration Statement on pages 135 and 136 to clarify that research and development expenses during the last three years related to company-sponsored research and development activity.

Management, page 135

| 30. | We note disclosure on page 144 that you have entered into employment agreements with each of your named executive officers. Please describe the material terms of each of those agreements. |

Response to Comment 30:

The Registration Statement has been revised on pages 159 and 160 in response to this comment to include the requested disclosure.

Executive and Director Compensation, page 141

| 31. | We note that there are various blanks in this section. Please include all compensation information relating to all of your named executive officers in your next amendment. |

Response to Comment 31:

The Registration Statement has been revised on pages 146 through 172 in response to this comment to include the requested disclosure.

12

Securities and Exchange Commission

Division of Corporation Finance

July 18, 2017

Director Compensation, page 155

| 32. | Please discuss how you determined and to which directors you awarded stock option awards in 2016. |

Response to Comment 32:

The Registration Statement has been revised on pages 167 and 168 in response to this comment to disclose the equity awards issued to members of the Company’s board of directors during the year ended December 31, 2016.

Certain Relationships and Related Party Transactions, page 157

General

| 33. | Please tell us what consideration you gave to disclosing the purchase of $4 million in principal amount of notes by one of your directors in connection with the offering by PQ Corporation of $525.0 million aggregate principal amount of Senior Unsecured Notes due 2022 in May 2016 discussed on page F-80 of your financial statements. See Item 404 of Regulation S-K. |

Response to Comment 33:

The Company supplementally advises the Staff that Mr. Currie’s purchase of $4 million in principal amount of Floating Rate Senior Unsecured Notes due 2022 is disclosed on page 174 of the Registration Statement under the heading “Floating Rate Senior Unsecured Notes Investment.”

Consolidated Financial Statements

PQ Group Holdings Inc.

General

| 34. | Please provide the disclosures required by Item 304 of Regulation S-K or explain why you determined they are not required. |

Response to Comment 34:

The Company supplementally advises the Staff that it does not believe that the disclosure specified in Item 304 of Regulation S-K is required to be included in the Registration Statement. Prior to the Business Combination, Deloitte & Touche LLP (“Deloitte”) was engaged by Eco Services Operations LLC to audit its financial statements and PricewaterhouseCoopers LLP (“PwC”) was engaged by PQ Holdings Inc. to audit its financial statements. The Company, upon its formation in connection with the Business Combination, engaged PwC to audit its financial statements. Item 304(a) of Regulation S-K requires disclosure if, among other things, “an independent accountant who was previously engaged as the principal accountant to audit the registrant’s financial statements” has

13

Securities and Exchange Commission

Division of Corporation Finance

July 18, 2017

resigned or was dismissed. The Company believes that, because Deloitte was never engaged to audit the Company’s financial statements (and its engagement was limited to Eco Services Operations LLC), the disclosure specified in Item 304 of Regulation S-K is not required to be included in the Registration Statement. The Company does not believe that the fact that the financial statements of Eco Services Operations LLC are presented in the Registration Statement as the accounting predecessor of the Company results in Deloitte being considered to have been engaged as the principal accountant to audit the Company’s financial statements. In addition, the Company believes that instruction 3 to Item 304(a) of Regulation S-K provides further support for the Company’s conclusion that disclosure under Item 304 is not required since Eco Services Operations LLC was not subject to the filing requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, when it was acquired by the Company in the Business Combination.

2. Summary of Significant Accounting Policies

Principles of Consolidation, page F-11

| 35. | We note your disclosures that the net foreign exchange included in other (income) expense, net was a gain of $3,558 for the year ended December 31, 2016 and this gain was primarily driven by non-permanent intercompany debt denominated in a local currency and translated into US dollars. Please more fully explain to us how you determine intercompany loans that are permanent and non- permanent and tell us the impact that permanent intercompany loans had on stockholders’ equity and accumulated other comprehensive loss during the periods presented. This comment is also applicable to note 2 on page F-l16. |

Response to Comment 35:

The Company supplementally advises the Staff that, pursuant to the guidance in ASC 830-20-35-3b, foreign exchange transaction gains or losses arising from intercompany loan arrangements can be deferred on the balance sheet as a component of accumulated other comprehensive income in stockholders’ equity if the loans are considered by management to be of a long-term investment nature. Eco Services Operations LLC, as the accounting predecessor to the Company, had no foreign exchange gains or losses since its business was entirely domestic. The Company, as well as PQ Holdings Inc., consider intercompany loans to be of a permanent or long-term nature if management expects and intends that the loans will not be repaid. However, the Company notes that for the periods highlighted by the Staff in this comment, all intercompany loan arrangements were determined to be non-permanent based on management’s intention as well as actual lending and repayment activity. Therefore, the foreign currency transaction gains or losses associated with the intercompany loans were recorded in the statements of operations for the respective periods.

14

Securities and Exchange Commission

Division of Corporation Finance

July 18, 2017

Property, Plant and Equipment, page F-12

| 36. | We note you capitalize the interest cost associated with the development and construction of significant new plant and equipment and “depreciate that amount over the lives of the related assets or ten years, whichever is shorter”. Please clarify or explain how your stated policy complies with ASC 835-20-40-1. |

Response to Comment 36:

The Registration Statement has been revised on page F-13 in response to this comment to clarify that capitalized interest cost associated with the development and construction of significant new plant and equipment is depreciated over the lives of the related assets.

Revenue Recognition, page F-15

| 37. | We note your disclosure that “any deviation from the standard terms and arrangements are reviewed for the proper accounting treatment, and revenue recognition is reported accordingly”. Please clarify or explain the nature of any deviations and disclose when and how revenue is recognized in those circumstances. This comment is also applicable to note 2 on page F-l19. |

Response to Comment 37:

The Registration Statement has been revised on pages F-15 and F-120 in response to this comment. The Company supplementally advises the Staff that the Company does not have deviations from its stated revenue recognition policies, but rather has certain delivery arrangements outside of standard “FOB shipping point” or “FOB destination” terms. The Company records revenue based on such shipping terms according to when title and risk of loss related to the product have been transferred to the customer.

7. Business Combination, page F-27

| 38. | We note your disclosure that Eco Services has been determined to be the accounting predecessor. Please explain to us any consideration given to PQ Holdings Inc. being the accounting predecessor, particularly based on the size of its assets and revenues prior to the business combination relative to the assets and revenues of Eco Services. |

| 39. | We note your disclosure that Eco Services is deemed to be the accounting acquirer in the business combination. Please more fully disclose and explain to us the equity ownership structures and percentage ownership interests in each entity subject to the business combination before the transaction and the ownership structure and percentage ownership interests subsequent to the transaction. In this regard, it does not appear to us that the number of shares outstanding before and after the business combination indicate a reverse acquisition. |

15

Securities and Exchange Commission

Division of Corporation Finance

July 18, 2017

Response to Comments 38 and 39:

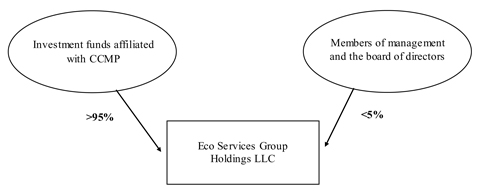

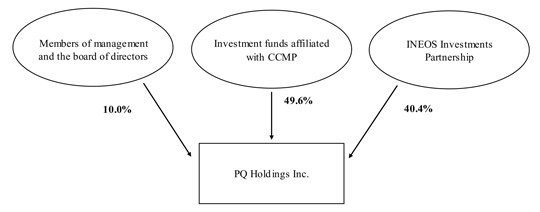

The Company supplementally advises the Staff that, prior to the Business Combination, investment funds affiliated with CCMP held a greater than 95% controlling equity interest in Eco Services Group Holdings LLC, the indirect parent of Eco Services Operations LLC, and an approximate 49.6% noncontrolling interest in PQ Holdings Inc. The following charts for each of Eco Services Group Holdings LLC and PQ Holdings Inc. provide detailed information regarding the ownership structure of each entity immediately prior to the Business Combination:

Eco Services Group Holdings LLC Ownership Structure Immediately Prior to the Business Combination

PQ Holdings Inc. Ownership Structure Immediately Prior to the Business Combination

On May 4, 2016, PQ Holdings Inc. and Eco Services Operations LLC were reorganized and combined into a new holding company, the Company. As a result of the Business

16

Securities and Exchange Commission

Division of Corporation Finance

July 18, 2017

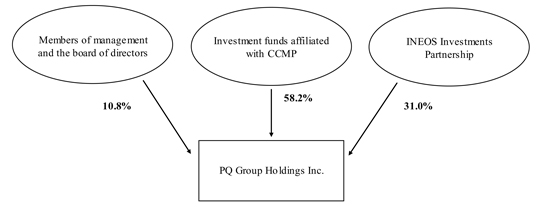

Combination, the equity interests of PQ Holdings Inc. and Eco Services Group Holdings LLC were converted into equity interests of the Company. The conversion of equity interests at the closing of the Business Combination was determined based on the relative fair market value of the equity interests of the legacy entities as of the date of the reorganization and transaction agreement related to the Business Combination, and neither entity paid or received a premium as part of the Business Combination. Accordingly, investment funds affiliated with CCMP obtained an approximate 58.2% controlling interest in the Company upon the closing of the Business Combination. The following chart provides detailed information regarding the ownership structure of the Company immediately following the Business Combination:

PQ Group Holdings Inc. Ownership Structure Immediately Following the Business Combination

In determining the accounting acquirer for the Business Combination, the Company referenced the guidance in ASC 805-10-55-15, which states, in part, that:

A new entity formed to effect a business combination is not necessarily the acquirer. If a new entity is formed to issue equity interests to effect a business combination, one of the combining entities that existed before the business combination shall be identified as the acquirer by applying the guidance in paragraphs 805-10-55-10 through 55-14.

The Company was formed solely to combine the equity interests of PQ Holdings Inc. and Eco Services Group Holdings LLC and to issue equity interests in the Company. Therefore, and in accordance with the guidance in ASC 805-10-55-15, the Company determined that it was not the substantive acquirer; rather, one of the combining entities should be identified as the acquirer for accounting purposes.

17

Securities and Exchange Commission

Division of Corporation Finance

July 18, 2017

The Company further referenced ASC 805-10-25-5, which provides that the consolidation framework under ASC 810-10 related to determining the existence of a controlling financial interest should be used to identify the acquirer in a business combination. The Company noted that investment funds affiliated with CCMP held a controlling interest in Eco Services Group Holdings LLC prior to the Business Combination and a controlling interest in the Company following the Business Combination. Conversely, investment funds affiliated with CCMP only held a noncontrolling interest in PQ Holdings Inc. prior to the Business Combination and obtained a controlling interest only as a result of the Business Combination. Furthermore, legacy PQ’s indebtedness was extinguished concurrent with the Business Combination as a result of change of control provisions that were triggered by the Business Combination, while legacy Eco’s indebtedness did not trigger similar change of control repayment provisions. Based on this analysis, the Company determined that the only change of control to occur as a result of the Business Combination was that of PQ Holdings Inc., and pursuant to the guidance in ASC 805-10-55-11 to 55-14, Eco Services Operations LLC was considered to be the acquirer in the Business Combination for accounting purposes.

| 40. | Please more fully disclose and discuss how you estimated the fair value of the equity consideration in the business combination. |

Response to Comment 40:

The Registration Statement has been revised on page F-28 in response to this comment to more fully disclose how the Company estimated the fair value of the equity consideration in the Business Combination.

| 41. | We note that as a result of the business combination you acquired interests in several equity investees. Please demonstrate to us how you determined that additional historical financial statements are not required for any equity investees pursuant to Rule 3-05 of Regulation S-X. |

Response to Comment 41:

The Company supplementally advises the Staff that it does not believe the inclusion of historical financial statements for any of the equity investee interests that were acquired as a result of the Business Combination is required pursuant to Rule 3-05 of Regulation S-X. Section 2005.5 of the SEC’s Division of Corporation Finance Financial Reporting Manual provides that the financial statements of equity method investees of an acquiree need not be filed pursuant to Rule 3-05 of Regulation S-X unless their omission would cause the acquiree’s financial statements to be misleading or substantially incomplete. The Company does not believe that the omission of the historical financial statements of the equity investee interests that were acquired in the Business Combination causes the financial statements of PQ Holdings Inc. to be misleading or substantially incomplete because disclosure related to the key financial metrics of the equity method investees, including the Zeolyst Joint Venture, the most significant of such equity method investees, are included within both the Company’s financial statements and PQ Holdings Inc.’s

18

Securities and Exchange Commission

Division of Corporation Finance

July 18, 2017

financial statements, along with further discussion in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” that provides information related to the results of operations, statement of position and trends of the Zeolyst Joint Venture.

12. Reportable Segments and Geographic Information, page F-32

| 42. | Please more fully explain to us how you determined your operating segments in accordance with ASC 280-10-50-1. In this regard, we note disclosures throughout your filing that indicate your shift from a product-based to a market-based company and disclosures related to “key end uses” on pages 106-116. We also note that it appears PQ Holdings Inc. had 4 reportable segments prior to the business combination in 2016 based of disclosures related to goodwill in their historical financial statements. |

Response to Comment 42:

The Company supplementally advises the Staff that several factors were analyzed in determining the Company’s operating segments, which are also the Company’s reportable segments, in accordance with ASC 280-10-50-1, which states that “an operating segment is a component of a public entity that has all of the following characteristics:

| (a) | It engages in business activities from which it may earn revenues and incur expenses (including revenues and expenses relating to transactions with other components of the same public entity). |

| (b) | Its operating results are regularly reviewed by the public entity’s chief operating decision maker (“CODM”) to make decisions about resources to be allocated to the segment and assess its performance. |

| (c) | Its discrete financial information is available.” |

The Company’s reporting structure to its CEO, who was determined to be the CODM, includes a group president for each of the operating segments as well as senior executives responsible for finance, administration, legal and technology. Pursuant to ASC 280-10-50-7, an operating segment generally has a segment manager who is directly accountable to, and maintains regular contact with, the CODM to discuss operating activities. The Company’s group presidents are directly accountable to the CODM, and they report and discuss the operating and financial results at the operating segment level with the CODM on a monthly basis. The form of the financial reports and information that the Company provides to the CODM as well as its board of directors to assess performance and allocate resources aligns with this organizational structure. The Company’s annual incentive compensation plan also aligns with this reporting structure and the segment profitability measures provided to the CODM because the incentive opportunity for each of the group presidents is based on the financial results for only the applicable operating segment.

As a result of the Business Combination between PQ Holdings Inc. and Eco Services Operations LLC in May 2016, several events occurred to result in a significant change from the historical reporting of PQ Holdings Inc. As a result of such changes, the Company does not continue to report under the same legacy structure. These changes included:

| • | CCMP obtained a controlling interest in PQ Holdings Inc; |

| • | the composition of the board of directors changed materially with CCMP obtaining a controlling interest; |

19

Securities and Exchange Commission

Division of Corporation Finance

July 18, 2017

| • | a new management team was brought in to run the business, including a new CEO and CFO; |

| • | PQ Holdings Inc. was acquired by an entity (Eco Services Operations LLC) that operates in other end markets; and |

| • | a new CODM (the new CEO) was determined as a result of the new management team and several executives in the legacy PQ structure that previously reported to the CEO no longer do so and instead report to the applicable group president. |

Upon joining the Company, the new CEO, James Gentilcore, spent several months visiting the Company’s operating locations, major customers and suppliers to gain an understanding of the business and its key drivers. Based on that review, the Company determined to revise the Company’s organizational and reporting structure in order to best assess performance, manage the business and allocate resources, to a markets-based approach with two operating segments—performance materials and chemicals and environmental catalysts and services. The Company believes that this structure better aligns its product groups with the key end uses, including but not limited to fuels & emissions, consumer products, highway safety & construction, and markets that it serves to allow for a streamlined customer interaction. In addition, the Company believes that this structure will allow its management team to allocate resources more effectively.

In accordance with ASC 280-10-50-10, the Company determined that its two operating segments were also its reportable segments. This conclusion is supported by the structure of the Company’s internal organization, the information regularly reviewed by the CODM and the alignment of the Company’s executive incentive compensation program with its operating segments.

20

Securities and Exchange Commission

Division of Corporation Finance

July 18, 2017

| 43. | Please provide product-line (product group) disclosures as required by ASC 280-10-50- 40. |

Response to Comment 43:

The Registration Statement has been revised on page F-34 in response to this comment to include product group disclosures as required by ASC 280-10-50-40.

18. Income Taxes, page F-49

| 44. | Please revise your disclosures related to the statutory income tax rate reconciliation to address how the amount related to the “change in tax status” line item was calculated. |

Response to Comment 44:

The Registration Statement has been revised on pages F-51 and F-52 in response to this comment to address how the amount related to the “change in tax status” line item was calculated.

27. Subsequent Events, page F-80

| 45. | Please indicate the date through which subsequent events were evaluated. Please also disclose whether that date is the date the financial statements were issued or available to be issued. Refer to ASC 855-10-50-1. This comment is also applicable to note 17 on page F-108. |

Response to Comment 45:

The Registration Statement has been revised on pages F-81 and F-109 in response to this comment to include the date through which subsequent events were evaluated in accordance with ASC 855-10-50-1 and to clarify that this date represents the issuance date of the related financial statements.

21

Securities and Exchange Commission

Division of Corporation Finance

July 18, 2017

Item 16, Exhibits and Financial Statement Schedules

| 46. | Please file as exhibits the employment agreements entered into with your named executive officers. See Item 601(b)(10) of Regulation S-K. |

Response to Comment 46:

The Company supplementally advises the Staff that as disclosed on page 155 of the Registration Statement, the Company intends to make changes to certain of the arrangements, including terminating existing employment agreements and entering into new severance agreements, with certain named executive officers prior to effectiveness of the Registration Statement. The Company will include a description of any agreements entered into with its named executive officers in a subsequent amendment to the Registration Statement and will file such agreements as exhibits to a subsequent amendment to the Registration Statement.

| 47. | Please tell us what consideration you have given to filing the following agreements as exhibits to your registration statement: |

| • | Joint Venture agreements, such as Zeolyst International; and, |

| • | long-term supply contracts for your raw materials, such as North American soda ash. |

Please refer to Item 601(b)(10) of Regulation S-K.

Response to Comment 47:

The Registration Statement has been revised in response to this comment to indicate that the Company will include the Zeolyst Joint Venture partnership agreement, and each of the amendments thereto, as Exhibits 10.10 to 10.13 to the Registration Statement in a subsequent amendment to the Registration Statement. The Company supplementally advises the Staff that none of the other joint venture agreements referenced on page 136 of the Registration Statement are, individually or in the aggregate, material to the Company. The Company further supplementally advises the Staff that it does not believe that any of its long-term supply contracts for raw materials are required to be filed as an exhibit to the Registration Statement. Each of these supply agreements are of the type that ordinarily accompany the kind of business conducted by the Company and the Company believes that there are readily available alternative sources of supply for each of its raw materials, including North American soda ash. As a result, the Company does not believe that its business is substantially dependent upon any of these long-term supply contracts. Accordingly, the Company believes that, in accordance with Item 601(b)(10)(ii) of Regulation S-K, these agreements are not required to be filed as exhibits to the Registration Statement.

* * *

22

Securities and Exchange Commission

Division of Corporation Finance

July 18, 2017

We hope that the foregoing has been responsive to the Staff’s comments. If you have any questions or comments about this letter or need any further information, please call the undersigned at (617) 951-7802 or Raymond J. Grant of our offices at (617) 235-4668.

| Very truly yours, |

| /s/ Craig E. Marcus |

| Craig E. Marcus |

| cc: | Joesph S. Koscinski (PQ Group Holdings Inc.) |

| Jason M. Licht (Latham & Watkins LLP) |

23